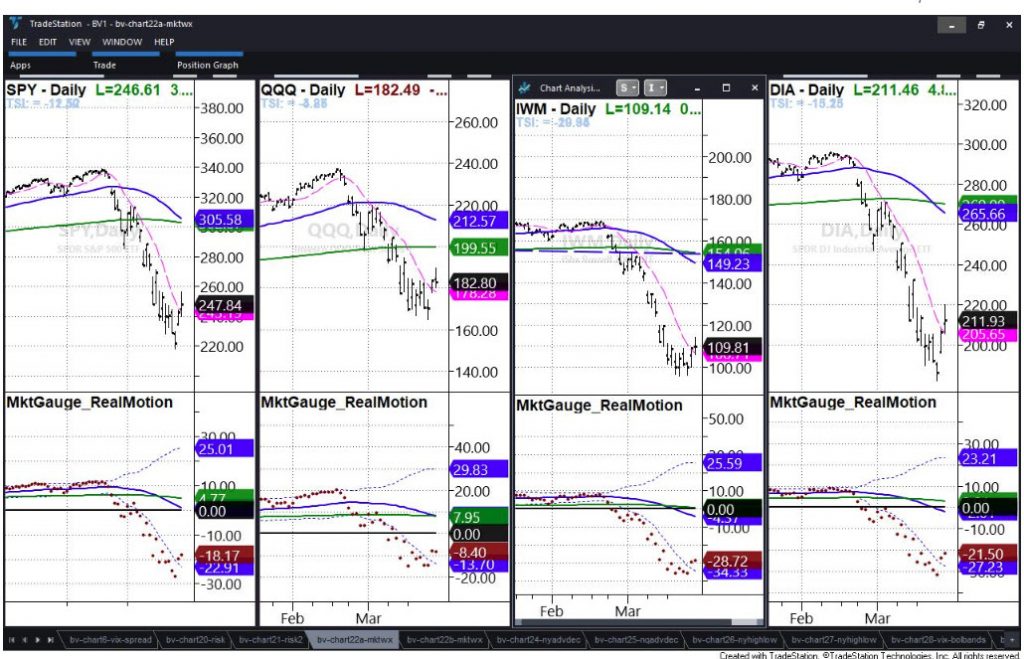

This is a shot of our BigView tool looking at the stock market indices with our real motion indicators.

Here’s some high level insights, key trading levels, and what you need to know:

First, the momentum indicator has turned the corner from falling to rising.

Second, below are the key closing levels for the week to determine how much, if any, risk you should take home for the weekend.

Stock Market Indices: Closing Levels

For the S&P 500 (SPY) it must close over 256.35, while a close under 241 is unhealthy. The 200-week moving average is 264.00

The Russell 2000 (IWM) must close over 111.30 and clear 119.47 to keep its rally going.

The NASDAQ 100 (QQQ) must hold 184.68 and clear 192.40 to keep going.

The Dow Jones Industrials (DIA) must hold 218.31 and clear 232.11 to keep going.

Economic Modern Family (of ETFs): Closing levels

Retail (XRT) Must clear 30.93, hold 27.96. Biotechnology IBB Must clear 104.99 and hold 95.00. Regional Banks KRE (weakest) must hold 32.25 and clear 35.34.

Semiconductors (SMH) must hold 112.44 and clear 120.66. Transportation IYT must hold 138.91 and clear 142.58.

KRE (Regional Banks) must hold 32.25 and clear 35.34.

IYT (Transportation) must hold 138.91 and clear 142.58

IBB (Biotechnology) Must clear 104.99 and hold 95.00

Important Outliers – Closing Levels

High Yield Investment Grade Bonds (LQD) has the 200-week moving average at 119.96. Must hold 115.42, and clear 122.05.

Junk Bonds (JNK) must close above 93.49 and hold 85.97

US Oil (USO) must close above 4.94, clear 6.09 and hold 4.29.

Volatility Index (VXX) Back looking at 40.00

This is the basis of my trading plan for not only our existing positions but also whether we add, raise stops or put on protection Friday or Monday.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.