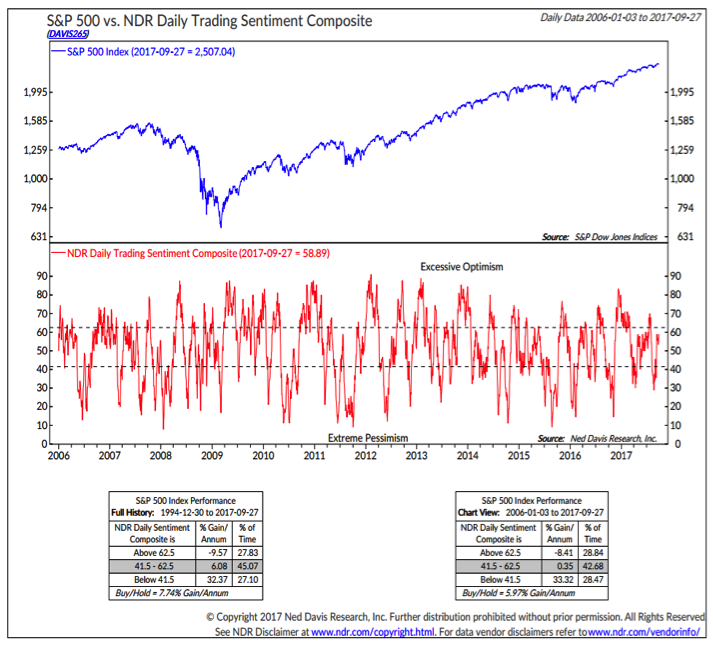

Short Sentiment

The short sentiment outlook is becoming more problematic for stocks. The NDR trading sentiment composite has turned higher in recent weeks (after doing a great job of pointing out the emergence of excessive pessimism in August) and is now on the cusp of signaling excessive optimism.

Broker-Dealer Index

Leading indicators for the S&P 500 are showing renewed strength. The Dow Transports (discussed last week) and the Broker/Dealer index have moved to new highs on an absolute basis. Momentum for the Broker/Dealer index, however, has not broken out to the upside and on a relative basis (versus the S&P 500) the Broker/Dealer index is facing resistance at the early 2017 highs.

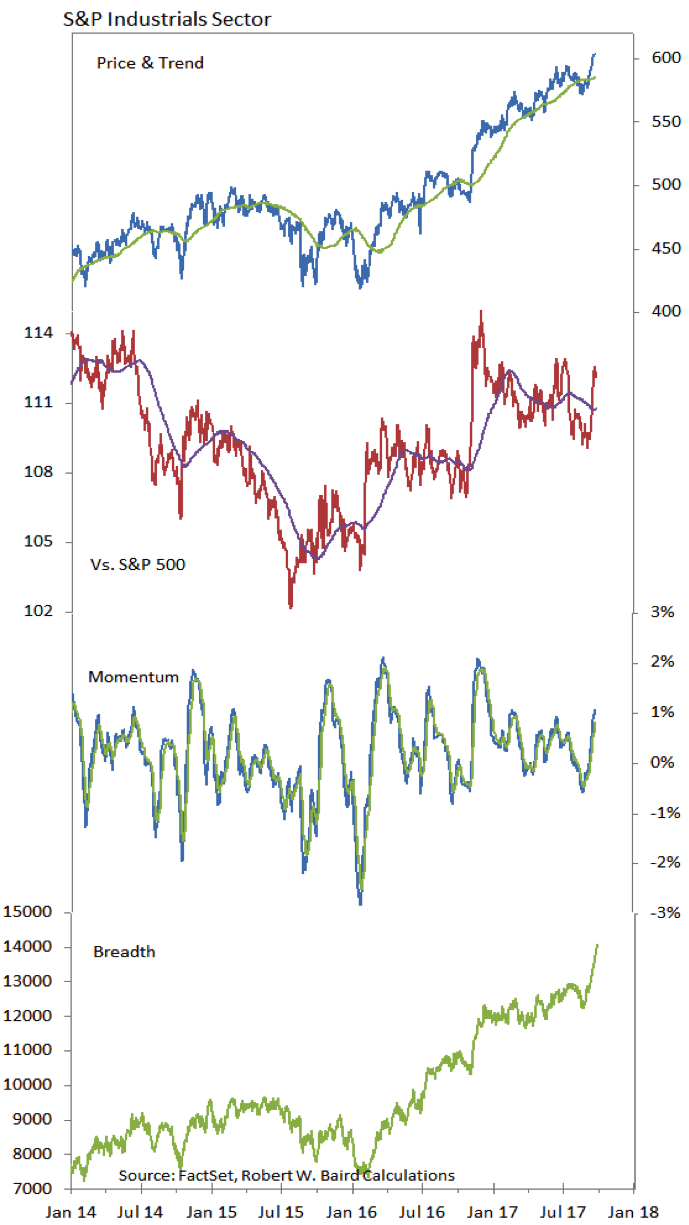

Industrials Sector

The Industrials sector has gotten back in gear, moving to new highs and re-joining the leadership group in our relative strength rankings (moving to the number two spot this week). Breadth in the sector has surged, momentum is expanding and the relative price line is testing down-trend resistance.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.