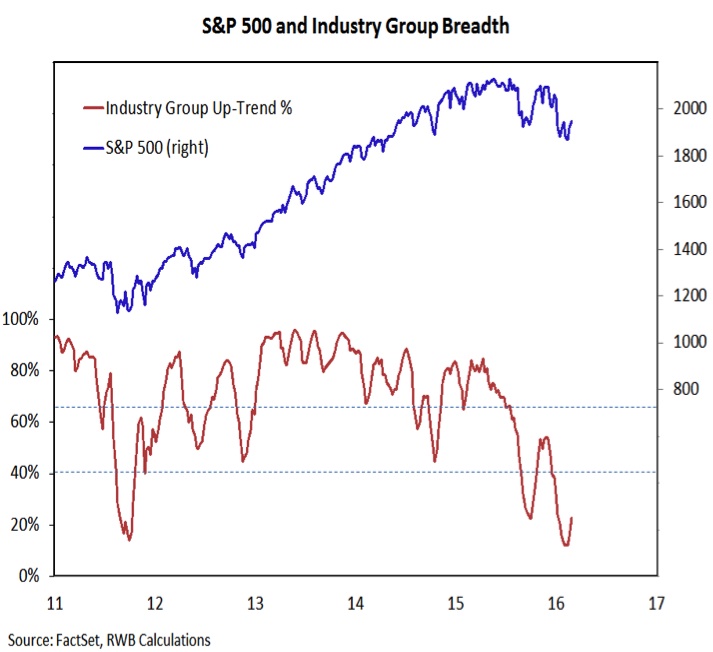

To gain more conviction that the cyclical bear market has run its course, we need to see more improvement from our industry group trend indicator. It has turned higher over the past two weeks, but the February low was below last year’s low.

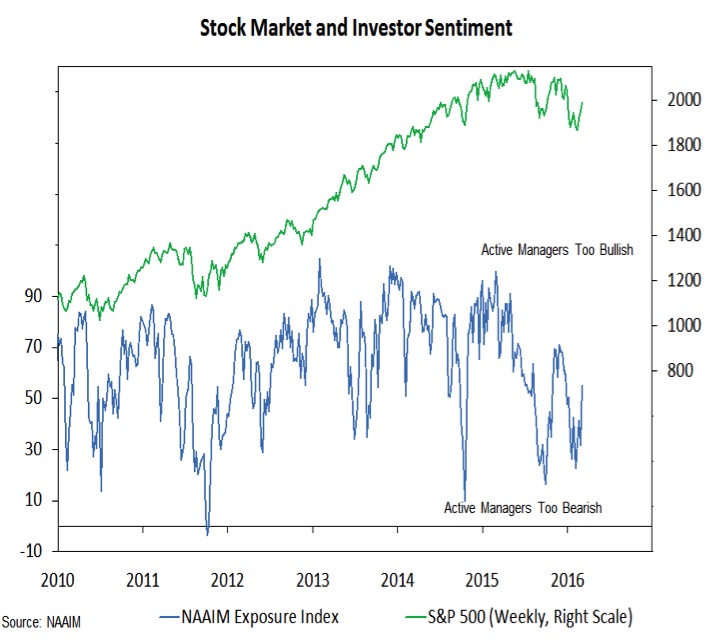

Investor Sentiment

Rising optimism after excessive pessimism is bullish. We are seeing that across the various investor sentiment surveys. Both the AAII and Investors Intelligence surveys now show more bulls than bears and the NAAIM exposure index jumped from 32 to 54 this week. With demand for puts falling over the past several days and the VIX dropping to its lowest level of the year, we will continue to keep a close eye on the sentiment surveys. If the NAAIM index rises above 70%, that could be evidence that optimism has gotten ahead of itself.

