Important Stocks, Earnings, and Data Insights: $TSM, $TSLA, $COST

Market-moving information surfaces between earnings events, reshaping expectations before quarterly reporting cycles

Interim data updates offer early insight into demand, production, and profitability across key...

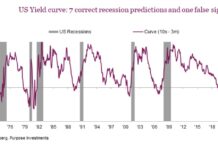

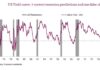

Why Steep Yield Curves Aren’t Always Good

If an inverted yield curve is a harbinger of a near-term recession, then a steeper yield curve must be good news, right? Not so...

Tech Stocks Rebound Soothing Greenland-Induced Shivers as Earnings Season Hits Stride

With only 13% of companies reporting thus far, S&P 500 EPS growth for Q4 2025 currently stands at 8.2%

The tech sector continues to dominate,...

Bank Stocks: Another Quarter of Double-Digit S&P 500 Earnings Growth?

Q4 earnings for big banks were marked by robust bottom-line performance despite some top-line misses

CEOs appear confident as the earnings season kicks off according...

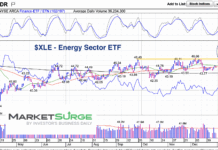

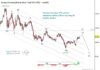

Energy Sector (XLE) Front Running Oil Prices

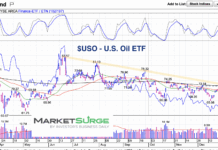

Last week I highlighted the U.S. Oil ETF (USO) and its set up to move higher.

Today, we look at the Energy Sector ETF (XLE)...

2026 Macro Economic Data Quiet, But Storylines Add Intrigue

Political noise, earnings momentum, and fresh economic data collide as markets recalibrate 2026 expectations

Conference commentary and bank earnings offer some clarity amid policy drama...

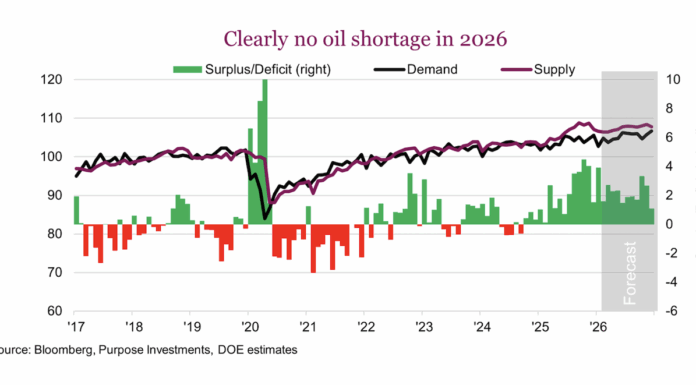

Are Oil Prices Setting Up For A Move Higher?

Over the past several months, I've been surprised to see oil prices remain stagnant in the face of geopolitical events.

Ukraine/Russia, Israel/Iran. Crude oil has...

Can Q4 2025 Corporate Earnings Sustain S&P 500 Record Highs?

Earnings season gets underway this week, with reports from major banks providing the first look at corporate performance

The technology sector is expected to be...

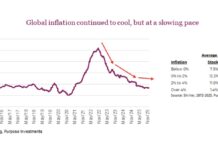

How To Combat Inflation In 2026?

Prices are still pretty high, but inflation appears to have continued to cool or decelerate in 2025. Will this trend continue in 2026, or...