With the minor decline in the U.S. Dollar Index (CURRENCY:USD) during recent weeks, it looks as though the alternate scenario we wrote about in March may be playing out.

If so, then the Dollar index and the related Power Shares DB U.S. Dollar Bullish ETF (NYSEARCA:UUP) may be ready to try for new highs soon. This is an area that a trader working on time frames of weeks or months might watch.

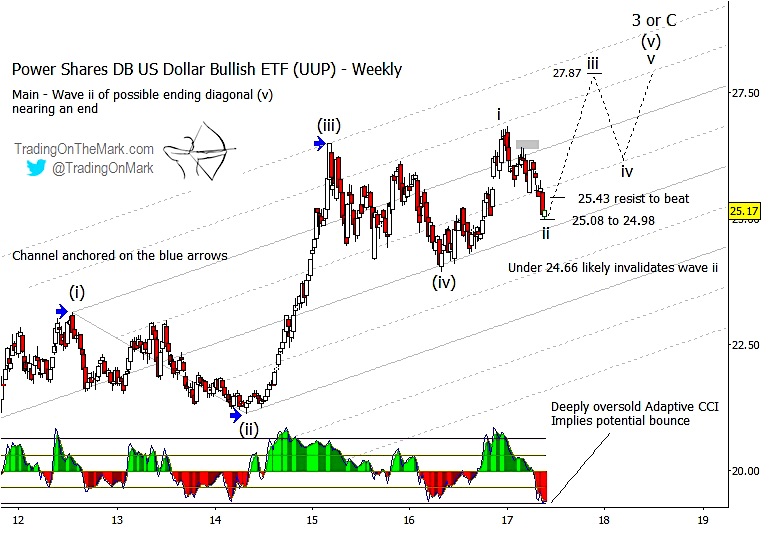

It still appears that the Dollar Index is working upward through an Elliott wave completion pattern – one which began in 2016. However the recent decline has caused overlap of sub-waves that makes us think the upward structure is not an impulsive one. An ending diagonal pattern is the most likely scenario now for the US Dollar.

If UUP finds support near the 24.98 – 25.08 area or even slightly lower near the central line of the channel, that could be a setup for a rally in sub-wave ‘iii’ of what should be a five-wave diagonal structure.

US Dollar Bullish ETF (UUP) Elliott Wave Chart

Depending on your trading style and the entry triggers you use, it may be possible to search for a long entry near support. Better confirmation of an upward move would come with a weekly close above 25.43, which would bring in the more cautious Dollar bulls.

We calculate an approximate resistance target for sub-wave ‘iii’ near 27.87, and we will be able to refine that target after the sub-wave ‘ii’ low is confirmed.

Keep in mind that a UUP decline beneath 24.66 would mean that the upward diagonal scenario has become less favorable. In that case, we might consider that a more lengthy wave (iv) correction is taking place, so any break beneath 24.66 should not necessarily be interpreted as a near-term bearish trading signal. A break lower could also suggest that a high is already in for the Dollar Index, but we would need to see evidence of additional supports breaking before we could move that scenario to the front.

Get timely alerts about market inflections by following us on Twitter and facebook!

Twitter: @TradingOnMark

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.