Broad Stock Market Futures Outlook for June 5, 2018

Breaches of prior resistance under continued technical divergence. Allow levels to test and fail if you are looking for shorts, or test and hold if you are looking for longs.

Pullbacks remain buying areas so be patient if choosing your trading directions.

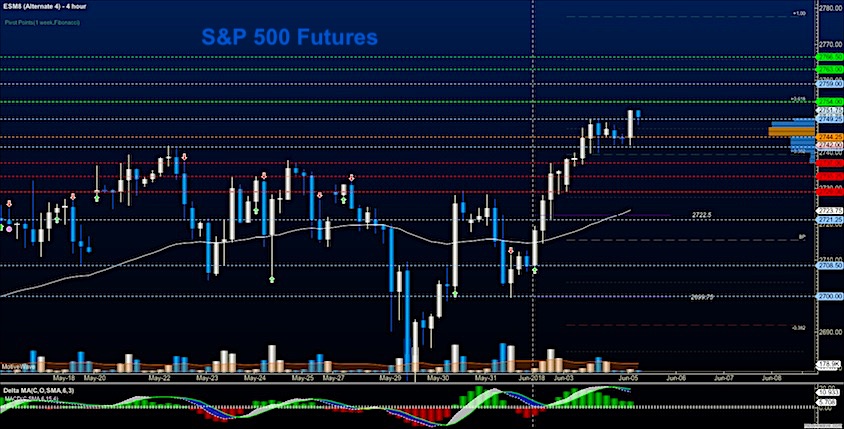

S&P 500 Futures

New intraday resistance levels in the early morning as bullish pressure holds. Fades will be buying opportunities as the charts and traders remain optimistic. Chasing breakouts may indeed reap rewards but at the risk of higher loss exposure. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2753.50

- Selling pressure intraday will likely strengthen with a bearish retest of 2741.5

- Resistance sits near 2749.5 to 2751.75, with 2754.75 and 2759.75 above that.

- Support sits between 2746.25 and 2741.75, with 2736.5 and 2729.5

NASDAQ Futures

Tech continues to outshine other indices holding higher support levels near 7102. Formations remain generally bullish but divergent, making pullbacks excellent opportunities for entry. Chasing breakouts will open risk here, but swift entries and exits could still prove fruitful. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 7175

- Selling pressure intraday will likely strengthen with a bearish retest of 7104.5

- Resistance sits near 7174.75 to 7190.25 with 7204.25 and 7213.5 above that.

- Support sits between 7161.5 and 7150.5, with 7131.75 and 7078.75 below that.

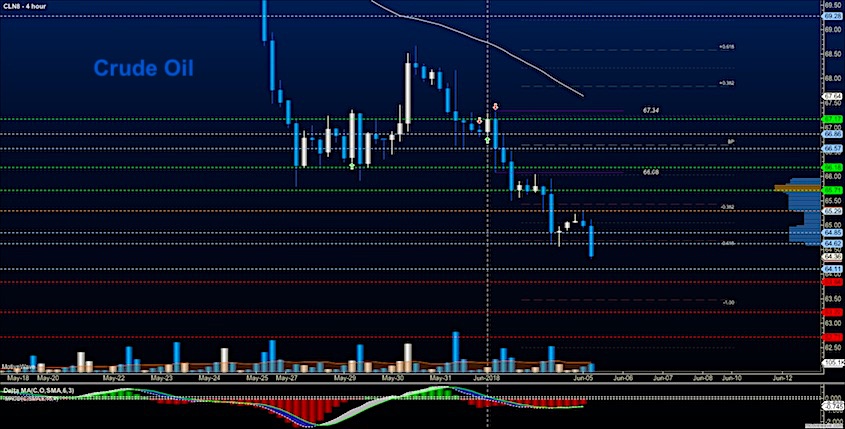

WTI Crude Oil

The crowded upside trade as inventory builds leaves trades heading for the doors. Dips continue as bounces allow trapped buyers to leave. Another important level of support near 64.3 exists below but buyers are tentative at best even with downward continuation as we extend a positive divergence-(hint – that means using positive divergence to initiate a trade will deliver mixed performance). Trading well means watching what traders are doing and adapting your behavior in that environment. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 65.35

- Selling pressure intraday will strengthen with a bearish retest of 64.3

- Resistance sits near 64.89 to 65.26, with 65.82 and 66.12 above that.

- Support holds near 64.4 to 64.17, with 63.81 and 63.27 below that.

You can learn more about trading and our memberships HERE.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.