September corn futures closed up 15 cents per bushel week-on-week, finishing at $4.54 on July 12.

That was its highest close since the June 28 Acreage report.

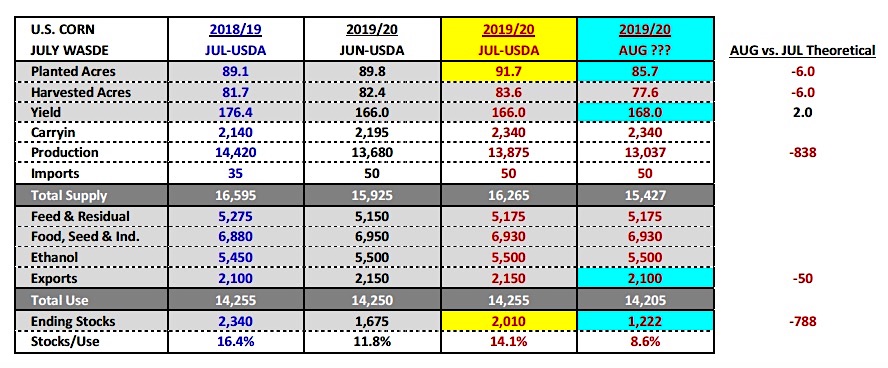

JULY 2019 U.S. CORN WASDE HIGHLIGHTS

The fine print that Corn Bulls needed, after what was on the surface an undeniably Bearish July WASDE report for corn futures, was this statement from the USDA:

“Excessive rainfall prevented planting at the time of the Acreage survey, leaving a portion of acres still to be planted for corn in a number of major producing states. In July, USDA’s National Agricultural Statistics Service will collect updated information on 2019 acres planted, and if the newly collected data justify any changes, NASS will publish updated acreage estimates in the August Crop Production report.”

That said, the key metrics from the USDA’s July 2019/20 U.S. corn Supply and Demand (S&D) balance sheet were as follows:

2019/20 total U.S. corn production improved to 13.875 billion bushels versus 13.680 billion in June.

The increase was a byproduct of NASS’s revised June planted acreage estimate of 91.7 million acres; 1.9 million acres higher than the acreage figure the USDA applied in its June 2019 WASDE report.

The USDA left the U.S. corn yield unchanged at 166 bushels per acre, this despite just 57% of the U.S. corn crop rated good-to-excellent as of July 7thversus 75% in 2018. Also of note as it relates to supply-side adjustments, 2019/20 U.S. corn beginning stocks were raised to 2.340 billion bushels, up 145 million bushels from a month ago. The carryin stocks increase came via corn demand decreases for all 3 major usage sectors for 2018/19; Feed & Residual use was lowered 25 million bushels, Food-Seed-Industrial use dropped 20 million bushels, and Exports were down 100 million bushels. The net month-on-month U.S. corn supply increase for 2019/20 penciled back at +340 million bushels or +2.1%.

Meanwhile, 2019/20 U.S. corn ending stocks improved to 2.010 billion bushels versus 1.675 billion in June and the average trade guess of 1.692 billion.

There were only minor revisions to 2019/20 total U.S. corn demand, which was forecasted at 14.255 billion bushels versus 14.250 billion in June. Once again, the ending stocks increase was entirely attributed to the increase in U.S. corn supplies (beginning stocks and total production).

Given the superficially Bearish July WASDE report, how and why did corn futures close higher on Thursday afternoon?

As I said initially, everyone’s assuming the August WASDE report will finally reflect a more realistic representation of 2019 U.S. planted corn acreage. Therefore no one wanted to be baited into selling the immediate price dip based on what was already perceived to be #fakenews (see also the USDA’s July 2019/20 U.S. corn production estimate of 13.875 billion bushels).

The Bottom Line: There are still many analysts applying planted acreage figures at or below 86.0 million acres versus NASS’s June acreage estimate of 91.7 million acres. In my most recent S&D model I lowered U.S. corn planted acreage 6 million acres to 85.7 million while maintaining the USDA’s current planted/harvested acreage spread of -8.1 million acres. That acreage configuration combined with a U.S. corn yield forecast of 168 bpa (slightly higher yield based on eliminating suspect acres) equates to total U.S. corn production of 13.037 billion bushels, 838 million bushels belowthe USDA’s just released July estimate.

