“Compared to What,” a classic jazz tune written in 1966, became famous in 1969 by Les McCann and Eddie Harris at the Montreux Jazz Festival. Over 200 artists made covers of the song. The song (LINK) is a protest about Vietnam, crime, and economic and social inequality.

Fifty years later, there is no Vietnam war to protest, but social and economic inequality is again front-page news.

After casually listening to the song, one line “Unreal values, Crass distortion” hit us over the head. The quote would have been perfect for several articles we have written to describe the economy and markets.

Alas, those words also accurately describe the Fed’s role in redefining “capitalism,” the topic of this article.

Don’t Blame Capitalism

It has become popular to blame capitalism for today’s economic inequality issues. We wholeheartedly disagree. The fault lies heavily in Washington DC for redefining capitalism.

Corporations own Capital Hill and the Oval Office. Their ability to fund elections ultimately allows them to pick our leaders. Candidates unwilling to take corporate money have little chance of winning elections. Once a politician is bought, the laws are mainly written to benefit corporations.

The nation is stumbling into an odd mixture of corporate socialism as a result. Companies flourish to the detriment of the people.

Just as corporations increasingly define the government’s fiscal role, the Federal Reserve increasingly dictates investment and speculative behaviors via monetary policy.

This article leaves political problems for another day and focuses on the Fed’s machinations and their harmful effects.

Wicksell Recap

The cost of money lies at the heart of free markets, and free markets are a core foundation of capitalism. The cost of money, or level of interest rates, is a primary factor in helping savers and borrowers determine the best uses of money. When interest rates appropriately reflect the economic growth rate, capital tends to gravitate toward its most productive uses. The more productive the economy, the more economic growth, and the better wealth is distributed to the entire population.

When the Fed interferes in the rates markets by setting interest rates and buying bonds, interest rates do not reflect the economy’s actual supply and demand for money.

In Wicksell’s Elegant Model, we wrote- “Per Wicksell, optimal policy should aim at keeping the natural rate and the market rate as closely aligned as possible to prevent misallocation. But when short-term market rates are below the natural rate, intelligent investors respond appropriately. They borrow heavily at the low rate and buy existing assets with somewhat predictable returns and shorter time horizons. Financial assets skyrocket in value while long-term, cash-flow driven investments with riskier prospects languish.”

Simply, money tends to flow to non-productive uses when rates are too low.

Bernanke Agrees with Wicksell

If you think Wicksell’s message is lost on the Fed, it’s not. They choose to ignore it.

Consider the following quote from Ben Bernanke.

“Paul Samuelson taught me in graduate school at MIT, if the real interest rate were expected to be negative indefinitely, almost any investment is profitable. For example, at a negative (or even zero) interest rate, it would pay to level the Rocky Mountains to save even the small amount of fuel expended by trains and cars that currently must climb steep grades.”

Said differently, non-productive, or even poor investments, have increasing value as rates decline, especially as they fall below zero.

We have shown on numerous occasions how the real rate, or yield, on U.S. Treasuries has been negative for the better part of the last decade. Over the last few months, the real rate for a wide assortment of risky loans turned negative. The incentive for corporations to level the Rocky Mountains has never been higher.

Fed Induced Distortion on Display

Over the last year and a half, the Fed has purchased nearly four trillion Treasury, mortgage, and corporate bonds. The reduction in the stock of investible bonds along with the Fed’s zero-rate interest rate policy has further warped interest rates for all types of lending. As Wicksell postulates, lower than normal interest rates are yielding a highly speculative environment. Productivity is languishing as a result.

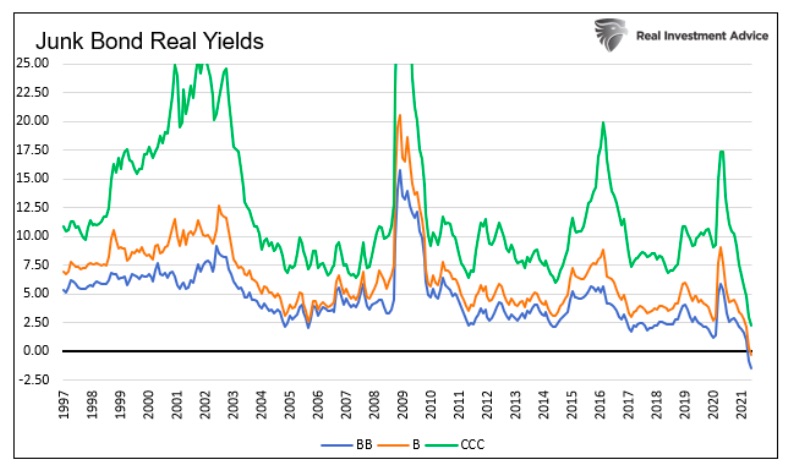

The graph below highlights how Fed policy distorts corporate bond yields. Corporate junk bonds offer investors a means to earn an above-average yield, albeit by taking on inflation and default risk. As shown below, yields on BB and B-rated junk bonds are now below the inflation rate, and CCC-rated bonds are not far from it.

Even if we assume zero defaults, which is impossible for an index of junk-rated bonds, investors will still lose money on an inflation-adjusted (real) basis.

Over the last 25 years, on average, junk bond investors were paid a premium over inflation of 4.7%, 6.5%, and 12.3% for holding B-, BB-, and C-rated bonds, respectively. Such yields offset inflation and, typically, the risk of default.

It’s not a leap to say interest rates are now well below their natural rate.

Summary

Society is paying a dear price for policies that most citizens have little understanding of. Forcing the price of money to absurdly low or even negative rates is slowly but constantly detracting from economic progress and ripping the social fabric of our nation. While there are many to blame, the Fed and their warped ideas around interest rates and economic growth should be among the first.

If only a famous musician today could stoke the public into action with a catchy song about the Fed’s role in dismantling capitalism.

Twitter: @michaellebowitz

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.