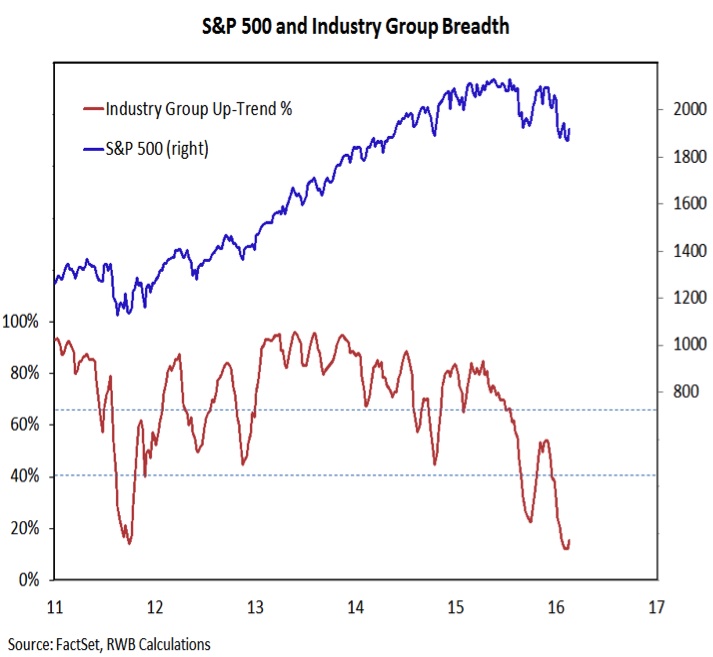

Market Breadth

While some evidence of better short-term breadth can be seen, the longer-term trends continue to argue for caution. Last week we noted that we have not seen a notable and sustained expansion in the number of stocks making new highs. This week we look at the percentage of industry groups in up-trends. While this number did increase last week (from 12% to 15%), it was just the first increase since November. The recent low undercut the 2015 low, meaning we have not seen a positive divergence from this indicator that would suggest the price lows are in place. We still need to see more evidence of improvement before the broad market gets the benefit of the doubt.

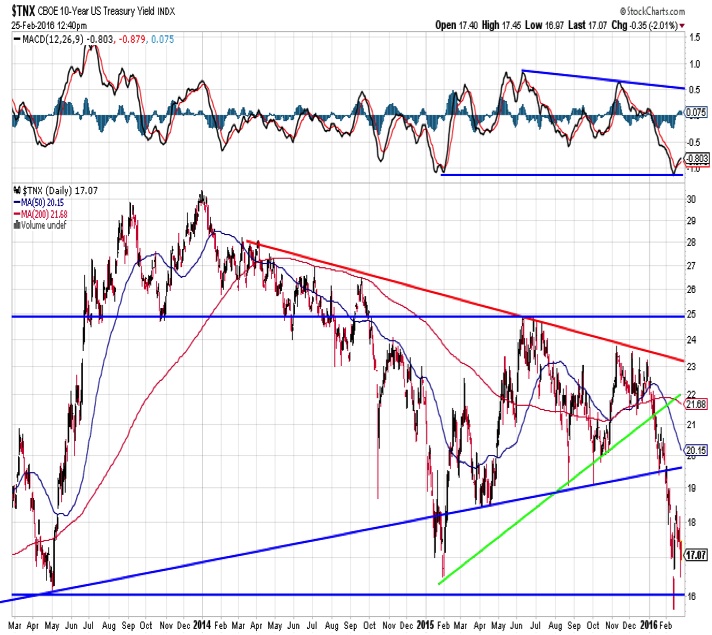

10 Year U.S. Treasury Yield

In this week’s Macro Update (Inflation Starting to Show Signs of Life) we discussed the outlook for inflation and suggested we may be in for an upside surprise. As such it might be timely to review key levels for the 10-year T-Note yield. Support has been established near 1.60%, which coincides with the 2013 low. In terms of resistance, 1.95% and 2.30% look like important levels. While they seem far away with the T-Note yield currently at 1.70%, they are levels that we have seen this year. In other words, yields appear extended to the downside at a time when optimism around bonds is excessive.

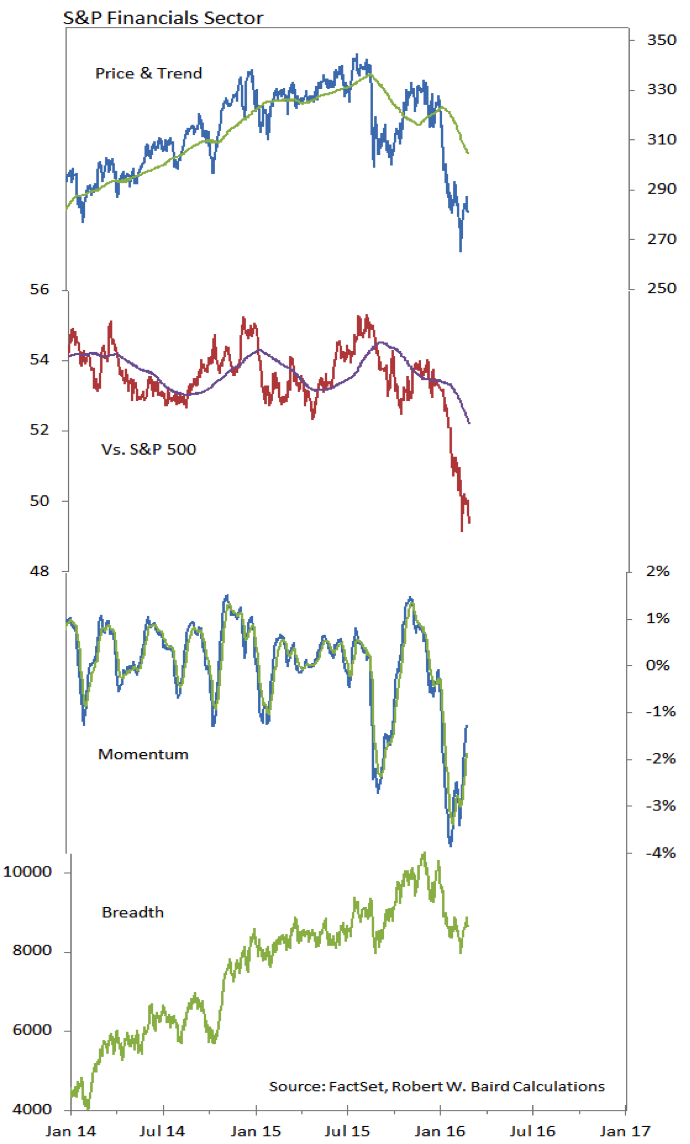

S&P Financials Sector

While we have seen some evidence of healing from the sentiment data and short-term breadth indicators, sector-level leadership conitnues to be tilted toward defensive sectors. We would have more confidence if the Financials sector were holding up better. They have bounced on an absolute basis (and momentum is moving higher), the relative price trend shows they continue to lag the overall market. One encouragement is that while price has undercut its 2015 lows, breadth has not.

Thanks for reading this week’s stock market outlook. Have a great weekend.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.