The following is a recap of The COT Report (Commitment Of Traders) released by the CFTC (Commodity Futures Trading Commission) looking at futures positions of non-commercial holdings as of September 1, 2015. Note that the change is week-over-wee

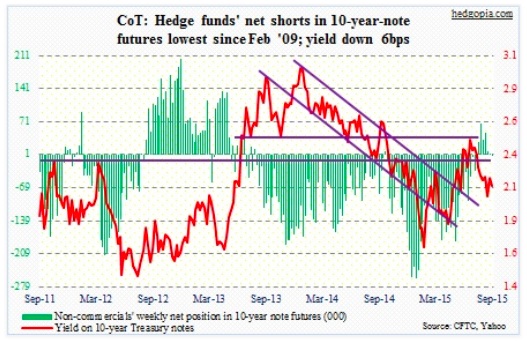

10-Year Treasury Note: The IMF is at it again. This week, it reiterated its stance that advanced economies should maintain accommodative monetary policies. By that it essentially means that the Fed should hold off on raising rates until next year (this isn’t the first time that the IMF has warned on this).

Even if the Federal Reserve gives the IMF the cold shoulder, the August jobs report has probably given fodder to both the Fed doves and hawks within the FOMC. Only 173,000 non-farm jobs were added, but June and July were revised higher by a combined 58,000. The unemployment rate slid further to 5.1 percent – lowest since April 2008 (five percent) – but more Americans are opting out of the labor force. When the recovery began six-plus years ago there were 81 million in the ‘not in labor force’ category, now they total 94 million. As well, private-sector average hourly earnings increased by better-than-expected $0.08 in August, but annual growth is still stuck in the two-percent range.

Is it any wonder that Federal Reserve members are as divided as they are? At Jackson Hole, Stanley Fischer, the Fed vice chair, hinted a September rate hike is still on the table. A few days before that, Bill Dudley, president of the New York Federal Reserve, wasn’t so sure. Perhaps it is up to the Fed Chair Janet Yellen to break the tie.

Reacting to the jobs report on Friday, the two-year Treasury yield rose three basis points to 0.71 percent – as if a hike is imminent in two weeks. Although the long end of the curve failed to go along. The iShares 20+ Year Treasury ETF (TLT) rallied 0.9 percent. A resulting flatter curve seems worried that a rate hike will hurt the economy more than help. The Fed has missed a window of opportunity to hike.

Per COT Report data, non-commercials are as confused as FOMC members. They are essentially straddling the line – and could go either way from here.

COT Report Data: Currently net short 2.8k, up 4.1k.

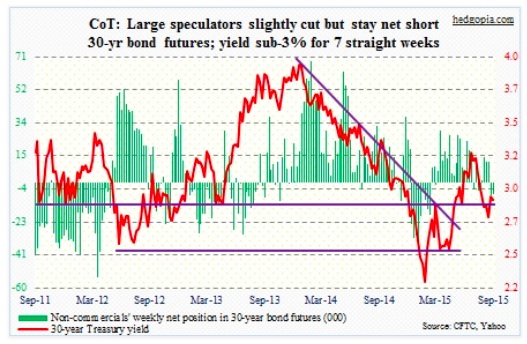

30-Year Treasury Bond: Here is a recap of the major economic releases set to hit the markets next week. Happy Labor Day!

The NFIB small business optimism index is published on Tuesday. July was 95.4, up 1.3 points month-over-month. The index has been under pressure since the recovery high of 100.4 reached last December.

July’s JOLTS report is due out on Wednesday. Non-farm job openings were 5.25 million in June, down from the all-time high of 5.36 million in May. This series tends to correlate with/lead non-farm jobs. Also, quits peaked at 2.78 million in January; June was 2.75 million. Not a big deal yet, but something to watch out for!

August’s Producer Price Index (PPI) for final demand comes out on Friday. In July, it rose 0.2 percent, down from 0.4 percent in June and 0.5 percent in May. In the 12 months through July, the PPI fell 0.8 percent, following a 0.7-percent decline in June – the sixth straight drop. Core PPI rose 0.2 percent in July, after rising 0.2 percent in June, and was up 0.9 percent in the 12 months through July. A subdued reading any way you look at it.

Also Friday is the University of Michigan’s consumer sentiment preliminary reading for September. August was 91.9, which was down from July’s 93.1 but up substantially from 82.5 year-over-year. Most recently, it peaked in January at 98.1.

No FOMC Fed member is scheduled to speak next week.

COT Report Data: Currently net short 6.7k, down 540.

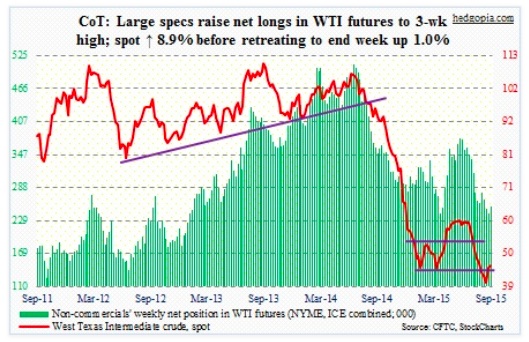

Crude Oil: A double whammy! In the August 28th week, U.S. crude stocks rose by 4.7 million barrels, to 455.4 million barrels, and stocks of crude oil and refined products were up by 5.7 million barrels, to 1.289 billion barrels. Spot West Texas Intermediate crude oil totally ignored this, rallying 4.2 percent on Wednesday. Earlier on Monday, it rallied 6.3 percent before dropping 8.2 percent the next day.

By the time spot WTI crude oil retreated from the intra-day high of 49.33 on Monday, it had rallied 28 percent in three sessions! Too fast, too soon? Sellers did appear where they were supposed to. There is resistance at the 49-50 level. Besides, the 50-day moving average – still dropping – lies at 47.61. Just underneath, shorter-term moving averages have turned up. Near-term, WTI can come under pressure, and needs to hold 43.

On worry for crude oil bulls in the COT report data: the three-week spike has failed to coax non-commercials into action. They only added a tad to net longs.

COT Report Data: Currently net long 254.1k, up 12.2k.

E-mini S&P 500: After massive $17.8 billion outflows in the August 26th week, equity funds continued to bleed in the September 2nd week, but at a much slower pace. A mere – relatively – $865 million was withdrawn, with domestic funds losing $1.6 billion and non-domestic funds attracting $746 million (courtesy of Lipper).