Early each morning, I scan and synthesize market-moving news. I look at macro themes, currency moves and global economic indicators that support or challenge my thinking on the Big Picture and help me take the mood of the market. I like to assemble these data points and turn them into context for my clients.

While surveying the market landscape, I am also actively looking for new momentum and value trades for my Live Trading Room and some may even make it into my Live Portfolio, Brokerage-Triggered, Trade Alerts! To catch all the live trading action, join me 9:00am – 12:00pm ET every trading day. I look forward to fishing with you!

Market Thoughts

Oh, we’ve got to hold on, ready or not

You live for the fight when it’s all that you’ve got

Woah, we’re half way there

Woah, livin’ on a prayer

Take my hand, we’ll make it I swear

Woah, livin’ on a prayer

– Bon Jovi

As we close the first half of 2019 today, it’s fun to reflect that we are ‘half way there”. Not just for the year but also it seems with the US-China Trade War. Color me skeptical, but this fight has been going on for over a year now, by some accounts, even longer. And I contend it will be “a thing” up until the 2020 Election if not later – so at least another year of the headline drama and disappointing growth. Sorry, but to think otherwise, I’m just livin’ on a prayer.

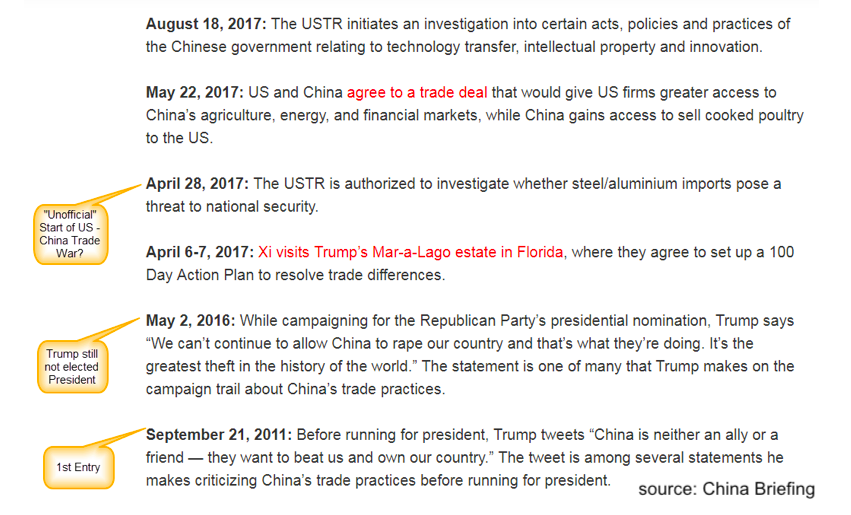

So when did this self-imposed US conflict officially begin? This battle that Trump took up to ‘level the playing field’? Would it surprise you to know that the China Briefing has kept a timeline?

Events leading up to the US-China trade war

Of course, this is just the first few entries by the Chinese newspaper (China Briefing); there is a long list you can check out, but what I found interesting was how they placed the first timestamped entry of a warring Trump long before he was even elected. Fast-forward from 2011 to 2017, and I would contend ‘first shots were fired” when Trump authorized “investigation” into Steel Tariffs.

US-China Trade War 358 Days In

A more official day for the trade conflict was the implementation of those tariffs on Chinese imports.

Day 1: July 6, 2018 – US implements first China-specific tariffs

US: The US Customs and Border Protection (CBP) begins collecting a 25 percent tariff on 818 imported Chinese products (List 1) valued at US$34 billion – giving effect to the first round of tariffs, which were revised and announced on June 15, 2018.

And here we are, 358 Days in and what else is there to say: “You live for the fight when it’s all that you’ve got”, Bon Jovi.

G20 is expected – by the markets not me – to produce the resolution to the Trump – Xi differences. Market have already priced it in! The S&P 500 is up almost 17% and the Dow had it’s best H1 in close to 81 years.

