Economic Releases continued…

Personal Income: Incomes advanced 0.5% for the second month in a row to help support higher household spending.

Core Inflation: Inflationary pressures remained quite low in May.

Although prices rose slightly, the pace of inflation over the past 12 months tapered off to 1.5% from 1.6% using the Federal Reserve’s favorite PCE price gauge. That’s well below the Fed’s 2% target.

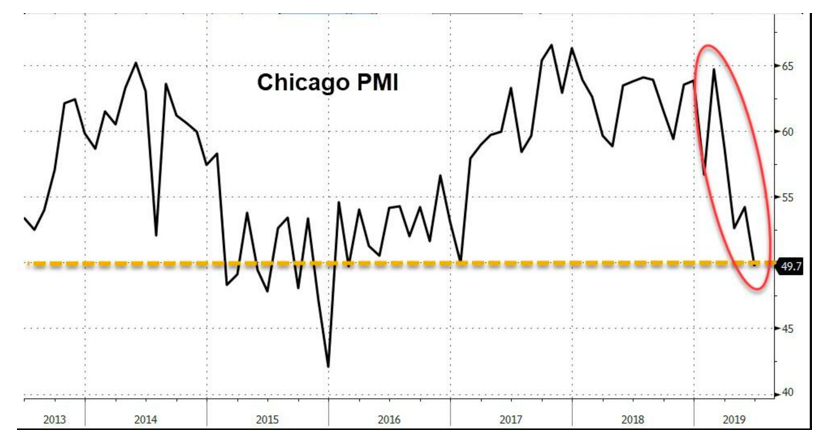

Chicago PMI: A measure of business conditions in the Chicago region fell in June into contraction territory for the first time since January 2017. The Chicago PMI business barometer declined to 49.7 in June from 54.2 in May, MNI Indicators said Friday.

Any reading below 50 indicates contracting conditions. The index had been as high as 64.7 just four months ago.

Samantha Says

Market Commentary from Samantha’s Live Trading Room and StockTwits Premium Chat Room

Jun. 28th, 9:17 am Good Morning – Banks are rallying on passing their ‘stress tests’ which they were guaranteed to pass. You’ve heard of ‘no child left behind?’ Same Thing. Having said that, if GS can get/stay >$204, it can nicely run into 61.8 fib ret at $210/211. BAC >$29… JPM >$113… C >$70. XLF >$27.50 is key for a buck higher.

Jun. 28th, 6:15 pm I have been in testing mode upon my return from NYC for the new roll-out of my Interactive Broker Trade Alert system for clients – now featuring Futures and Allocated trading in addition to Options and Stocks. It’s a funded account linked to my website so clients receive notice of my trades via real-time SMS/email. We also just added a LIVE PnL of all open trades across five portfolios. The whole thing is custom so LOTS OF WORK and tweaks. It begins July 7th. Thank you to WSJane for relaying my chase trade ideas, swing trade set ups and fave Unusual Option Activity here while I run my Live Trading Room. I will get back to posting more here intraday once my fintech product is flying on its own. Next week I will be working Mon, Tues, Wed then away Thurs – Sun. So both my trading room and this chat room will be closed! I hope you all have a wonderful time off over the 4th of July week/weekend!!

Jun. 28th, 6:29 pm Overbought ETFs that are in danger of giving back gains: HYG, DIA, IGV, IYR, GLD With Rotation into Oversold ETFs making some nice moves higher: IWM, IYT, XLF, XLE, XME

Jun. 28th, 6:38 pm IWM was my Chase long call at open with 158PT before real test. XLF was my Tell for higher markets as we have a potential ‘value’ set up for banks to continue higher (versus unicorns for example) based on overhead removed from stress tests and bull steepener in play. SMH has been great for 3 days txs to MU (rec buy on gap up>$35.50 post EPS) with NVDA and AMD. Thinking time for these to rest.

Jun. 28th, 6:44 pm Swing Short Ideas suggested this week with LRE (low risk entry) PT are still viable and need time to work (or not), but haven’t triggered their stops fascinatingly: BA, CAG, GIS, DG, ROKU, TSLA, IGV, TSN, DE, JNJ…

Jun. 28th, 6:49 pm Swing Longs also haven’t triggered their stops: GRUB, DBX , OSTK, AVGO, AMD, SNAP

Jun. 28th, 6:58 pm For Unusual Option Activity that matches my chart read: DIS $138P, MSFT $133P Speaking of UOA, I mentioned SRPT (this morning) in my trading room at $135 when I saw large July 5 $150C at $2.10 and loved the Weekly scoop pattern. A client bought the stock right then and sold when it spiked ~ $153+ an hour later. The options went to $9 before settling back to $5.50. Can I tell ya, the chart on the wkly still looks really constructive (for SRPT)!

Jun. 28th, 6:03 pm Last but not least, none of this will work if all hell breaks lose in Osaka this weekend, but if I was a betting gal, I would say nothing will happen but more posturing. No Meeting of substance, if at all. No Tariffs until closer to the FOMC July 31st (which I suspect Trump will use to ‘weaponize the Fed’ to cut.) Maybe Truce Talk which would be business as usual for stock pickers and allow more time for my intermarket analysis to trigger those Volatility calls. I lean more toward Chop until we Drop – right before FOMC or soon after.

Wall Street Jane’s Journal

Jane is not only Samantha’s Live Trading Room moderator, she facilitates client engagement and relays Samantha’s trade ideas into the LaDucTrading StockTwits Premium Room. A former banking VP during the GFC, she now actively trades full-time and actively shares her trading ideas, plan and process.

