March corn futures closed down 11 cents last week, finishing near $3.73.

It was a rough week for the Corn Market but Corn futures continue to trade in a tight range in 2019. Let’s discuss several key news spotlights, along with current market trends, data, and price analysis.

U.S. – China Trade News Update:

On Wednesday (2/27) U.S. Trade Representative Robert Lighthizer testified before the House Ways and Means Committee regarding the status of U.S. – China trade/tariff negotiations. Lighthizer indicated that the Administration’s primary objective was to make sure that any deal agreed to between the U.S. and China was enforceable.

Lighthizer was open about China’s history of breaking trade promises. He was also quoted as saying “I’m not foolish enough to believe that one agreement will solve everything with China.” As it related specifically to agriculture, Lighthizer said the goal was fair trade practices.

On 2/22 Ag Secretary Sonny Perdue announced via Twitter that China had committed to buying an additional 10 MMT of U.S. soybeans. The soybean market reacted positively to this news initially Monday morning (2/24). However it quickly became apparent (via the soybean market fading from its highs late in Monday’s session) that traders have grown tired of these one-off purchases from China, regardless of their size. Traders have viewed such purchases as being primarily politically motivated versus market driven.

President Trump has since stated that he along with President Xi will conclude and finalize a U.S. – China trade agreement later in March. U.S. Trade Representative Lighthizer however has already acknowledged that any agreement will likely remain an ongoing process requiring continued talks, adjustments, and oversight to insure its enforcement.

China’s January Trade Data

China’s January 2019 trade data showed total monthly soybean imports of 7.38 MMT. Brazil accounted for 4.93 MMT (67%) of that total versus U.S. shipments of only 0.14 MMT (2%).

Conversely in January 2018 China imported 8.48 MMT of all origin soybeans with the U.S. shipping 5.82 MMT (69%) versus Brazil’s share of 2.07 MMT (24%). As it stands currently, the U.S. has been the recent beneficiary of renewed soybean export “sales” to China (or “purchase commitments” via ongoing trade talks) however thus far that hasn’t translated into increased physical shipments. That said with Brazil’s 2018/19 soybean crop now nearly 50% harvested, I remain far from convinced that China will actually follow through on receiving shipment of its latest U.S. soybean purchases.

China’s clearly in a position of leverage with ample South American soybean supplies now readily available. In the USDA’s February 2019 WASDE report total South American soybean exports for 2018/19 were estimated at 91.4 MMT versus 84.3 MMT in 2017/18 (Brazil-Argentina-Paraguay).

U.S. AG SECRETARY COMMENTS ON E15

On Wednesday Ag Secretary Sonny Perdue told a congressional hearing that it was unlikely the EPA would formalize a rule allowing for year-round sales of higher ethanol blends in time for the summer driving season. However Perdue later reversed course after speaking to a counterpart at EPA who reassured the Ag Secretary that a rule by June 1 was in fact “very likely.”

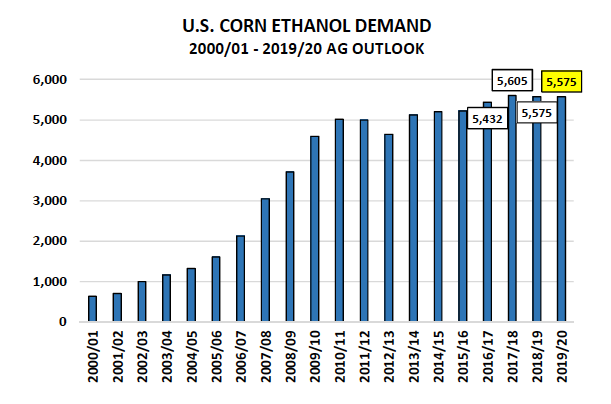

This would be a much needed win for the U.S. ethanol industry, which has been bleeding cash for the better part of the last 8 months. Industry “average” U.S. ethanol margins have been negative since the end of April and negative EBITDA since July. Furthermore the USDA at last week’s Ag Outlook Forum estimated 2019/20 U.S. corn ethanol demand at 5.575 billion bushels, which was 150 million bushels BELOW the USDA’s “Baseline” forecast released in November and equal to 2018/19’s projected use. That said the trend in U.S. corn ethanol demand has essentially flat-lined since 2016/17.

Big picture…U.S corn ethanol demand has accounted for approximately 38% of total U.S. corn demand the last 3-crop years. That figure needs to continue to grow to offset what has been a remarkable run of record to near-record U.S. corn yields since 2014/15.

U.S. corn exports and U.S. corn ethanol demand in my opinion are the best positioned usage sectors to experience immediate increases, assuming the EPA, China, etc. provide open (tariff-free) market access.

U.S. Corn Futures Weekly Trading Outlook

Corn futures faced consistent selling pressure throughout the week with Money Managers aggressively expanding their net short corn positions.

Friday’s Commitment of Traders report showed the Managed Money net corn short at -86,275 contracts as of the market closes on 2/19/2019. Comparatively on approximately the same date a year ago Money Managers were short just -10,614 contracts. And in 2017 they were carrying a net long of +85,360 contracts.

How do we make sense of the growing net corn short from Money Managers? I believe it has a lot to do with the continued uncertainty surrounding U.S. – China trade negotiations.

Even though the narrative has shifted to a trade deal likely being inked later this month I think it’s become apparent the Ag markets have reached their exhaustion point with this storyline. Trump continues to paint a picture of prosperity for U.S. farmers moving forward via increased trade with China. However…those comments have been met with more and more skepticism given his own trade representative acknowledging the difficulty in enforcing any such future trade deal.

That said I haven’t shifted in my long-term Bullish view on corn prices. The probability of U.S. corn growers getting in the field early this spring is low given the winter, continued cold, and massive snow accumulation in the upper Midwest.

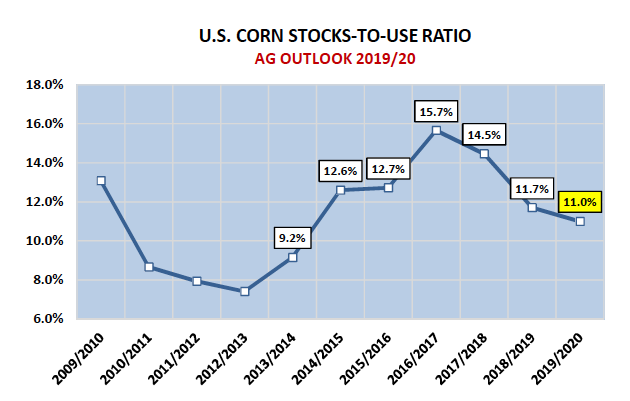

Furthermore last fall this same region experienced excessively wet field conditions, not allowing for post-harvest field prep for the 2019 growing season. I have not changed my opinion regarding the doubts I have on the U.S. adding 2.9 million corn acres this spring. Furthermore with the new-crop soybeans (SX19) / corn (CZ19) price ratio closing at 2.40 on Friday afternoon, I still don’t see the economic justification to add corn acres at the expense of soybeans. I view the 2019/20 U.S. corn S&D as price supportive.

Technically, the day low on Friday in May corn futures came within 2 ¾-cents per bushel of the current contract low at $3.63 ¼. That’s an area I want to own…

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.