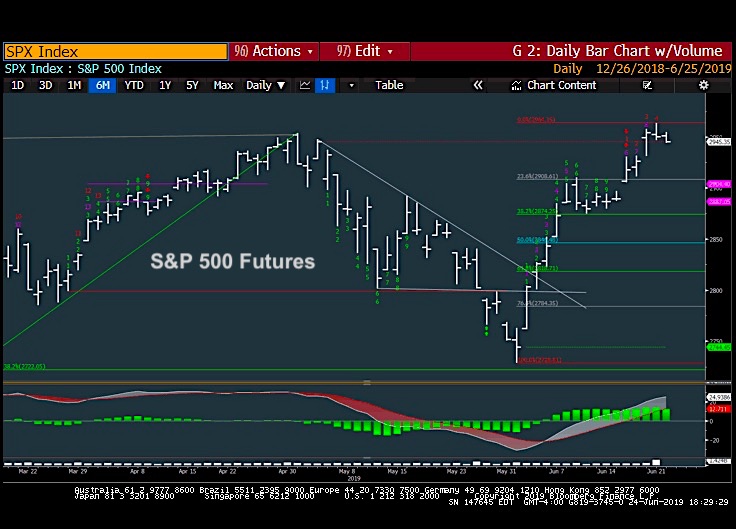

S&P 500 Futures “daily” Chart with Analysis

Monday’s decline on the S&P 500 (INDEXSP: .INX) below last Friday’s lows could bring about 3 to 4 days of selling into the G-20 meeting. But we’ll continue to let the price action dictate.

There is support near 2900. And any close over 2964 lets the rally continue.

The S&P 500 Index could weaken near-term, but likely will prove minor and buyable into G-20. Movement over 2964 would postpone any decline.

Looking back at yesterday, SPX managed to pullback under the prior days lows which represented the first time this has happened on a closing basis since early June.

While not a “hard and fast” sell rule per se, many other stock indices are starting to show some evidence of stalling out and rolling over to multi-day lows, the Transports and REITS being two.

Other sectors like XLY failed at former highs and are weakening. Bottom line, some minor weakness could happen in the days ahead, but likely does not get down under 2900 and should be used as a buying opportunity for further strength into July.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.