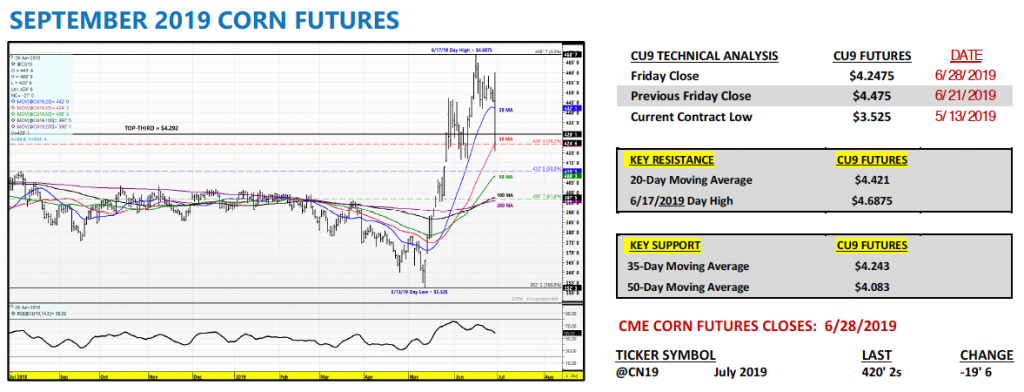

September corn futures closed down 23 cents per bushel week-on-week, finishing at $4.25 on Friday.

Today we look at the week ahead, focusing on important news and recent (and future) data releases.

JUNE ACREAGE & STOCKS REPORTS HIGHLIGHTS

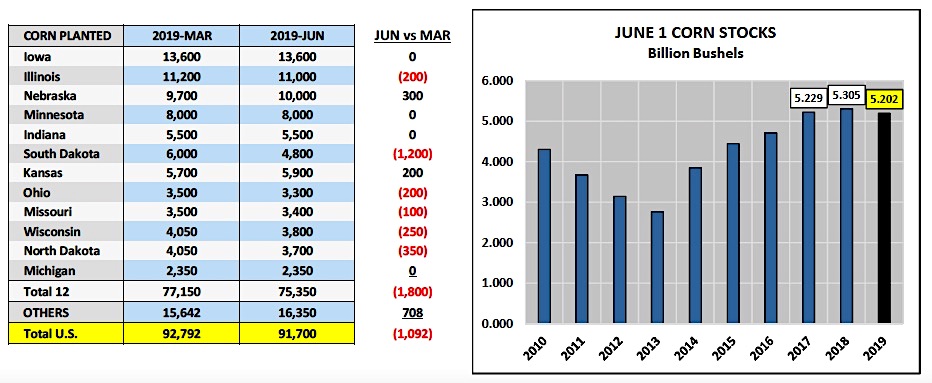

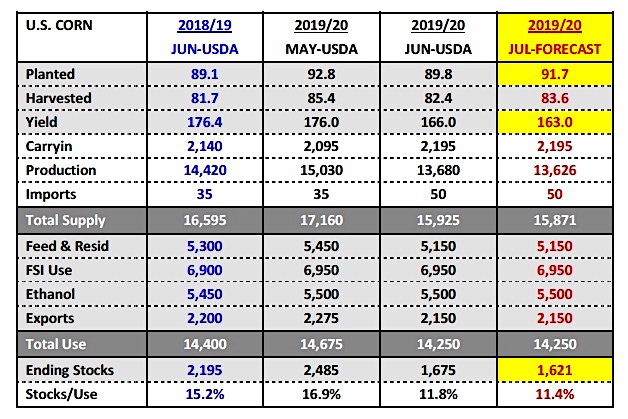

June Acreage Revisions: The USDA did it again. Friday’s report showed 2019 U.S. corn planted acreage of 91.7 million acres, down just 1.1 million acres versus the USDA’s March Prospective Plantings forecast of 92.8 million and 5 million acres higher than the average trade guess of 86.7 million. Keep in mind, the silent majority was even more aggressive in their expected acreage cut, hoping to see a planted acreage figure under 84 million acres.

Of the top 12 corn producing states in the country, South Dakota experienced the largest March to June acreage cut totaling -1.2 million acres. However, the surprises were many with Illinois and Ohio’s corn acreage estimates down just 200,000 acres versus March with Indiana’s planted corn acreage unchanged at 5.500 million.

In soybeans the USDA lowered its 2019 planted acreage estimate to 80.04 million acres, down 4.6 million acres versus the March Prospective Plantings forecast of 84.62 million and 4.3 million acres belowthe average trade guess of 84.4 million. All of the top 12 soybean producing states experienced acreage reductions with South and North Dakota seeing the largest March to June acreage declines totaling -800,000 and -600,000 acres respectively.

