Today’s Jobs Report showed that the US Economy added 142,000 jobs. This missed estimates and caused an immediate reaction to the downside for stocks. At one point this morning, the S&P 500 was trading down 30+ points. But if you missed seeing the market close, it was green. Solidly.

The S&P 500 finished up 1.43% at 1951.36. So what caused this market reversal? Was the Jobs report actually a good thing for stocks? Did the lack of jobs mean the Fed will remain on hold longer?

Perhaps any of the above could be used as excuses, but I think the main catalyst was exhaustion. The price action was exhausted short-term, as was market sentiment. And a sure-fire sign of this is when bad news gets bought.

In the roller coaster that is market sentiment, I’m sure we’ll see some pretty big battles between bulls and bears. But I don’t care to join that fray. Right now, the bulls have an opportunity to use the market reversal to push stocks higher, if even for a trade.

Yesterday, I tweeted the following:

Market sentiment & setup should lead to a few more days of rally. But staying nimble w/ small trading long pos. Looking for new lows in Oct.

— Andy Nyquist (@andrewnyquist) October 1, 2015

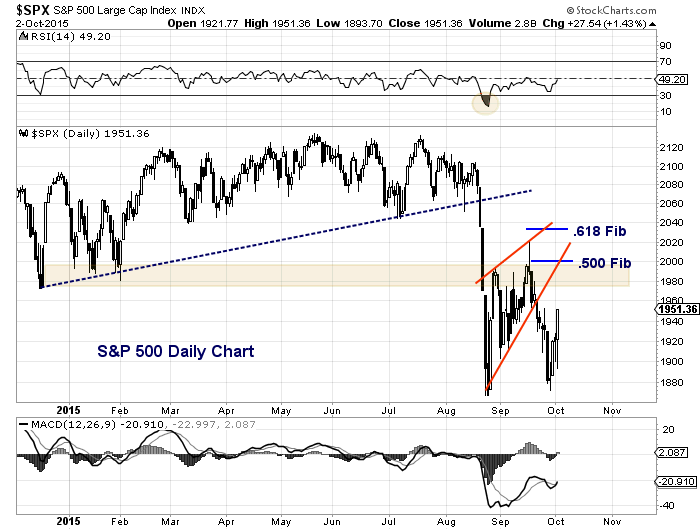

The action today was constructive and gives bulls a chance to create a base for a more meaningful rally. But it is far too early to tell how far bulls will be able to run. And, to be fair, the macro chart is still bearish until proven otherwise (i.e. several layers of resistance are still in play).

Near-term positives include the MACD indicator crossing higher and sentiment that got too bearish too fast. The index has room to run up to 1980 pretty quickly. Above that and traders will focus on resistance levels at 2000 and 2040, with the latter being the strongest.

There has been a lot of technical damage and bulls have plenty of work to do. But it’s probably fair to let them relish in a market reversal where bad news gets bought. Even if it proves to be short-lived.

S&P 500 Daily Chart

Stay tuned – I’ll provide a more in depth S&P 500 update later this weekend. Thanks for reading.

Twitter: @andrewnyquist

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.