Judging by the price action the past couple of sessions, bears clearly have the ball. The poor action was not just limited to the Nasdaq 100. The S&P 500 too had a shooting star on Thursday, followed by a long red candle on Friday; on Thursday, it did not quite get to 2040, where resistance was massive, but did rise to 2021. Similarly, the Dow Industrials was rejected at 17000.

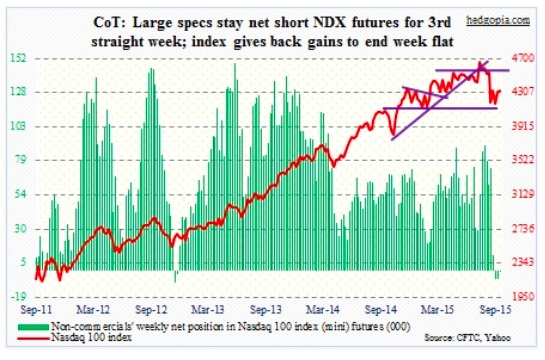

The COT Report: Currently net short 616, down 5.2k.

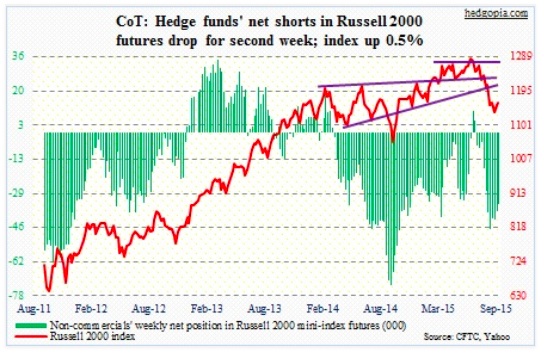

Russell 2000 mini-Index: As did the Dow, the S&P 500 and the Nasdaq 100, among others, the Russell 2000 also tested/came close to testing broken support. The 1210 level has been an important support/resistance line since March last year, which the index lost during the sell-off last month. Thursday, it rose to 1194 before reversing. On the iShares Russell 2000 ETF (IWM) the corresponding support lied in the 118-119 range; on Thursday, IWM rose to 118.89 before reversing. Daily momentum indicators are overbought, and there is plenty of room for unwinding.

The COT Report: Currently net short 34.4k, down 3.1k.

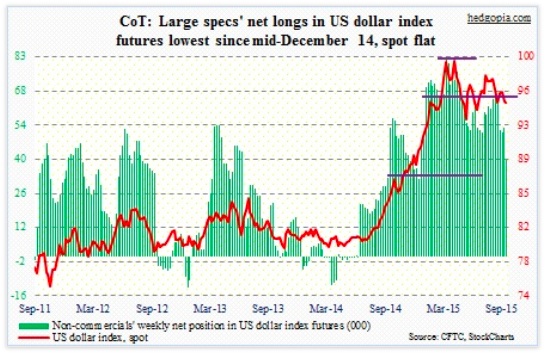

US Dollar Index: Standard & Poor’s on Wednesday lowered its rating of Japan’s sovereign credit by one notch – to A-Plus from AA-Minus. Fitch Ratings took similar action in April, preceded by Moody’s in December. The lesson here? Money-printing is not a panacea.

S&P’s move also did not have adverse impact on the yen, which rose 0.9 percent for the week. The Japanese currency (Yen) makes up 13.6 percent of the dollar index, which lost 0.2 percent for the week. The US Dollar was probably disappointed that the Fed did not hike.

Non-commercials continue to trim net longs per the COT Report.

The COT Report: Currently net long 39.8k, down 13.6k.

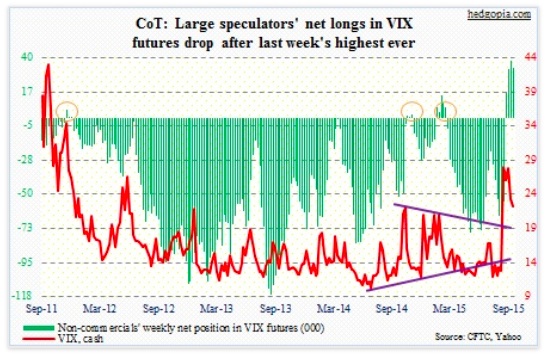

VIX: Per COT Report data, non-commercials slightly reduced their holdings. That said, they continued to stay net long for the fourth straight week. These are decent-size positions. Spot VIX has now stayed north of 20 for the fifth consecutive week, and is itching to move higher on a daily chart.

The COT Report: Currently net long 33.2k, down 4.8k.

Thanks for reading.

Twitter: @hedgopia

Read more from Paban on his blog.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.