Hindsight is always 20/20. Back on June 1 when I hypothetically wrote a June 5th weekly 76.50 naked call on the SPDR Consumer Discretionary ETF (XLY), it turned out to be a dud trade. The idea was to generate income, but it ended up effectively going short at $76.97. Last Friday, the ETF closed at $79.15. If held, the trade would be $2.18 under water.

Enter the magic of options.

That call write was then followed by three weekly short puts generating $1.20 in premium, effectively raising the short price to $78.17.

Last week, a short collar was deployed. July 17th 77 puts were sold for $0.46 and 78 calls were purchased for $0.49 (short put and long call combined with the existing short). Due to the $0.03 spent on putting on the trade, the short price dropped to $78.14. At expiration, the long call was in the money by $1.15. Hence the short price now rises to $79.29, from the original $76.97.

Initially the trade obviously did not go as expected. Now that it has been repaired to essentially even – in the money by $0.14 – should we cover and move on?

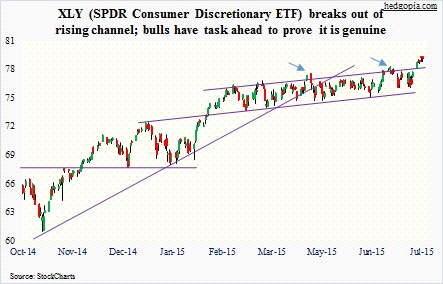

The question becomes pertinent as XLY broke out last week – out of a five-month-long slightly rising channel. In the past three months, there have been two false breakouts (arrows in the chart above). On both occasions, the breakout failed within a few days. This time around, it broke out on Monday, and built on it the next four sessions, though only slightly.

So it is too soon to say if the breakout last week will meet the same fate as the ones in April and June. This week, three of XLY’s top five holdings report their earnings. Amazon (AMZN) (7.1 percent of total assets), Comcast Corp (CMCSA) (6.5 percent) and McDonalds (MCD) (3.9 percent) report on July 23. DIS (7.6 percent) reports on August 4 and HD (6.2 percent) on August 18. They are all trading near all-time highs and are overbought on a daily chart. Post-earnings reaction could go either way, even if earnings come in good.

As are its top holdings, XLY is overbought, particularly near-term. The price currently is right underneath the upper Bollinger band. Should a breakout retest occur, it is about a point lower.

Given all this, staying short is probably the right course of action for now. In the meantime, July 24th 77 puts fetch $0.08. Selling those would increase the short price to $79.37. It is hard to imagine the ETF closing under $77 this week; the 50-day moving average lies at $76.89. If it does close under $77, then the short gets covered for a profit of $2.37.

Thanks for reading and have a great week.

Twitter: @hedgopia

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.