September corn futures closed down 16 cents per bushel week-on-week, finishing at $4.14 ½ on July 26. The primary Corn ETF – NYSEARCA: CORN – also fell.

Let’s review a list of key corn market drivers and news headlines:

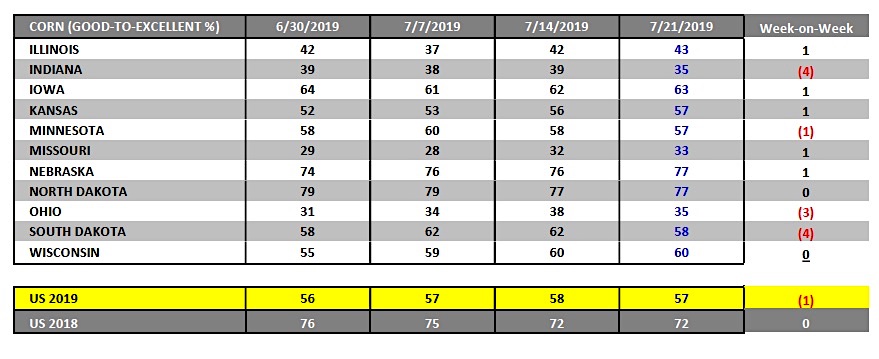

Monday’s Weekly Crop Progress report offered a slight decrease to the U.S. corn good-to-excellent rating. The U.S. corn crop was rated 57% good-to-excellent versus 58% a week ago and 72% in 2018.

Indiana and Ohio both saw their state corn ratings slide week-on-week with Indiana’s corn crop rated just 35% good-to-excellent (down 4%) with Ohio’s corn crop also rated 35% good-to-excellent (down 3%).

Conversely…the top 3 corn producing states in the country (Iowa, Illinois, and Nebraska) all enjoyed 1% improvements in their good-to-excellent ratings. Iowa’s corn crop was rated a respectable 63% good-to-excellent with Illinois at 43% good-to-excellent and Nebraska at 77% good-to-excellent.

There continues to be a fairly significant range in U.S. corn yield expectations among a host of private analysts.

The most Bullish yield estimates I’m seeing are at or near 160 bpa with the top-end of the range coming in closer to 167 to 168 bpa. That said the market does this every year…that being trying to establish some tangible yield correlation relative to what are extremely subjective crop condition ratings. Meaning at present traders see a national corn rating 15% behind a year ago. Therefore this year’s U.S. corn yield has to be down 10 to 15 bpa versus 2018/19 doesn’t it? I’d hesitate before drawing such conclusions.

In my opinion, the “ratings – yield” correlation will always be a losing proposition and even more so in 2019 with so much of the U.S. corn crop 3 to 4 weeks behind schedule. There’s no way to know how 3,600 survey respondents are interpreting the condition of a corn field that looks “good” (showing no stress, with adequate subsoil moisture) but is noticeably behind due to an extremely late planting date. For this reason I’m not willing to validate a pre-mature trading bias on U.S. corn yield potential (as well as total production) until more is known about August weather.

My current impression, however, is that final U.S. corn yields could surprise to the upside versus the downside, assuming an early frost proves to be a non-issue.

Wednesday’s EIA report showed weekly U.S. ethanol production of 1.039 million barrels per day for the week ending 7/19/19 versus 1.066 MMbpd the week prior and the 4-week average of 1.058 MMbpd.

Despite the dip in production, U.S. ethanol stocks climbed to 23.7 million barrels; their highest level since 3/29/2019. Industry “average” U.S. ethanol margins remained under pressure this week due to a combination of high corn prices (futures and basis) and low ethanol prices. The U.S. ethanol industry continues to endure an extended period of negative margins. Surplus ethanol supplies, disappointing demand, and rising inventory levels have continued to plague an industry starved for even the slightest of positive news regarding future demand prospects. Several reports surfaced last that week that production curtailment was likely inevitable with ethanol plants forced to finally respond to the ongoing negative margin environment.

Thursday’s Weekly Export Sales summary showed U.S. corn old-crop export sales of just 4.8 million bushels for the week ending 7/18/19.

Marketing year-to-date (2018/19) corn sales improved to 1.958 billion bushels, 16% behind a year ago. In the July 2019 WASDE report the USDA estimated 2018/19 U.S. corn exports at 2.100 billion bushels. With the 2018/19 marketing year ending on August 31stit appears very unlikely in my opinion that the U.S. will meet that target. That said I fully expect the USDA to make another cut to their export forecast in the August 2019 WASDE report, which will be released on 8/12. I would also not rule out a cut to the USDA’s 2019/20 export estimate of 2.150 billion bushels. New-crop U.S. corn export sales are already off to an extremely slow start.

CORN FUTURES WEEKLY TRADING OUTLOOK – JULY 29th

Corn futures moved sharply lower for the second consecutive week befuddling many Corn Bulls still enamored by various private analysts projecting total U.S. corn production as much as 1.5 billion bushels BELOW the USDA’s July estimate of 13.875 billion bushels.

The continued hope for Corn Bulls is the August WASDE report, which they believe will provide the “smoking gun” on prevent plant acreage necessary to reignite rallies back to and beyond the current contract high in September corn futures of $4.68 ¾.

Are there any holes in their argument that could prove problematic regarding that type of price recovery? Several…

- The most obvious being that most Corn Bulls got long corn futures well above current price levels. Therefore what most won’t say is they are growing impatient with the continued weakness in corn, which ultimately then makes them a more aggressive seller on even minor recoveries out of fear and the underlying desire to scratch the initial trade. No one admits this of course; however this psychology plays out every year (the market action post 7/15 proves this via the 5, 15, and 30-year price seasonals all of which show overwhelmingly nearly allrallies to new highs after this date failing). This year those fears will be even more amplified given the degree social media played into the decision-making process; arguing for Armageddon type production scenarios. This invariably led a greater number of traders and hedgers to get long or buy back corn futures at elevated levels.

- Late this week an ethanol plant suspending production at Merrill, IA made major headlines; offering the first real sign the ethanol industry is tapping-out on the continued negative margin environment. They won’t be the only plant waving the white flag in my opinion, which highlights the other reason corn rallies to new highs should struggle. The market is already trading at levels that ration demand in both the corn-ethanol and export sectors.

All this to say, I’m not against getting long some corn on this break; however the entry point is everything. As is having a realistic exit strategy should corn futures rally into the August WASDE report.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Editors note: 7/29/19 1:04 pm CST added image of corn ratings by state.