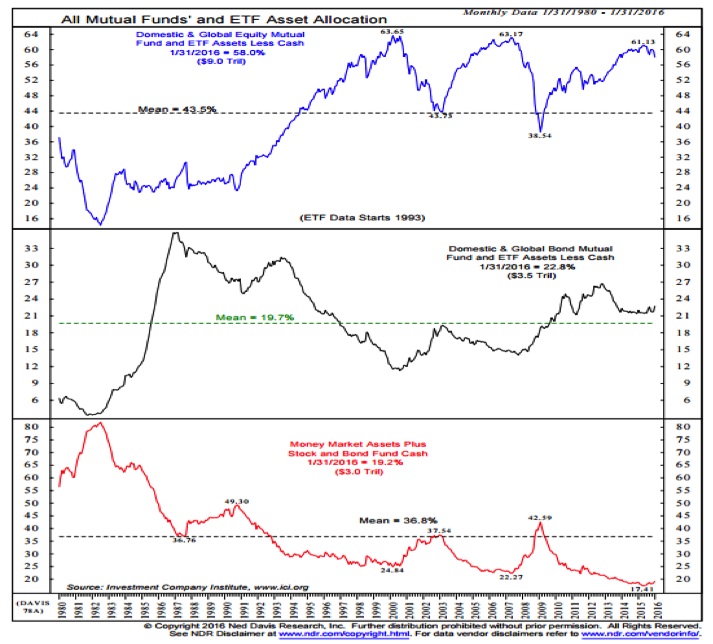

From a longer-term perspective, equity exposure remains elevated and cash levels are just above record lows. Despite what investors say on surveys it is difficult to look at these allocation levels and argue that investors are not overly bullish on equities. A move toward the long-term medians in terms of stocks and cash allocations would be a much healthier setup heading into a new bull market.

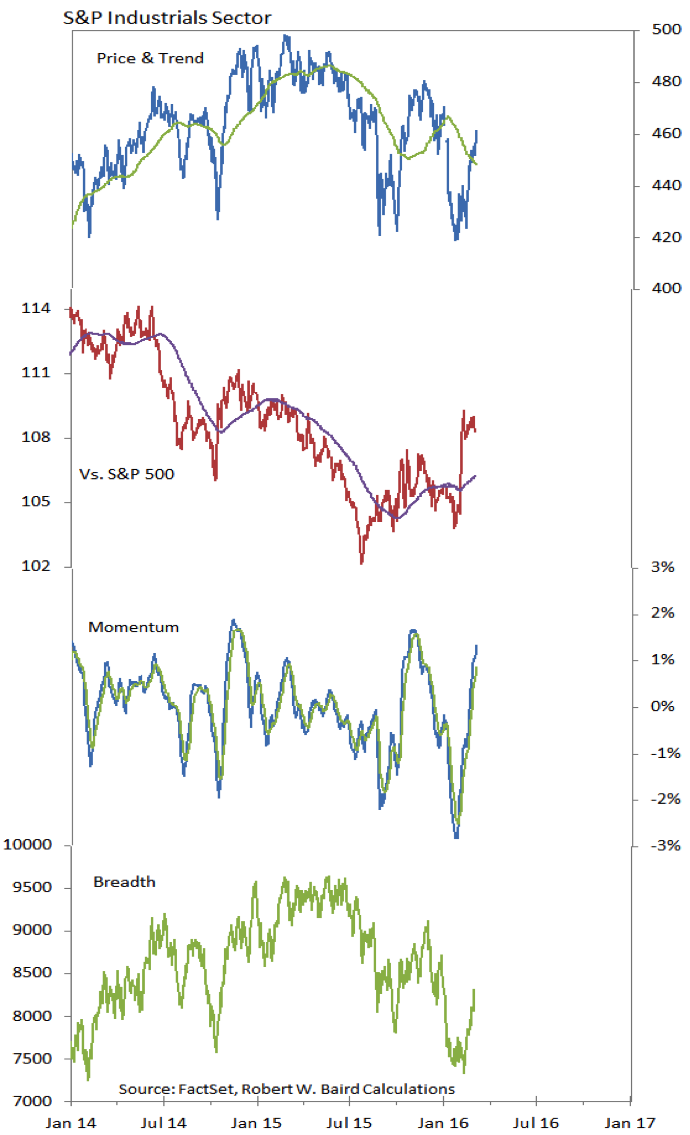

S&P Industrials Sector

Indsutrials have joined the Staples, Utilities and Telecom sector in being positive on a year-to-date basis, and Industrials have actually outperformed the S&P 500 since August (before talk of an “industrial recession” became so widrespread and certain). Whether fundamentals are improving, or just becoming less bad than expected, is beyond the purview of our discussion here. Market breadth and momentum are improving, supporting price action that suggests fears of recession may have been overblown (or just late in being recognized).

Thanks for reading this week’s stock market outlook. Have a great weekend.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.