GROWTH IN ISOLATION

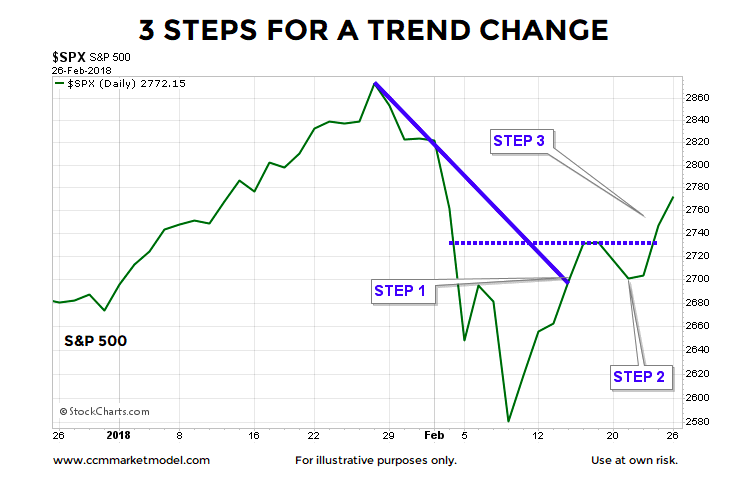

A July 2013 See-It-Market post outlined the three steps required for a trend change.

The S&P 500 recently broke the downward-sloping trend line below (step 1), made a higher low relative to the previous low (step 2), and went on to print a higher high (step 3). The completion of these three steps tells us the odds of the correction low being in place have improved.

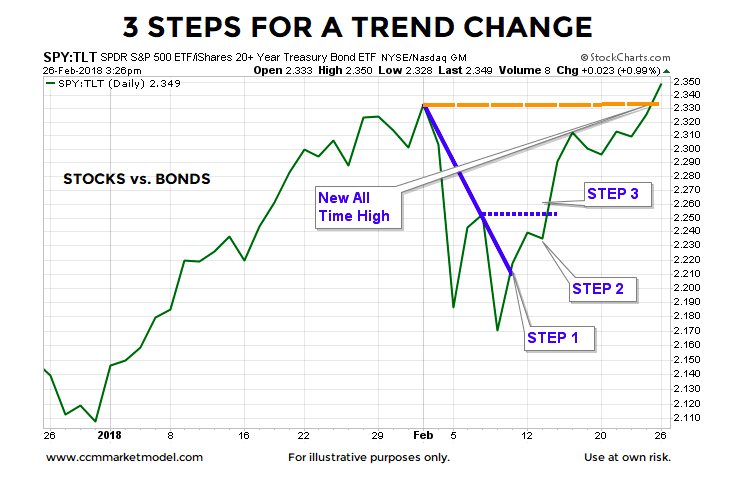

GROWTH VS. INCOME

As outlined in a February 6 post, when market participants are concerned about the economy and a prolonged bear market, the conviction to own bonds tends to increase relative to the conviction to own stocks. The current chart of stocks vs. bonds below continues to align with a market that prefers growth-oriented assets relative to defensive assets; it is hard to label the chart below concerning.

WHY THE “I NEED INCOME” APPROACH MAY PRODUCE EXTREMELY DISAPPOINTING RETURNS

Obviously, it is reasonable to be concerned about generating income from your investments in retirement. However, as shown in this week’s video, in the current environment it may be vitally important to shift from a “I need income” mindset to a “I need to protect and grow my assets” strategy. The video walks through a historical example using the actual performance of an “income- generating” portfolio.

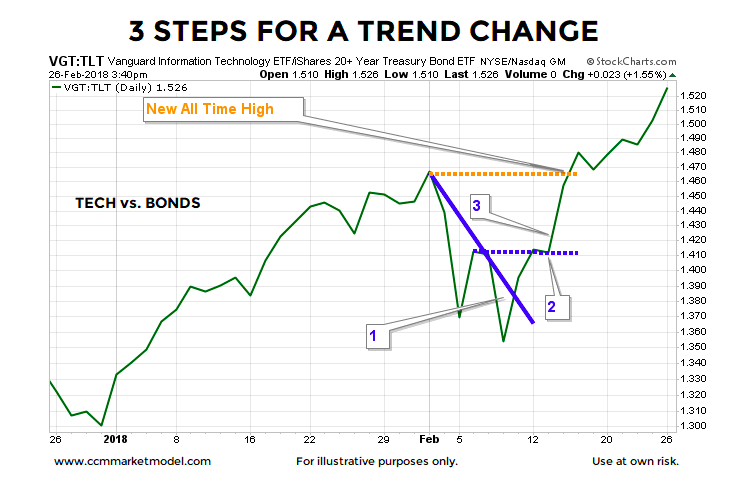

TECH VS. DEFENSIVE

A similar and constructive looking conclusion can be drawn when reviewing the ratio of technology stocks (VGT) to defensive bonds (TLT). The ratio has not only completed the 3 steps needed for a short-term trend change, but also has printed a new all-time high.

MORAL OF THE STORY

The stock market’s long-term profile told us to be patient on February 6 when the market was in waterfall decline mode. The longer-term picture is now being complemented by improvement in the shorter-term picture, which is an encouraging sign for stock market bulls from a probability perspective.

Twitter: @CiovaccoCapital

The author or his clients may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.