At this point in the stock market correction, timeframes appear to be colliding. It’s tough to get a true read on the market, but that leads us to an important point. Who cares? We just need to trade what’s in front of us.

A bullish near-term backdrop became more evident throughout the week and helped Friday’s massive turnaround.

What’s driving this turnaround? It might just be an improving environment in the commodities complex. Stay Tuned for more.

There’s plenty to study, so let’s dig in. Hope you enjoy this week’s “Top Trading Links”.

Market Insights

@andrewnyquist discusses Friday’s stunning reversal and what it means for the market.

@HumbleStudent beautifully lays out the bull case for a successful re-test of the August flash crash lows.

I shared a handful of reasons why the market favors the bulls, at least in the near term.

@howardlindzon makes some interesting points about Carl Icahn’s scary video about the markets. The timing of Carl Icahn’s scary stock market video is suspicious given his recent market maneuvers.

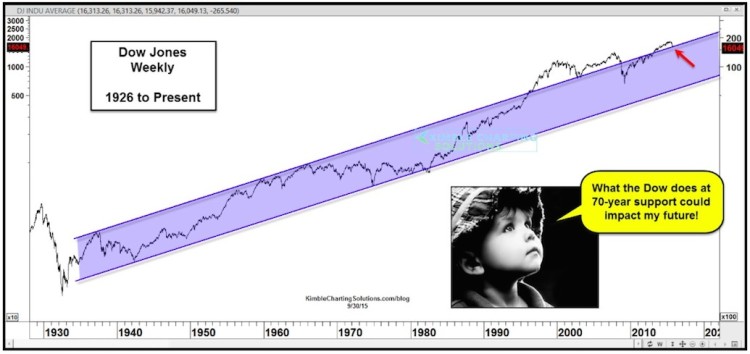

Major trendlines are in play as @KimbleCharting shares this major zone in the Dow Jones Industrials Average.

@RyanDetrick hints at what may the biggest theme of Q4. A giant turn around in everything commodity related.

@allstarcharts notes the bullish action in the Canadian dollar. This is another sign of a healthier environment for commodities and commodity plays.

@BtrBetaTrading discusses the Average True Range indicator and how it can help us navigate the market environment.

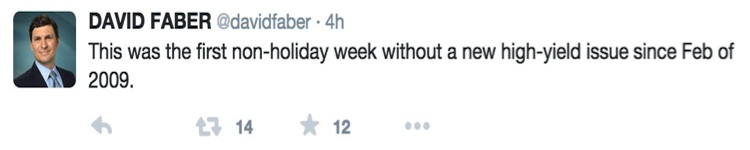

@DavidFaber notes the fear in the high yield space via a very interesting statistic:

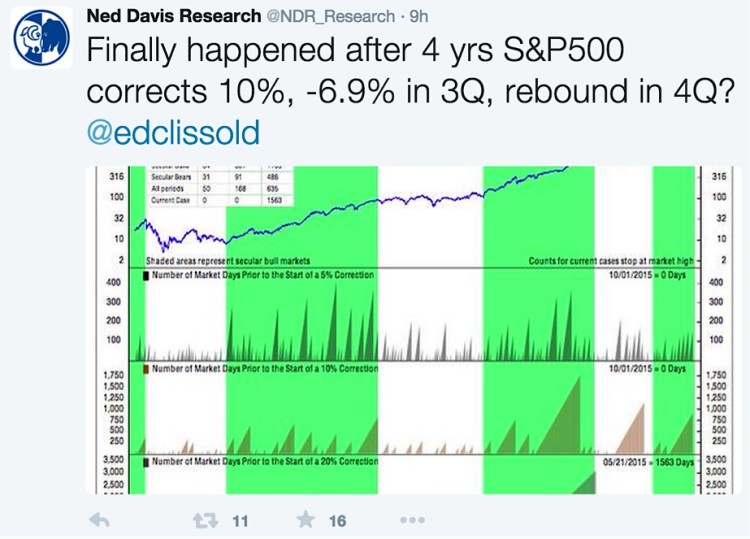

@NedDavisResearch looks at the recent correction in the S&P 500 Index from a historical perspective.

continue reading more of “Top Trading Links” on next page…