That type of negative supply-side correction would theoretically cut U.S. corn ending stocks to approximately 1.2 billion bushels. I firmly believe that’s the reason corn futures rallied…traders simply waited for this report to post, let the immediate sell-off play out, before pivoting and re-positioning for a longer-term “Bullish” play leading into the August 2019 WASDE report, which will be released on 8/12.

Any reasons for caution for Corn Bulls despite the USDA acknowledging NASS will publish updated acreage estimates in the August Crop Production report?

In my opinion yes, there are several. What clearly continues to be overlooked right now is a lack of U.S. corn demand. If we focus just on the 2018/19 marketing year, in the December 2018 WASDE report 2018/19 total U.S. corn demand was estimated at 15.030 billion bushels (Feed & Residual use 5.500 billion bushels, Ethanol demand 5.600 billion bushels, and Exports 2.450 billion bushels).

Since then we’ve seen consistent cuts to all 3 major demand sectors with total U.S. corn demand now 775 million bushels BELOW that December forecast (14.255 billion bushels). The impact of substantially lower corn demand in 2018/19 is now being reflected in 2019/20 U.S. corn beginning stocks of 2.340 billion bushels. That’s the largest carryin stocks figure since 1988/89, offering the 2019/20 U.S. corn growing season a huge supply cushion should corn acreage be reduced in the August WASDE report.

Point being, Corn Bulls better hope for a significant acreage decline in August (+6 million acres). If for example, U.S. corn acreage is only reduced 3 million acres to 88.7 million, U.S. corn ending stocks would likely only fall to 1.6 to 1.7 billion bushels. That creates a sizably different pricing scenario moving forward for corn futures.

CORN FUTURES TRADING OUTLOOK

I think its safe to say the market dismissed the USDA’s July WASDE report in short order.

Once again, clearly we’re starting to see the increased impact social media is having on U.S. markets. Since the June Acreage report was released Corn Bulls (posing as marketing analysts and Ag economic professors) have continued to push their agenda, which is NASS got it wrong on U.S. corn acreage. They may or may not be right; however the bigger question for corn traders and producers specifically should be, “What’s the real upside market opportunity, if planted acreage is indeed reduced to 85-86 million corn acres in the August WASDE report?” It’s fun to throw out numbers, but at some point I think you have to make it applicable to a trading strategy. Here’s what I see as important:

- I still view U.S. corn ending stocks in the 1.1 to 1.3 billion bushel ranges on a revised U.S. corn acreage estimate of 85-86 million corn acres. That type of carryout in and of itself likely doesn’t justify sustainablerallies in September corn futures above $4.80-$4.90 per bushel. (current contract high is $4.68 ¾ on 6/17)

- For rallies to exceed those levels (on a sustainable basis) the U.S. corn yield would have to fall into the low 160 bpa ranges, meaning pollination weather and/or an early frost-freeze event would have to become significant factors in my opinion. Under such a scenario U.S. corn ending stocks could dip under the preferred 1.0 billion bushel threshold, which then increases the potential upside in September corn futures beyond $5.00 per bushel.

- HOWEVER, keep in mind the following, U.S. corn demand is already being displaced at current futures values. Exports and feed demand remain sluggish and U.S. corn ethanol demand continues to be restricted by tight margins, exploding spot basis values, as well as, a recently proposed rule by the EPA for 2020 that did nothing to eliminate the smallrefinery exemption waivers.

All things considered I strongly believe sellers need to respect opportunities to price corn back near its current contract highs ($4.68 ¾ CU19, $4.73 CZ19). Extended length I still prefer being held in long calls versus long futures, unpriced cash longs, or short puts. The “home-run” up move is ultimately a bet on the August acreage figure and yield. That said I’m mindful of my lack of omniscience regarding the size and scope of the U.S. Corn Belt, as well as, Mother Nature. Safe to say only God and Twitter truly know the answers.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.