The Consumer Is Alright

Everyone appears keenly aware that the global economy, while still expanding, has been slowing.

This slowing trend has been evident since the beginning of 2018 and continues today.

Initially, it was focused on emerging economies which then spread to the more developed economies of Europe, Asia and North America. It is worth noting that the headwinds have been primarily focused on a number of areas of the economy. Global trade has been slowing which has been exacerbated by trade uncertainty.

Uncertainty can be very damaging to the economy and this has weighed on corporate confidence – so much so that companies have slowed investment, also known as corporate spending or capex.

This is very logical; when uncertainty on trade or even the rules of trade are in flux, a prudent company will hold back on making capex decisions, in case the rules change again. Manufacturing has also been slowing globally, which has added to uncertainty.

Put all this together and it paints a rather sobering picture which can easily justify the lower global bond yields we are seeing and the pivot by central banks to provide more monetary stimulus. These global headwinds could percolate through the economy and inevitably trigger a full-blown recession.

But let’s not forget about the consumer, which is by far the biggest component of most developed economies.

Despite the aforementioned bad news, the U.S. consumer is actually in really good shape. We are going to focus on the U.S. consumer in this report over the Canadian consumer because when it comes to the global economy, the U.S. consumer is the one that matters.

US Consumer Fundamentals Are Good

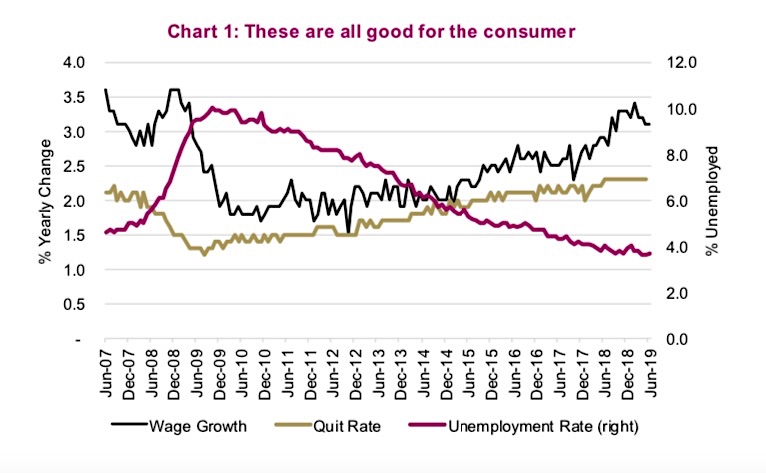

Chart 1 on the previous page provides some compelling evidence on the health of the U.S. consumer. Unemployment at below 4% is the lowest rate we have seen since the late 1960s. Wage growth has been running at over 3% for the past year, putting more money in the pocket of workers. And the quit rate is at the highest level since the last cycle.

The fact is, people don’t typically quit their job unless they have confidence in the economy and feel comfortable jumping ship.

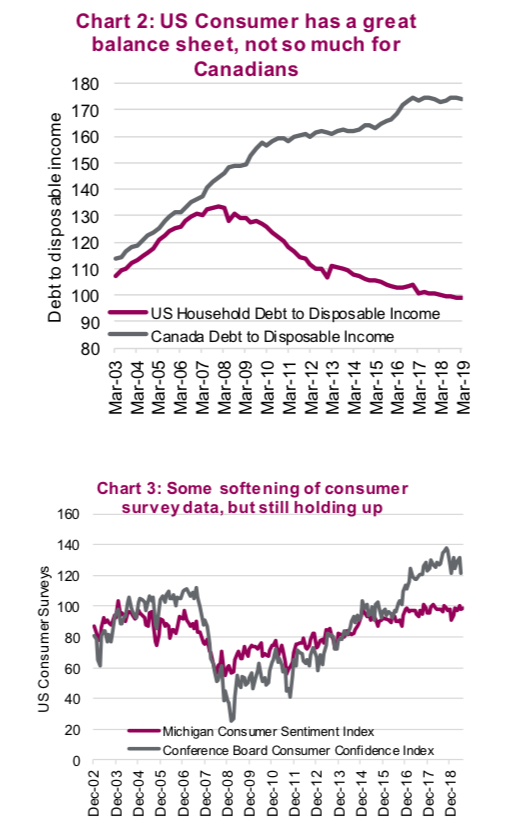

Conversely, when people are worried about the economy, they usually opt to stay put and hold onto seniority and stability. Add to this the fact that consumers overall have dramatically reduced the liability (debt) side of the household balance sheet, and most would agree that consumer heath is certainly good these days. Chart 2 below illustrates the debt to disposable income ratio for U.S. and Canadian consumers. Evidently, Canadian consumers have failed to delever following the last recession over a decade ago.

The consumer survey data is slightly mixed. There has been a drop from multi-cycle highs of the U.S. Conference Board Consumer Confidence Index (Chart 3). Worth noting within this confidence index: it is the under-35 age cohort that has been largely responsibe for the decline in the aggregate index.

The core age 35-55 has been much more stable from a confidence perspective. Alternatively, the University of Michigan Consumer Sentiment index has been more stable. This survey asks a range of questions. Notable takeaways of the June reading had more respondents believing interest rates would not rise or could even fall further. Plus, buying attitudes towards durable goods remained near the most optimistic of the past year at 76%.

With interest rates on the decline, whether you are watching bond yields or short- term rates, this will provide another shot in the arm for the consumer. We have already started to see improving trends in U.S. housing which can be at least partially attributed to lower interest rates encouraging buyers. Just take a peak at the homebuilders, up 32% this year.

Time to add consumer discretionary stocks?

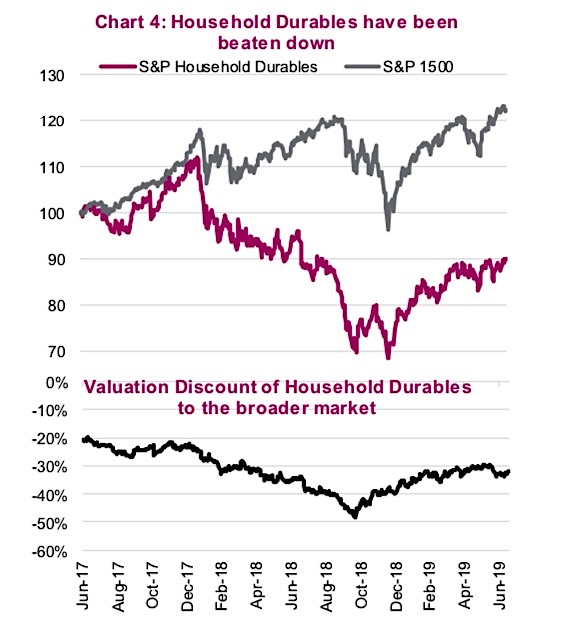

The consumer discretionary sector is diverse, but there are some pockets that should benefit more than others from lower interest rates and a healthy consumer sector. Bigger ticket items in the household durables sub-industry certainly fit the bill. This sub-industry has rallied this year inline with the markets but has lagged considerably over the past few years. Chart 4 contrasts the Household Durables relative to the S&P 1500 and the current valuation discount. This sector includes big- ticket items that are often financed at purchase and homebuilders.

Investment conclusion

Perhaps the consumer sector will falter if job losses mount from slowing data. But while slower economic growth will likely be a headwind for the U.S. consumer sector, it is also benefiting from a number of tailwinds, not least of which are lower interest rates and a healthy balance sheet. If we are slipping into a manufacturing recession (or we are already in one), exposure to a more healthy consumer sector may prove to be a defensive move.

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.