Market Reaction: Largely disbelief. I think it’s safe to say almostno one saw the corn acreage number coming after what had been the wettest spring and corresponding slowest planting pace on record for the bulk of the entire Corn Belt (specifically Illinois, Missouri, Indiana, and Ohio). Already conspiracy theories abound (Russia, Trump, Snowden) with the vast majority of Ag economists and Ag analysts not wanting to own any part of being this wrong on acreage.

However, I have to say it (please forgive)…I did mention in last week’s comments the economics at the end of May told farmers to keep planting corn where possible and ultimately I think that’s what happened. Corn acres were planted at the expense of soybeans.

Is the acreage debate over? No…NASS has already released comments suggesting they will re-interview a number of states to further assess planted acreage (see below). This will surely be the market spin Corn and Soybean Bulls cling to in the coming weeks to keep hopes alive of future acreage reductions. There will also be discussions on prevent plant acres. Ultimately I do expect corn acreage to see further decreases; however not until the August WASDE report at the earliest. And therein lies the problem for Corn/Soybean Bulls.

If weather remains a non-issue and crop condition ratings improve in the coming weeks (due to the return of much needed warmer temperatures), the acreage debate will likely lose a large percentage of the “first page news” status it’s enjoyed for the better part of the last 6-weeks. That said if I’m a Corn Bull, I’m shifting my argument to a sub-160 bpa national corn yield based on the premise that if indeed farmers did plant +90 million corn acres, there’s no way the national corn yield can approach anything close to even slightly-below trend with all the late planted corn and large areas of drown out. To me that’s the better rallying cry during the month of July.

June 1 Corn and Soybean Stocks: Lost in the acreage post-mortem analysis were June 1 corn stocks of 5.202 billion bushels and June 1 soybean stocks of 1.790 billion bushels. Both estimates were below the average trade guesses but still historically high, and in the case of soybeans, record-breaking high. June 1 soybeans stocks were 571 million bushels higher than a year ago, which again speaks to the lack of U.S. soybean exports via the ongoing impact of China’s tariff on U.S. soybeans coupled with diminished global feed demand from African Swine Fever. I don’t believe that either stocks estimate will have much influence on 2019/20 carryin stocks adjustments in the July 11thWASDE report.

SEPTEMBER US CORN FUTURES TRADING OUTLOOK

Corn futures got crushed on Friday. And once again the June Acreage (and Stocks) report lived up to its reputation. “I’ve seen a million faces and I’ve rocked them all.”

That was Ag Secretary Sonny Perdue on Friday doing his best Jon Bon Jovi interpretation. For weeks we had been inundated with Corn Bull after Corn Bull, some wearing white coats and posing as Ag Economists at such notable institutions as the University of Illinois, painting an almost bullet-proof argument for much higher corn prices on the premise of losing 8 to 12 million corn acres this spring/early summer.

It was a sure thing until it wasn’t. At last check on Twitter…pretty much crickets from the peanut gallery today after the report came out. I’ll always contend…be careful listening to any outspoken “expert” who doesn’t have at least some skin in the game.

I should really be showing them more grace; however the reality is, this is far from the first time the USDA has issued a shocking June acreage estimate. History has proven that time and time again. That said, what now for Corn Bulls?The hard part moving forward is that even if the analysts are right and corn acreage does come down over time (after they re-interview certain states)…we still have to trade 91.7 million acres until we know otherwise. And again we might not see any major corrections to that figure until the August WASDE report (approximately 45-days from now).

Typically what happens then is the market sets back before once again attempting to reignite upward momentum back close to the levels we were trading at prior to this report. That’s the problem however…who now doesn’t want another chance to sell corn at $4.55 to $4.60 CU19 or $4.65 to $4.70 CZ19?Fool me once, shame on you. Fool me twice, shame on me. Everyone will likely be wanting to sell that move (similar price targets), which usually means you never get there.

September corn futures did come off trading limit-lower on Friday; however it was far from convincing with CU19 still closing down 21-cents that afternoon. I fully expect Corn Bulls to try and hold this market together early next week. However I’m assuming the weather will have to be more of a factor (threat). Right now I would expect an improvement in corn’s good-to-excellent rating on Monday (7/1) with the warmer temperatures this week helping crops considerable.

For those on the wrong end of today’s move, I still think corn hangs in there (50-day MA at $4.083 = strong support). Plenty of summer weather, pollination, and yield hurdles to overcome. It’s far from over…

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.