In last night’s article, we wondered if the market correction was over?

To recap:

Both the S&P 500 ETF NYSEARCA: SPY and Nasdaq 100 ETF NASDAQ: QQQ traded into price resistance.

For the S&P 500 ETF (SPY) that number is 342. And on the Nasdaq 100 ETF (QQQ) it is 282.

The Dow Jones Industrial Average had to hold 28,000.

Well, SPY tried to clear 342 but wound up closing red and under 340.

The QQQs tried to take out 282, and as first to go red, it closed down over 1%.

The Dow Jones Industrial Average did indeed hold 28,000.

The Federal Reserve came out dovish today, with no change to interest rates and the comment that rates will stay near zero until 2023.

But the Federal Reserve was once again vague on how to get inflation going.

Furthermore, the meeting minutes yielded nothing unexpected.

So, did that put the kibosh on the rally?

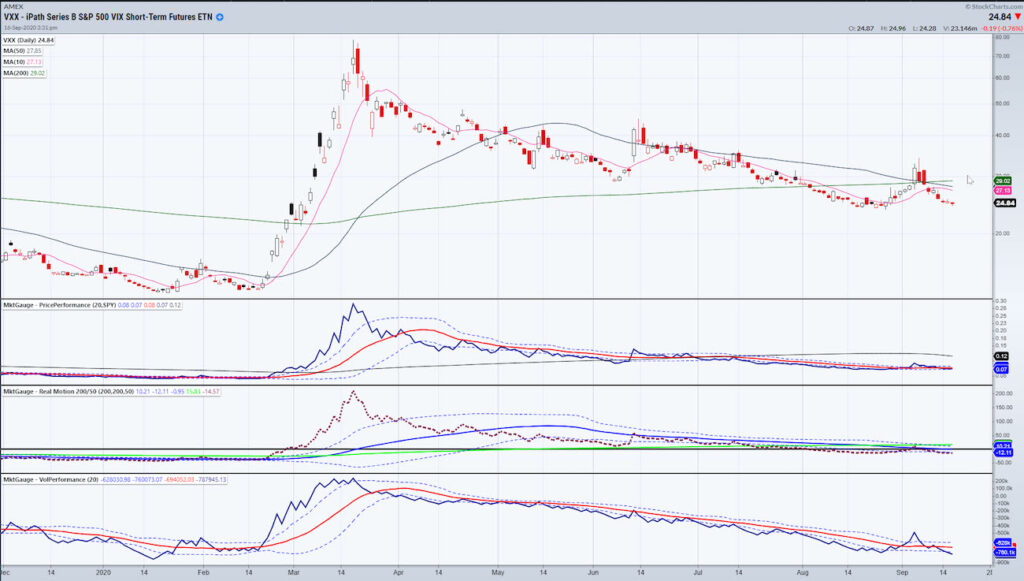

Enter the Volatility ETFs. Here, I include a chart of the volatility index etf (VXX):

As the stock market did exactly as one would expect, with the run but failure to hold above the resistance levels in SPY and QQQ, it’s that time again.

Or, we can call it, the continuation of the love/hate relationship the market has with the FED.

First off, junk bonds and high-grade investment bonds, the Fed’s playground, are still doing well. So that tempers real bearishness.

However, on August 26th, VXX made a low at 23.64 and then put in a reversal bottom.

Currently, VXX closed down about ½% on an options expiration day, so the better assessment will be tomorrow and Friday.

If SPY and QQQs cannot recover today’s early bounce or if the Dow gives up 28,000, watching VXX is a good way to hedge or at least assess your portfolio.

I still believe that as we get closer to the end of this month, another correction is coming. But of course, we need more evidence (like in JNK and LQD).

VXX over 25.03 is a possible entry with risk under the August 26th low.

Latest on Wall Street Media on the run to resistance

S&P 500 (SPY) 338 must hold support. 340 pivotal 342 resistance

Russell 2000 (IWM) 153 153 support 155-156 resistance

Dow (DIA) 280 pivotal support 285 resistance

Nasdaq (QQQ) Right on the 50-DMA-could get ugly if breaks again-270 support

KRE (Regional Banks) Tried but could not close over the 50-DMA so still bearish

SMH (Semiconductors) 171.25 support and if breaks 170 a short consideration

IYT (Transportation) 200 key support

IBB (Biotechnology) Sitting right on the 50-DMA

XRT (Retail) 49.30 the 50-DMA

Volatility Index (VXX) Eyes here tomorrow

Junk Bonds (JNK) 104.90 support

LQD (iShs iBoxx High yield Bonds) 135.50 support

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.