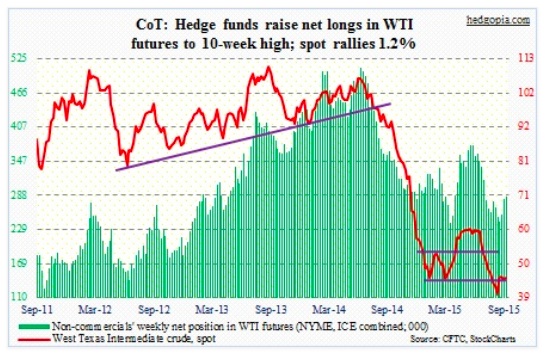

On Tuesday and Wednesday, it rallied 6.8 percent, then fell 3.8 percent in the next two sessions. Crude Oil was right not to expect a hike, but probably did not expect a rather dismal FOMC commentary on global growth.

With that said, Crude Oil prices rallied 1.2 percent for the week. The 49-50 level should continue to provide resistance, while support lies at 43-44. Odds favor it breaks to the downside.

The COT Report: Currently net long 285.6k, up 4.2k.

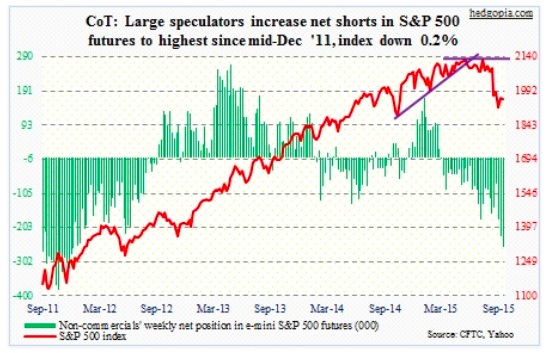

E-mini S&P 500: As per a Bank of America Merrill Lynch survey of fund managers, the percentage of those that are overweight stocks fell to 17 percent this month from 41 percent in August – allocations are at three-year lows. The rather sour mood among investors is also reflected on other polls. Investors Intelligence bulls’ count inched up to 26.8 percent; last week’s 25.7 percent was the lowest since late 2008. American Association of Individual Investors bulls were 33.3 percent, although their ranks have grown from 21.1 percent at the end of July.

Even so, in the September 16th week U.S.-based stocks funds attracted $12.7 billion – huge improvement over outflows of $16.2 billion in the prior week (courtesy of Lipper). Funds focused on U.S. shares saw inflows of $11.8 billion, while $835 million went to non-domestic-focused stocks funds. This perhaps explains the 2.2-percent jump in the S&P 500 on Tuesday and Wednesday, before an intra-day reversal on Thursday.

Post-FOMC decision and the subsequent confusion among market participants, the path of least resistance for the S&P 500 is probably down – at least in the near-term. Per the COT Report, non-commercials raised net shorts to the highest since mid-December 2011.

Moody’s Investors Service, by the way, seems to be throwing cold water on sell-side expectations for a rebound in earnings next year. As of September 10, operating earnings estimates for S&P 500 companies were $130.23, versus $111.54 this year. One reason why 2015 estimates have collapsed this year is what is transpiring in the energy sector. Moody’s is forecasting cash flow for global integrated oil and gas companies (such as Chevron (CVX), Exxon Mobil (XOM) and BP (BP)) is likely to fall by 20 percent or more this year, and that oil and gas prices will stay near recent low levels well into 2016. In other words, not a whole lot of improvement next year.

The COT Report: Currently net short 258.9k, up 32k.

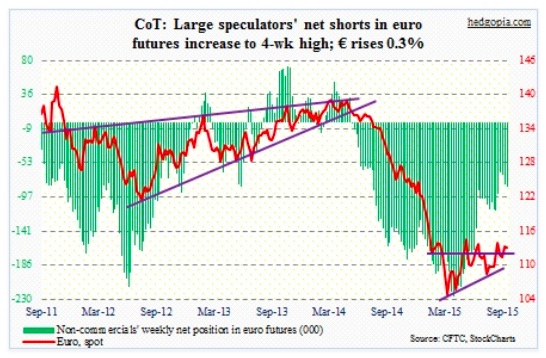

Euro: Eurozone annual inflation was a mere 0.1 percent in August, down from 0.2 percent in July – nowhere near the ECB’s target of just below two percent. This probably helps those wanting to extend/expand the current stimulus program. Currently, the ECB spends €60 billion/month in asset purchases, with a targeted end date of September 2016. Two weeks ago, Mario Draghi, ECB president, said there will be more stimulus, if the need be. And this may factor on the Euro.

In the meantime, the OECD on Wednesday raised its 2015 growth forecast for the Eurozone by 0.1 percentage point to 1.6 percent, but cut its 2016 forecast to 1.9 percent from 2.1 percent in June.

The COT Report: Currently net short 84.2k, up 3k.

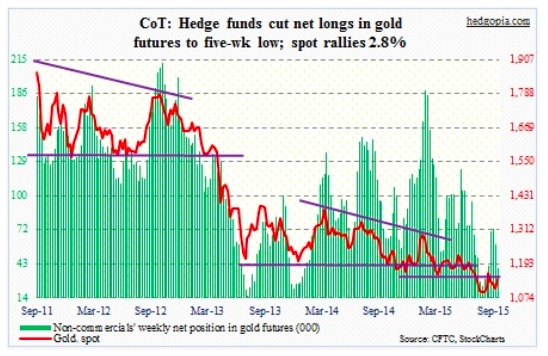

Gold: Kudos to gold bugs for reading the pre-FOMC tea leaves so well! Gold rallied huge on both Wednesday and Thursday, as well as both pre- and post-meeting, ending the week up 2.8 percent.

With this week’s move, the metal, as well as the SPDR Gold ETF (GLD) have moved past their respective 50-day moving averages. If Gold prices stay above for several more sessions, the average could begin to at least go flat.

But can GLD take out resistance at 110 is the big question? On Friday, the Gold ETF traded as high as $109.38. A convincing break higher will be a significant step as this resistance goes back to November last year.

The COT Report: Currently net long 39.5k, down 19.7k.

Nasdaq 100 Index (mini): Until shortly after Fed Chair Yellen’s press conference on Thursday, the stock market index was up nearly three percent for the week. Then came the late-day reversal, which resulted in a shooting star, followed by another on Friday. Back-to-back shooting stars! The first one was rejected at the 50-day moving average and the second at the 200-day. The index ended the week essentially unchanged. The 4350 resistance is intact.

On the PowerShares QQQ ETF (QQQ) the corresponding resistance lies at 105.50, and it closed Friday slightly below that.

continue reading about equities indices, the US Dollar, and the VIX…