Stocks rose last week, with the S&P 500 (INDEXSP: .INX) up 45 points to 2531, a gain of almost 2 percent.

To get there, however, the stock market bounced around considerably, finishing Friday higher by over 3 percent.

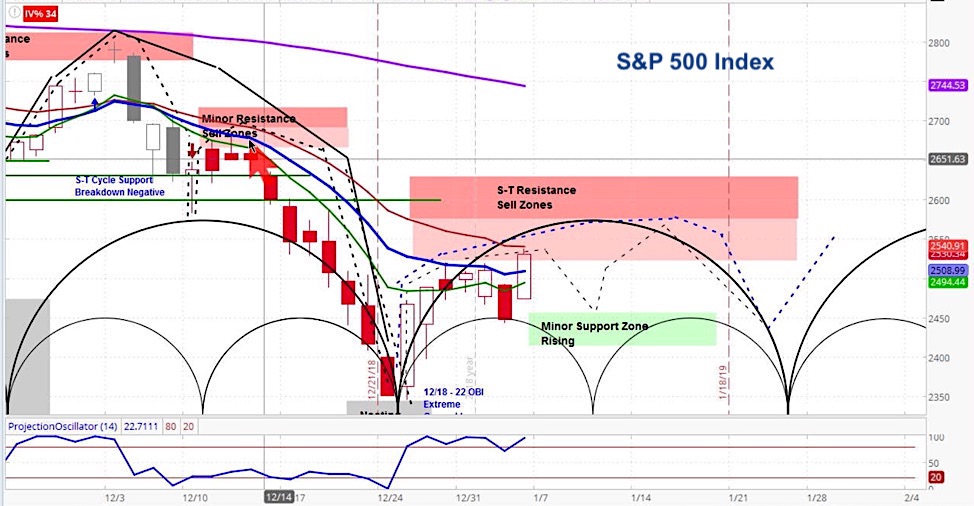

In the near term, we will use technical analysis and market cycles to project price action.

Our analysis of the S&P 500 is for a decline into the middle of the week with a the support zone between 2425-2465.

By the end of the week, we expect stocks to rise again, with follow through into the subsequent week.

Overall, we expect the resistance zone shown on the chart to stop rallies over the coming weeks. See chart further below – it is discussed in detail in this week’s video.

S&P 500 Market Cycle Outlook for the Week of January 7, 2019:

The stock market began the new year where it left off the last one – with investors nervous about the emerging bear market and fearful they could miss the next rally. With above average volatility, the S&P 500 was both up and down by multiple percentage points.

The week began with the Caixin Manufacturing Purchasing Managers Index (PMI) for December coming in at 49.7, which was both lower than expected and below the previous month. The Chinese government’s PMI also showed data that underperformed.

On Wednesday night, Apple (AAPL) projected lower revenue for the holiday quarter, below their previous forecast and also showed a decline compared to the quarter one year ago. The stock tanked as did the S&P 500, NASDAQ, and Dow Jones.

In the US, PMI registered at 54.1, which was also lower than expected and below the previous month. The fact that both PMI data points underperformed could mean that the effects of the trade war are impacting the economy.

In any case, the stock market finished the week strongly, with 312,000 new jobs in December, crushing expectations. The unemployment rate ticked higher to 3.9%, as people re-entered the workforce, which was perceived as a sign of economic health.

Investors were further comforted when Fed Chair Jerome Powell confirmed that he was willing to shift monetary policy should economic data indicate slowing growth. He said, “We’re listening carefully and will take downside risks into account as we make policy.”

Going forward, we expect continued weakness in the stock market. We believe a worldwide bear market has begun and it is thus important to consider when you are going to sell this rally. Stay tuned, as we will revisit this topic in the coming weeks and months.

S&P 500 (SPX) Daily Chart

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.