Stock market bulls received more breathing room after the S&P 500 pushed higher for the second week in a row (+1.6%). After the market gave back gains in trading action on Friday, it will be interesting to see how much gas stocks have next week.

Balancing our desire to “play along” (emotions) with sound risk management is key. This could be relief rally that gives way to another leg lower… or it could be the start of a broader rally.

It pays to have an open mind when trading. It gives us the ability to overcome emotion and increase or decrease exposure as price action permits.

As I said last week: “…there aren’t any free rides, and no one knows for sure if a stock market bottom is in.”

This week, we’ll keep on grinding it out with some excellent research and market insights.

TRADING INSIGHTS

The Gold to Dollar ratio is at an important juncture – Chris Kimble

The popular 2011 S&P 500 analog is wrong – Peter Brandt

Hedge Funds are getting ready for armageddon – Business Insider

The Pain Trade is Higher – David Fabian

Byron Wien’s latest market commentary – Blackstone

Emotional Selling has tripled so far this year – Gavekal Capital

One market indicator signaling more pain in 2016 – Michael Lebowitz

Inflation showing signs of life – Willie Delwiche

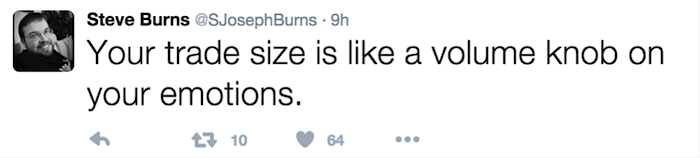

A well said piece of wisdom via Steve Burns on Twitter:

What happens if something goes right? – Brian Gilmartin

Abundance is killing us – Josh Brown

The Courage to Fail – Jesse Felder

February vehicle sales could hit 15 year highs – Calculated Risk

On the Brexit – Credit Writedowns

Investments and the Generation Gap – Columbia ThreadNeedle Investments

A look at Vehicle Miles Traveled – Doug Short

A Stock Market Time Lapse – Jason Leach

The Case of the Century – Slate

Thanks for reading and be sure to check back in next weekend for “Top Trading Links”!

Further reading from Aaron: “The Financial Blogosphere Weighs In“

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.