Here’s a look at some key stock market indicators, charts, and themes that we are watching.

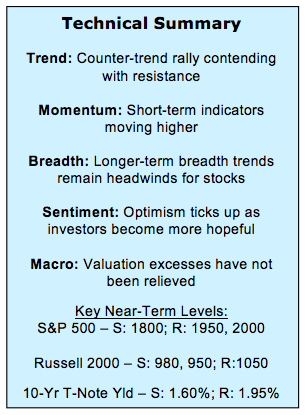

This Week’s Stock Market Outlook:

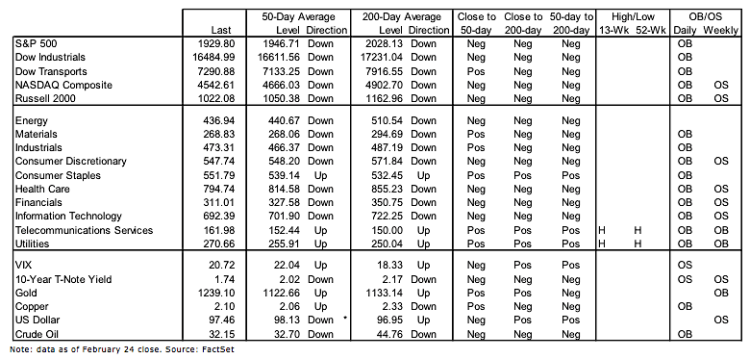

Is Rising Optimism Helpful? In a word, yes. So often the focus with sentiment data is the contrarian aspect. Overlooked is that after crowd sentiment gets excessive in either direction and begins to reverse, it pays to go with the crowd. After having seen excessive pessimism a modest rise in optimism, like what is being seen now, is bullish and something to weight in the near-term stock market outlook.

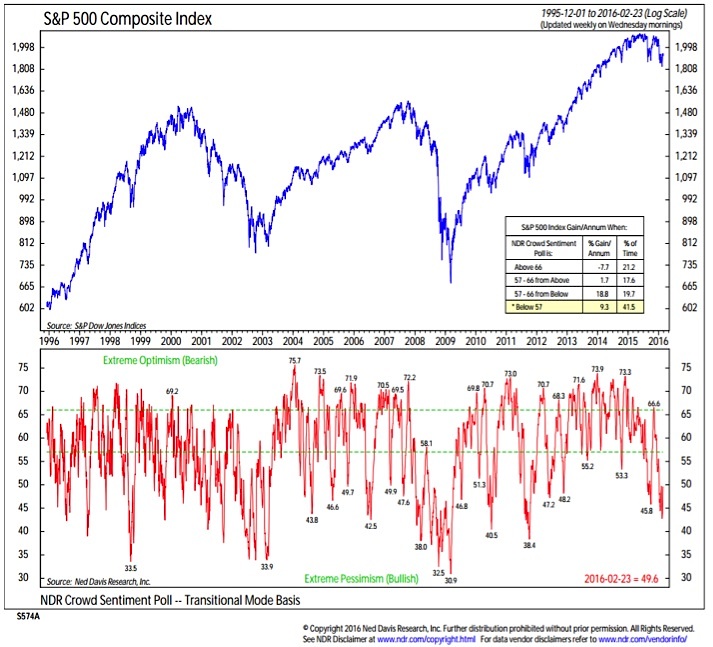

Where in the World Is Relative Leadership? The trend favoring U.S. leadership versus the rest of the world is intact and gaining strength. Beyond that, things get more interesting. Emerging markets face long-term headwinds, but are gaining strength relative to developed markets, and the large-cap/small-cap ratio here at home continues to break in favor of large-caps.

Breadth Trends More Hopeful Than Helpful at This Point – The improvement in short-term breadth could help provide some buoyancy to the near-term stock market outlook. That said, we have yet to get the sort of longer-term breadth divergences that strongly suggest a lasting low is in place. Trends in those indicators need to improve in coming weeks and stay robust on any re-test of the S&P 500 lows to provide a more helpful breadth signal.

Stock Market Indicators – Indices & Sectors (click to enlarge)

U.S. Equity Markets

This week’s AAII survey shows an even split between bulls and bears (31% apiece). Bulls have risen from extremely low levels and are at their highest level since November – but they are still below their long-term average. We’ve seen a similar situation on the Investors Intelligence data. At this point, following readings consistent with excessive pessimism, a rise in optimism is actually bullish for stocks. It suggests near-term fears are subsiding and investors are moving back into equities.

When there is a window of opportunity for stocks overall to rally, the question that follows is usually about relative leadership. The trend favoring the U.S. over the rest of the world remains not just intact, but appears to be gaining strength. Momentum in favor of the U.S. has rallied toward down-trend resistance. A breakout there could help sustain another leg higher in the U.S. relative to the rest of the developed world.