But even if a trade deal is not reached this weekend, we have the FOMC ready to hold our hand. And we may need it: The second-quarter earnings season is set to begin in two weeks and earnings growth is expected to decline in both Q2 and Q3. Earnings are expected to decline by 2.6% for Q2. Tech earnings in particular are expected to fall by 9.3%.

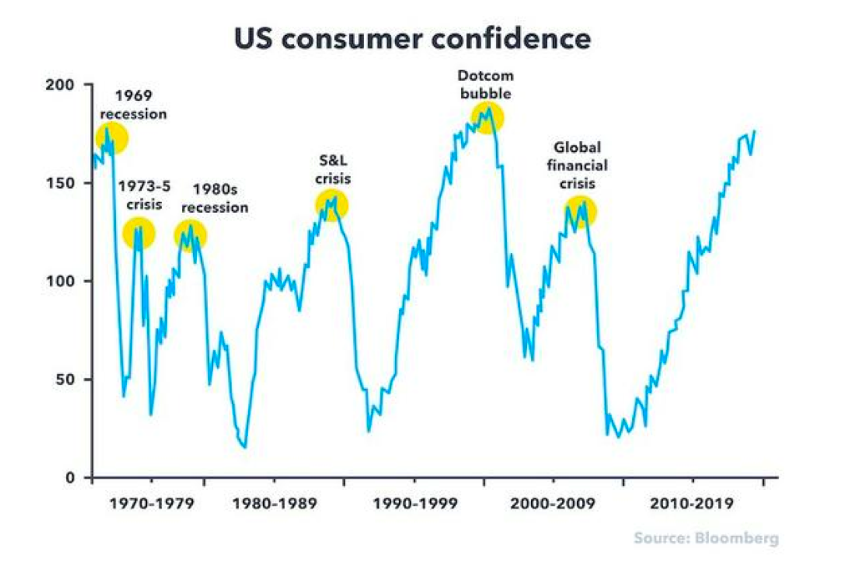

Despite earnings weakness, stocks have fared well this half of the year – despite tariffs, despite Iran, despite Brexit and despite the Fed. What stocks haven’t done is fall despite the weak consumer-confidence, despite weak new home sales, despite weak earnings growth. So I caution not to get too carried away with sentiment-driven stock market prices.

There’s a direct relationship between short-term interest rates and stock valuations. So we’ve seen share prices rise as earnings have flatlined. But at the same time, short-term rates are expected to fall soon. In other words, the valuations can mask the weakness in the market. Eddy Elfenbein

Next week, besides the outcome of the G20 meeting and Trump – Xi meetings, we have some economic reports to help size up market strength or weakness: ISM Manufacturing Index will come out on Monday, ADP payroll Wednesday and NFP jobs report Friday.

Day 356: June 26, 2019 – Tentative truce reached days before G20 Summit

The US and China have agreed to a tentative truce in the lead up to their resumed trade talks in Osaka this weekend. Details of the agreement are being drawn up and are expected to be released prior to the meeting. The US has threatened 25 percent tariffs on a further US$300 billion of Chinese imports, which is expected to be halted. Sources quoted by the media suggest that Trump might propose a deadline of six months for the talks to reach an agreement. If this does culminate, it would mean the US would hold off on implementing further tariffs until the end of the year.

And if Trump instead decides he is not happy this weekend and follows through with his threat of implementing the extra 25% tariffs, we will be signing a different tune:

“Take my hand, we’ll make it I swear

Woah, livin’ on a prayer”

