One of the most important traits of successful traders and investors is they think in probabilities. Markets have many moving parts and thus take on various shades of grey; set-ups are never binary or black and white.

One of the most important traits of successful traders and investors is they think in probabilities. Markets have many moving parts and thus take on various shades of grey; set-ups are never binary or black and white.

Why Do We Care About Higher Stock Market Highs?

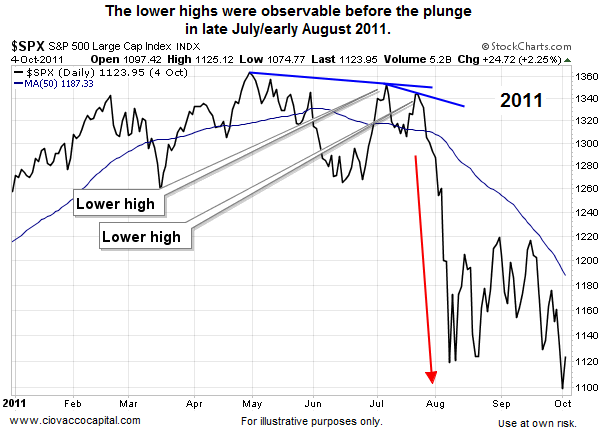

Higher highs remove the possibility of a lower high. A lower high increases the probability of bad things happening. The chart below of the 2011 correction in the S&P 500 illustrates the point.

Cannot Start A New Bear Market Without A Lower High

It is not possible for a bull market to flip to a bear market without lower stock market highs entering the picture. A lower high was made in the S&P 500 in October 2007 with the market trading around 1,545. The S&P eventually bottomed at 666.

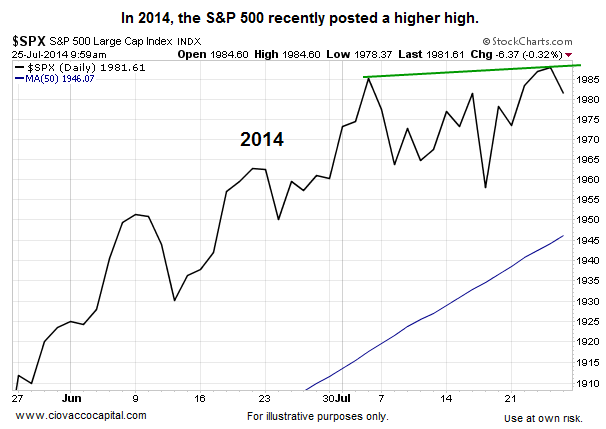

How Does The Same Chart Look Today?

Rather than recently posting a lower high, the S&P 500 made a new closing high this week.

Does the higher high in 2014 take a correction off the table? No, but it does tell us the probability is relatively low of plunging from here directly into a protracted bear market. More importantly, when we eventually see a lower high, it will tell us the odds of bad things happening have increased.

Lower High Is Required For A Trend Change

If you want to put lower highs into the broader context of trends, the topic is covered in more detail in Investing in Trends As Easy As 1-2-3. Thanks for reading.

Position in SPY at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.