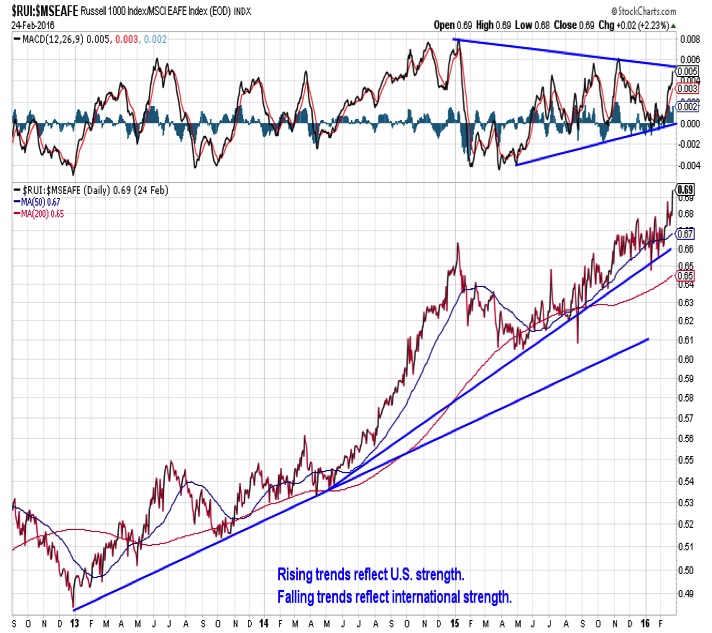

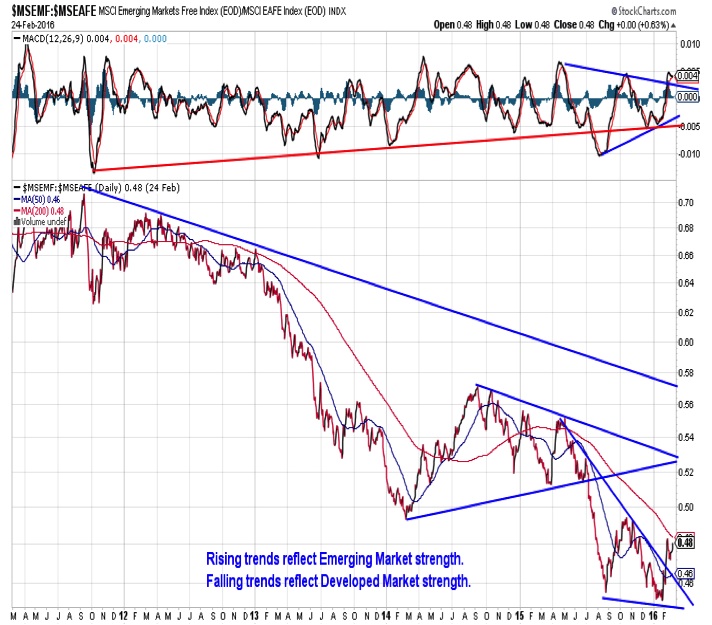

Emerging Markets

Emerging markets remain in a long-term down-trend relative to developed markets. But over a more intermediate-term horizon, there may be opportunity for emerging market leadership. While emerging markets made a new price low relative to developed markets earlier this year, momentum did not follow suit. Now, the trend in developed market leadership (from both a price and momentum perspective) that had been in place since mid-2015 is being broken.

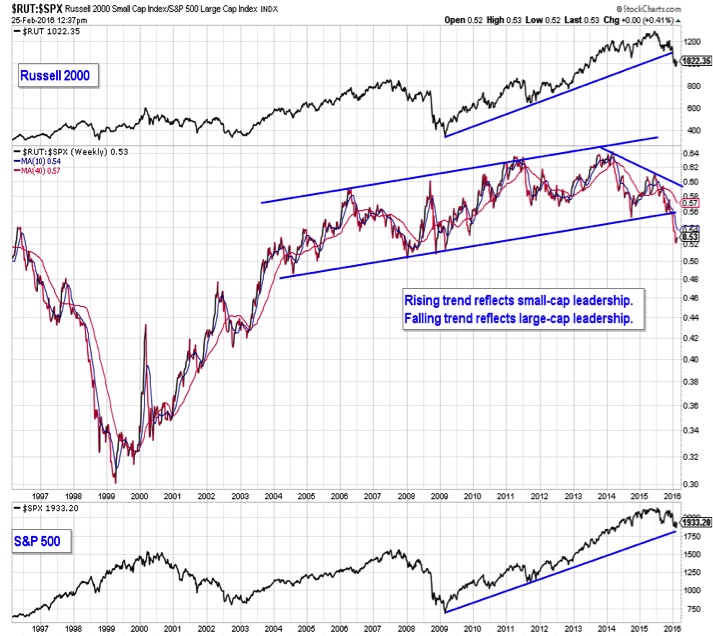

Russell 2000 : S&P 500 Index Ratio

At home, we continue to see large-cap leadership. The break-down in small-caps follows failed rallies and appears to be the early stages of a secular trend in large-cap leadership. The breakdown in the small-cap/large-cap ratio comes as the Russell 2000 has broken below a long-term up-trend line while the trend-line for the S&P 500 over a similar time period continues to provide support.

continue reading on the next page…