Macro Matters

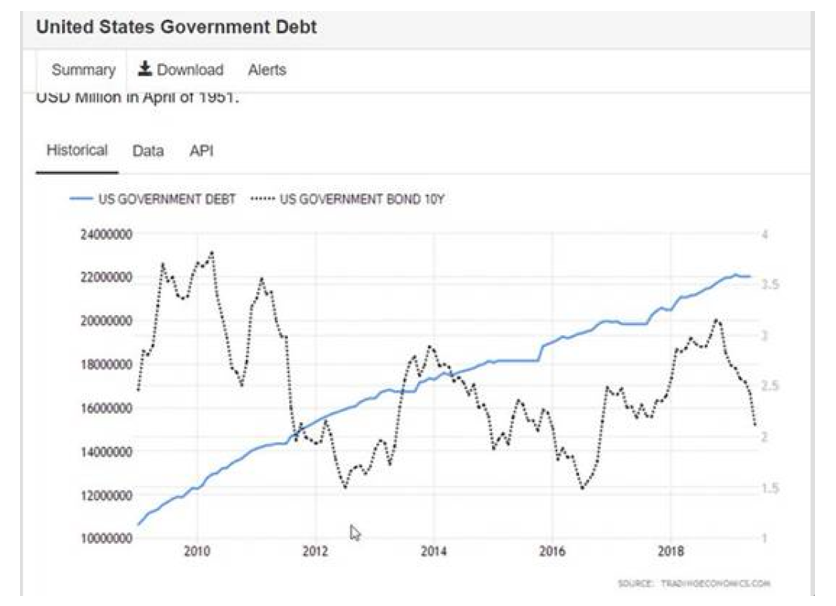

Humor Me: With the coming debt ceiling and potential federal government shutdown in the Fall, I am not surprised to see slowing Gov Spending. The Treasury Shortage has also most likely contributed to an inverted curve (Lower FFR; excess bank reserves depressing interbank rates) so it’s not a surprise to see Gold rally hard, but watch for when Treasuries are again available. We will see the opposite: rates rise and Gold falls.

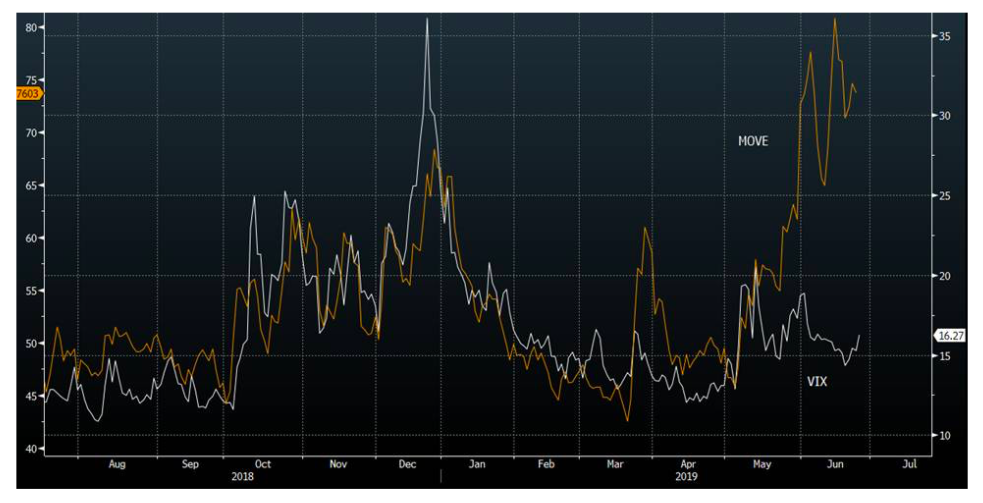

Speaking of treasuries: that Treasury Volatility Move has been out-sized, but all the more reason the reversion back to VIX Volatility will be as out-sized… VIX chart via Bloomberg charting.

Economic Releases

No Consumer Confidence

The 9.8-pt drop in confidence was one of the largest monthly declines for the Conference Board index of the expansion, and it brought the level of confidence down towards the low end of the range reported over the past couple of years.

Consumer spending rose at a healthy clip in May for the third month in a row, suggesting the U.S. economy is still on solid ground even as growth has waned. Consumer spending increased 0.4% last month, the government said Friday.

continue reading on the next page…