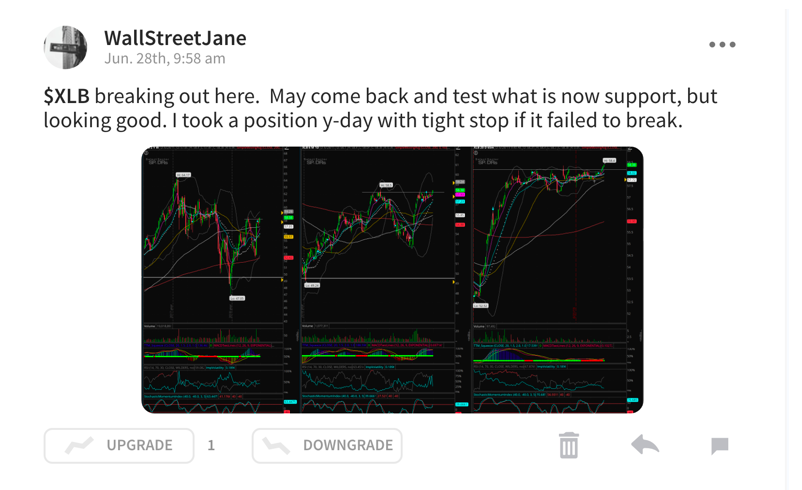

We’ve been watching the SPDR Materials Sector ETF (NYSEARCA: XLB) since June 23rd in the StockTwits room and today was the day it finally broke above that resistance today.

It didn’t pullback much and finished near the high of the day. My August monthly calls are up 17% as of close.

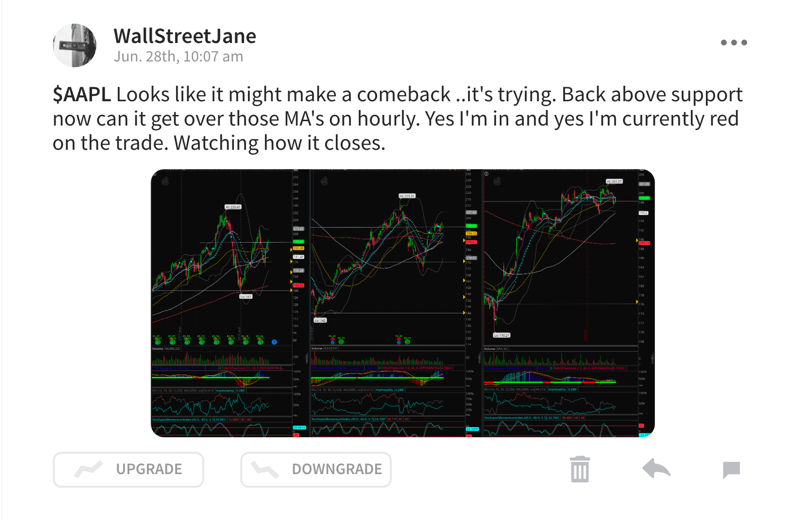

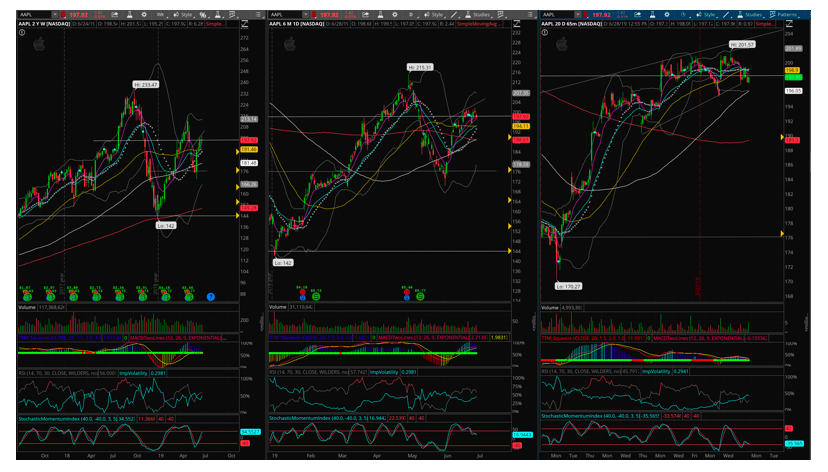

On the flip side, I took a long position in Apple (NASDAQ: AAPL) on June 26th and I was clearly trying to will it higher today.

Not a great close, but I continue to hold my August monthly calls. I’m currently down 17% on my options.

Stocks of Interest in the News

AAPL: After hours last night Apple announced its long-time design guru, Jory Ive, was departing the company to start his own firm. The stock took an initial hit, but it was then disclosed that AAPL will be a client at his new firm. This departure had been in the works for some time so the initial shock wore off fairly quickly. Here is a nice piece about his long tenure at Apple and relationship with Steve Jobs: The Jony Ive Obsessions That Built Apple

Great Reads

The great outdoors and important trails like the Pacific Coast Trail do require maintenance and the effort these men are willing to contribute is inspiring, to say the least: The Retiree ‘Trail Gorillas’ Who Keep the PCT Clean

This Bloomberg Feature is a tough but excellent read: Hooked: A raging heroin addiction fueled a former Boeing engineer’s yearlong, 30-bank robbery spree

Thanks for reading and please consider joining me in the LaDucTrading LIVE Trading Room where I take macro and market-moving news, give it context, and recommend trade ideas from it. For additional education, I provide my LIVE Trade Alerts from Interactive Broker to clients interested in my Value and Momentum stock and option plays.

Twitter: @SamanthaLaDuc @LaDucTrading

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.