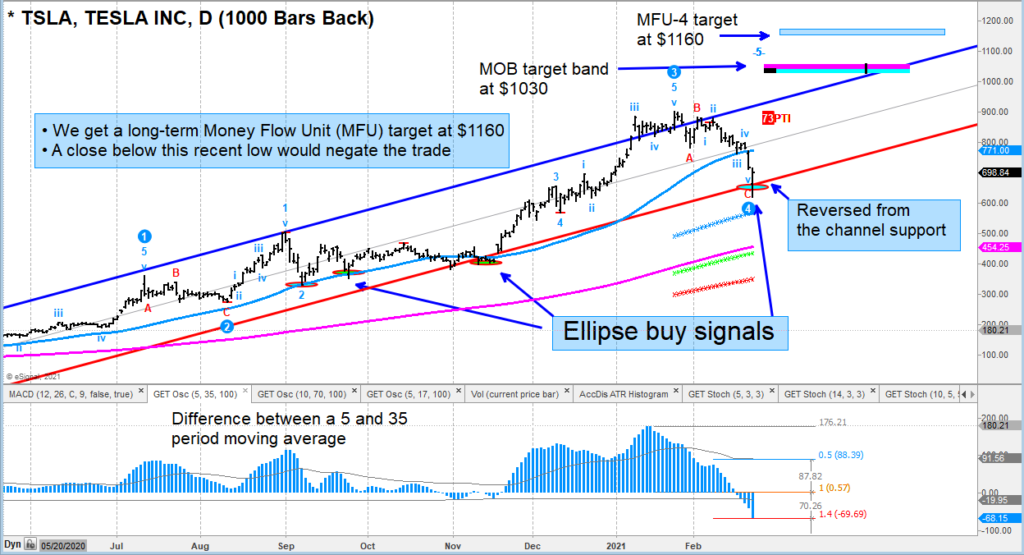

I am not an Elliott wave specialist, but I do use that methodology to help qualify wave 4 pullbacks in an uptrend. And in the case of Tesla’s stock (TSLA) pullback and Tuesday’s price reversal, an Elliott wave 4 low may be in place.

The recent pullback recovered the lower end of the regression trend channel, and we have an ellipse buy signal that triggered on Tuesday’s reversal.

The 5/35 oscillator below pulled back just enough to qualify the recent decline as a “normal profit-taking” pullback.

We need to see how price trades at the 50-day moving average at $771. Should it exceed that level, then the upper end of the price channel around $920 would become a target.

If recent lows hold and momentum gathers steam, then the MOB price target band at $1030 could be hit in the weeks to come (with an MFU-4 extreme target as high as $1160).

Patience though, positions need to be managed with discipline (stops) as TSLA approaches its 50 day MA.

$TSLA Tesla Stock Chart

The author or his firm may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.