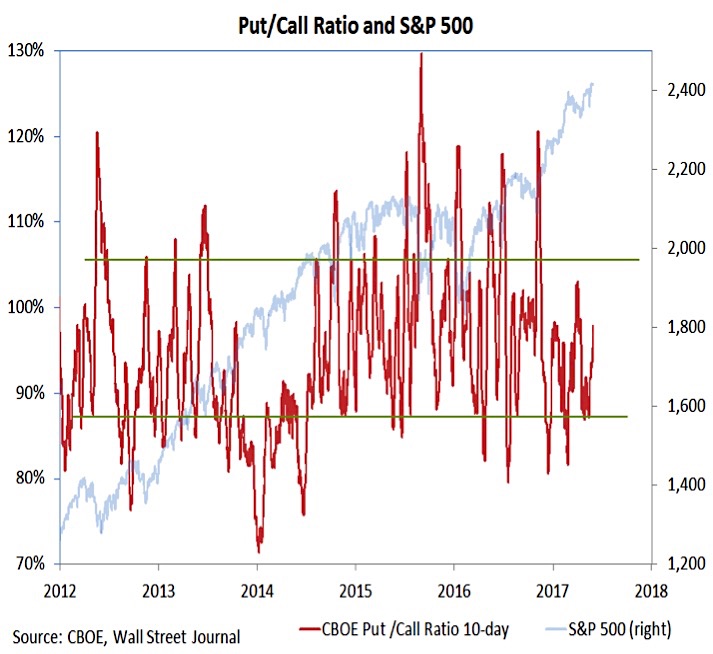

CBOE Put/Call Ratio

Sentiment surveys continue to offer a mixed bag of evidence. Both the NAAIM and Investors Intelligence surveys this week showed a pullback in bullishness, but optimism remains elevated. The AAII survey again shows more bears than bulls, although if there is euphoria anywhere in that survey it is probably among the neutral respondents (41% this week). What has caught our eye this week as been persistent strong demand for put options. The 10-day CBOE put/call ratio is rising sharply even as stocks move to new all-times highs. The displays a healthy level of skepticism even amid evidence of some degree of optimism in some of the sentiment surveys.

10 Year Treasury Yield

The recent decline in bond yields speaks to uncertainty about the outlook for the U.S. economy and skepticism about stocks. This skepticism has had and continues to have bullish implications for stocks. The 10-Year Treasury Note Yield (INDEXCBOE:TNX) has pulled back to support near 2.20%. The peak yield for the year at 2.60% in the first quarter remains an important resistance level. If confidence in the economy returns, this level could be tested in a relatively short period of time.

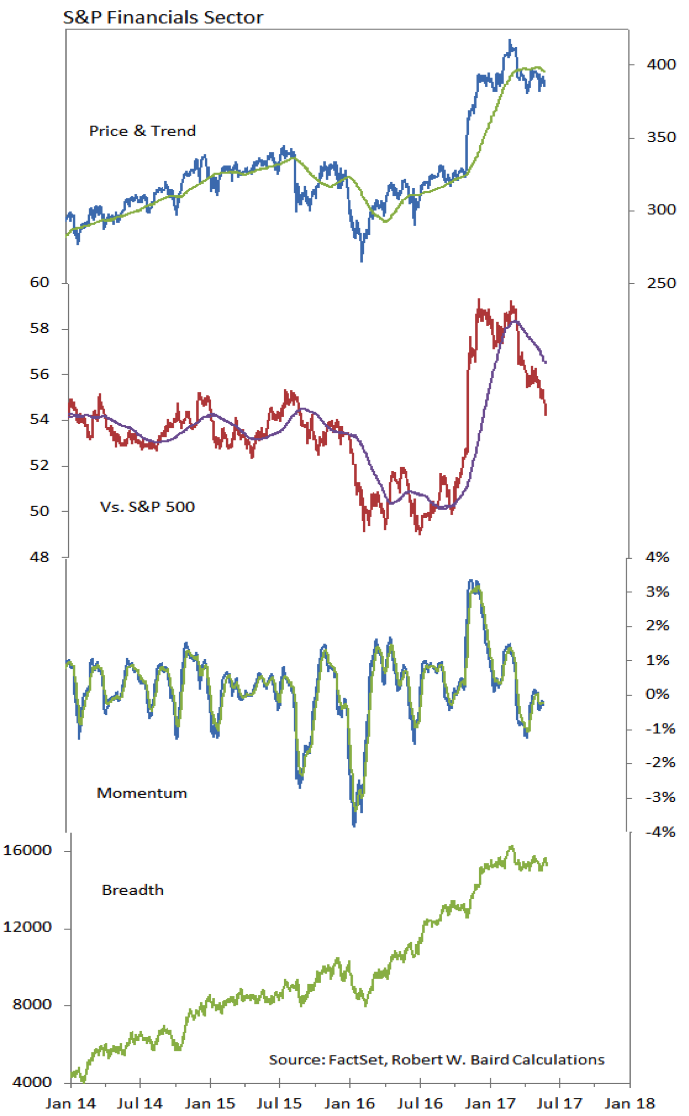

S&P Financial Sector

If bond yields do move back toward their early-year highs, the Financial sector could see renewed interest. So far, the trends do not offer much evidence that this will be the case. Breadth in the sector has been relatively strong, but momentum remains in a downtrend (defined by lower highs and lower lows) and price has stalled on an absolute and relative basis. The up-trends that emerged over the course of 2016 do remain intact but got over extended in the fourth quarter of last year.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.