Candor as it relates to a discernible trading recommendation seems to be as elusive these days as a straight answer from a candidate seeking future residence at 1600 Pennsylvania Ave.

That said here are my current takes on both corn prices and soybean prices:

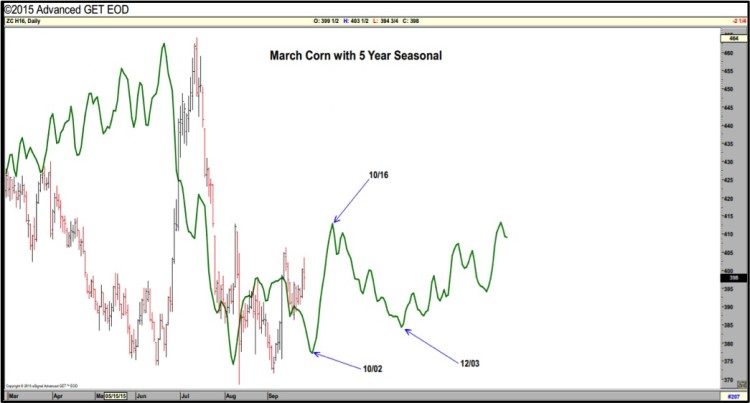

CORN: The 5 and 10-year price seasonals both show corn forming a harvest bottom between 9/30 – 10/2 with corn futures then tracking higher through calendar year end. I don’t disagree with that assessment based on my belief that the US corn carryout will continue to come down in both the October and November Crop reports due to minor yield and harvested acreage reductions. HOWEVER…my point of caution to Corn Bulls would be that the word “higher” doesn’t necessarily equate to $1.00 per bushel rallies. Even a 3-bpa yield decline going forward still leaves the 2015/16 US corn carryout at approximately 1,350 million bushels, which doesn’t support $5.00 CZ5 futures in the Oct/Nov/Dec timeframe. Furthermore corn demand is static and the impression currently from a variety of reputable private analysts is that next year’s corn acreage base could jump back up to +90 million acres. If the export market had a pulse and China wasn’t looking to off-load a percentage of its massive state corn inventories through lower “support” prices I might have a more favorable market opinion. Overall, I still see rallies as range bound in nature with immediate nearby resistance at $4.00 CZ5. If the desire is to own corn, I’m opting to limit my exposure to a synthetic long position. Volatility is cheap (sub 28% for ATM CZ5 calls). My preference then is to buy calls and/or sell puts in combination versus owning outright futures.

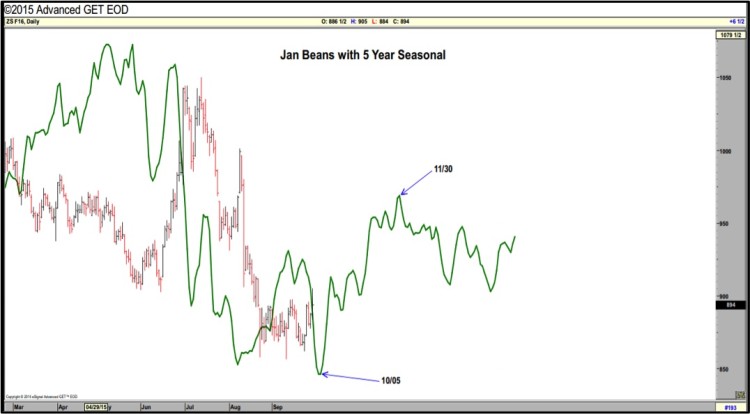

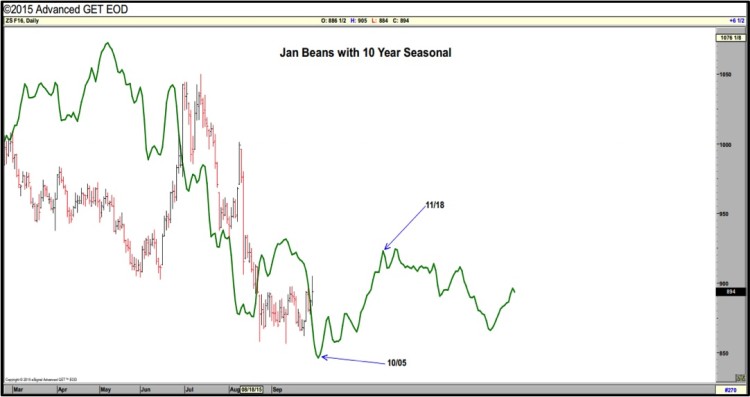

SOYBEANS: Soybean Bulls were hoping for a more sustainable rally post lower Sep 1 stocks figure (actual 191 million bushels versus the average trade guess of 205 million); however with the majority of early yield results coming back “favorable” and traders still expecting record to near record US soybean production in 2015, rallies of significance just aren’t happening. The 50-day moving average in SX5 at $9.035 has thus far proven to be a stopper on even small rallies. Monday’ s Crop Progress report showed the national soybean harvest at 21% complete versus 16% on average and 9% a year ago, which means there is still plenty of harvest pressure to come (hedge paper). The good-to-excellent rating did drop 1% to 62% versus the prior week; however I don’t think anyone’s assuming that equates to a yield reduction of consequence in the October WASDE report. And finally, Brazilian soybean production estimates for 2015/16 continue to soar. I’ve seen one private forecast just south of 100 MMT versus 2014/15’s record production of 94 MMT. Recent production estimates have expanded due in part to the sell-off in the Brazilian Real, which just ended the quarter at its lowest level versus the dollar since 2002. Brazilian farmers are accelerating forward soybean sales as a result with the weaker currency offsetting lower world soybean prices. My trade opinion on soybeans doesn’t differ substantially from corn. Are soybean futures trading at their lowest level since 2009? Yes. Is that a reason to buy soybeans? Probably not at this time…the global supply cushion via the US and South America transcends any potential short-term demand increases. I’m not against trading the range; however bullish bets beyond the 100-day moving average in January soybeans at $9.352 are probably unjustified.

Thanks for reading.

Twitter: @MarcusLudtke

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.