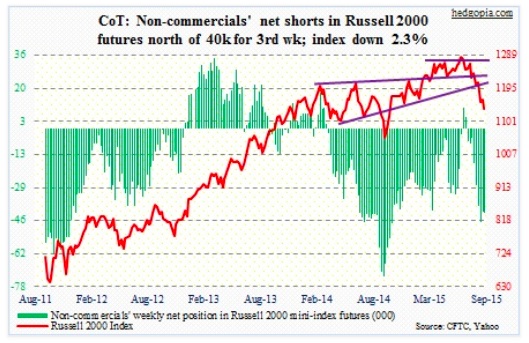

For the week, the Russell 2000 was down 2.3 percent, against a 3.4-percent drop in S&P 500. Could small caps stocks be setting up to outperform large caps?

COT Report Data: Currently net short 41.8k, up 441.

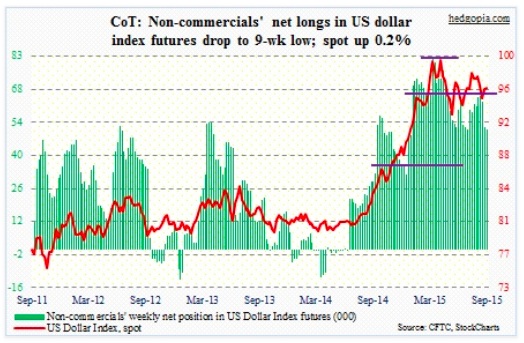

US Dollar Index: This week’s holdings do not tell us a lot. But perhaps next week’s US Dollar holdings will. Post-Mr. Draghi’s dovish comments, we will not know until next week non-commercials’ reaction to what is now looking like inevitable expansion in Eurozone QE. So far, they have continued to trim net longs.

A strong dollar has already taken its toll on U.S. exports; the latter’s share in nominal GDP dropped to 12.7 percent in 2Q15 from 13.7 percent 4Q13. The Dollar Index spiked 26 percent between July last year and March this year.

Welcome to a currency war – open or stealth.

COT Report Data: Currently net long 51.2k, down 1k.

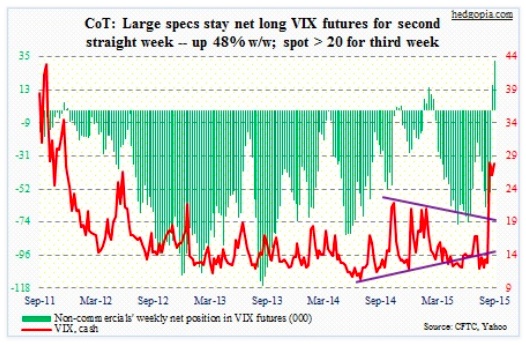

VIX: Spot VIX Volatility Index remained north of 20 for the third straight week, although it is substantially below the August 24th panic peak of 53.29. The CBOE did brisk business in that panicky atmosphere. Total market volume in VIX futures for August was 6.4 million contracts, up 28 percent month-over-month and 41 percent year-over-year. The month also included VIX weekly contracts, which were launched on July 23rd, but the increase in activity is reflective of the prevailing investor mood in the bottom third of August.

Where to from here? Per COT report data, non-commercials were right to have gone net long last week, and they are at it again, raising net longs by 48 percent and staying net long for the second consecutive week.

COT Report Data: Currently net long 32.2k, up 15.4k.

Thanks for reading!

Twitter: @hedgopia

Read more from Paban on his blog.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.