Given the improvement in the discounts to NAV and lower yields, we need to re-address the risk that municipal yields underperform Treasury yields. Said differently, it is worthwhile here to assess the risk that the municipal-Treasury yield spread could widen or cheapen.

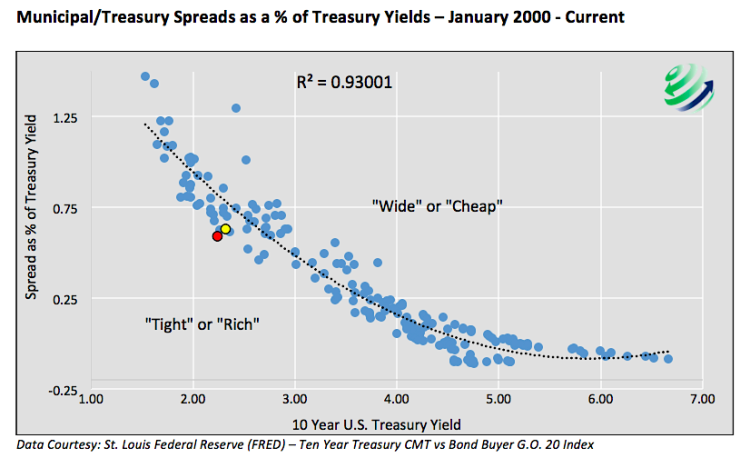

The scatter plot below compares municipal-Treasury spreads as a percentage of Treasury yields through different interest rate environments since 2000.

While there are many ways to evaluate the spread, the method shown is attractive as it accounts for spreads with consideration for the absolute level of rates. The effectiveness of this model is supported by an R-squared of .93, which denotes a very tight relationship between the factors. Data points that lie below the regression trend line are instances where the spread is considered tight or rich, with the difference between Municipal bonds yields and Treasury bonds yields being lower than average. The opposite holds true for data points above the line.

The current spread is represented by the red dot, and the spread from July 2015 is yellow. By comparing the two highlighted data points, one notices the spread tightened further over the last 6 months. Statistically this can be quantified by measuring the distance between each dot and the trend line. During this period the spread moved from 1.40 standard deviations to 2.25 standard deviations below the trend line. The current spread, is now the tightest (furthest from the trend) that it has been since at least the year 2000.

Current Thoughts

Given that the factors driving our original recommendation (discount to NAV and lower yields) are not as compelling today as they were in July, coupled with a probable widening of the municipal-Treasury spread, we are not as comfortable with the risk-reward scenarios as we were. To further appreciate the tight spread, consider that if the spread were to instantly revert back to trend, the prices on the bonds underlying the CEF’s, on average, would decline by about 3%. Given that the CEF’s employ leverage the likely price drop of the CEF’s would be greater than the drop in the bond prices underlying the CEF’s.

Due to our concern over the potential for spread widening and weakened prospects for further discount normalization we are recommending to clients that they sell LEO (Dreyfus Strategic Municipal Fund) as the discount to NAV is nearing zero. We are also recommending that investors pare back their other holdings. Take well-earned profits and remain vigilant on any remaining holdings, perhaps employing a stop loss order. The remaining CEF’s still offer a sound value proposition.

Twitter: @michaellebowitz

The author or his clients hold positions in the mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.