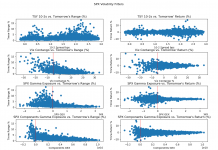

A Look at Volatility Filters Into Recent Stock Market Decline

The recent volatility, like all volatility events, has brought some traders a fortune and others pain.

The ability to identify volatility regimes is paramount!

Correct...

How to Trade Through an Overnight Gap Against Your Stock Position

When holding an overnight stock position, you run the risk of having that stock gap against you at the open.

The way to combat...

How to Validate a Trade Setup Using Multiple Time Frames

Looking at multiple time frames is a helpful way to verify support or resistance before placing a trade.

When looking at an intraday setup,...

Coach’s Corner: Are You Aiming for the Right Bucket?

Do you know how to quickly assess the probability of price follow-through?

Here's my favorite way to do this.

When we are live trading together in...

5 Lessons From One of the Greatest Traders of All Time (Jim Simons)

As a quantitative trader, I could not have been more excited for the new book "The Man Who Solved the Markets" by Gregory Zuckerman which details...

Simulated Trading versus Real Trading: How to Make Quick Gains

For an athlete, improving performance starts with breaking down the different parts of the game. What are the pieces that make up match, tournament...

When Stocks Flash a Reversal of Fortune

We've all been there before.

A stock we own is trending higher, moving from lower left to upper right on trading screens.

And all the sudden,...

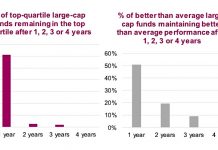

How To Focus On Investment Performance… Without “Chasing”

“Past performance is no guarantee of future results,” or a similar iteration, is likely the most common phrase found among investment disclaimers.

To say...

Understanding Investor Behavior During Era of 24/7 News Cycle

There is an evolution for individuals learning to play poker that is often captured in the adage ‘Play the player, not your cards’.

Beginning...

5 Practices of Mindful Investors

I started a mindfulness routine a couple years ago, during a particularly stressful period in my life. A daily meditation practice was a life...