Stock Market Futures Considerations For March 1, 2017

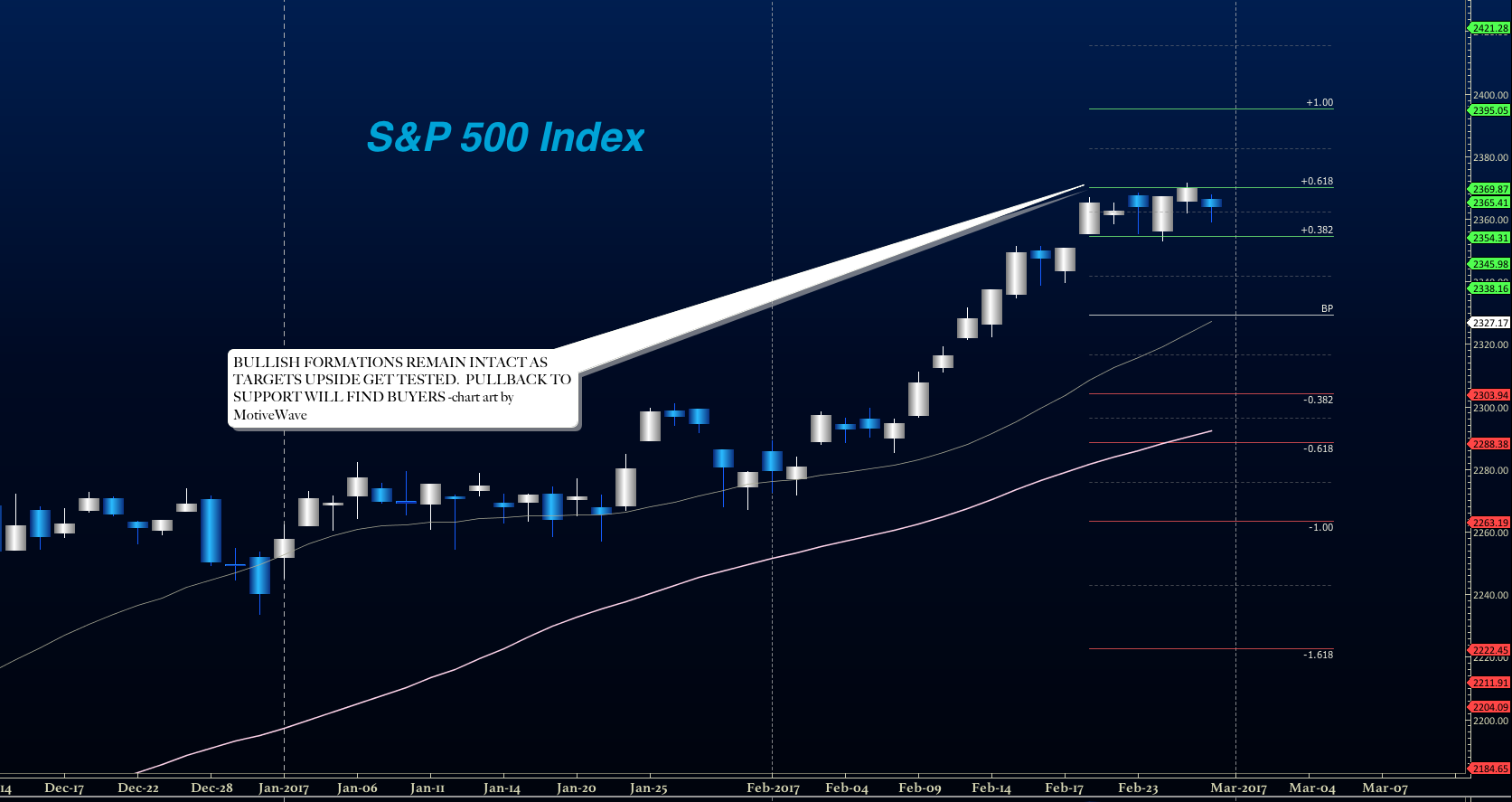

New highs formed again overnight and the S&P 500 (INDEXSP:.INX) is stretching forward into a test of upside projections. Pessimistic traders have been destroyed in this move upward – a stark reminder to trade what you SEE, and not what you think will happen.

Many of us want to be leaders of the pack, when we should be content to follow based on the size of our accounts. Many of us think we are professionals, when we are really amateurs – and amateurs typically lose against professionals. Hard words to swallow but the proof is always in the pudding (what’s your balance and what direction is that number moving in?). As the news heavy week cranks along, it should provide volatile trading spaces and good opportunities for the nimble in both directions. Remember the positive slant to motion. Watch your risk.

Buying pressure will likely strengthen above a positive retest of 2377.5, while selling pressure will strengthen with a failed retest of 2359.75.

Price resistance sits near 2376 to 2377.75, followed by 2381.25 and 2383 (more upside targets below). Price support holds between 2359 and 2357.25, with 2354 and 2349.5 below that

See today’s economic calendar with a rundown of releases.

TRADING SETUPS

E-mini S&P 500 Futures

Upside trades – Two options for entry

- Positive retest of continuation level -2377.5

- Positive retest of support level– 2370.75

- Opening targets ranges – 2370.25, 2372.25, 2376, 2377.5, 2381.25, 2383, 2386.5, 2391

Downside trades – Two options for entry

- Failed retest of resistance level -2370.25

- Failed retest of support level– 2365.75

- Opening target ranges – 2368.75, 2365, 2361.5, 2358.75, 2354.5, 2351.5, 2346.25, 2343.25, 2337.5, 2334, 2329.25, 2323.5, 2319, 2315.25, 2313, 2309.75, 2304.75, 2302.75, 2299.5, 2297, 2294.25, 2291.75, 2288.5, 2284.5, 2279.75, 2276.25, 2274.25, 2272.25, 2269.5, 2264.5, 2260.5, 2256, 2253.5 and 2249.75

Nasdaq Futures (NQ)

Buying pressure will likely strengthen with a positive retest of 5370.75 while selling pressure will strengthen with a failed retest of 5332.

Price resistance sits near 5367.75 to 5370.75, with 5378.75 and 5385.75 above that. Price support holds between 5332 and 5323.5, with 5317.25 and 5311.75 below that

Upside trades – Two options

- Positive retest of continuation level -5370.75

- Positive retest of support level– 5345.75

- Opening target ranges – 5350.5, 5354.5, 5360.25, 5364.5, 5369.75, 5378.75, 5382.75

Downside trades- Two options

- Failed retest of resistance level -5354.25

- Failed retest of support level– 5348.

- Opening target ranges – 5348.25, 5340.75, 5336.25, 5332, 5327.75, 5323.75, 5320.75, 5318.75, 5311.75, 5306.5, 5297.75, 5294.25, 5291.25, 5286.75, 5277.75, 5273.75, 5271.25, 5266.75, 5263.25, 5259, 5252.75, 5246.75, 5240.25, 5235.25, 5229.75, 5227.75, 5221.75, 5217.75, 5212.5, 5207.5

Crude Oil –WTI

Oil traders are once again range bound after a bounce of support yesterday. EIA report is released today. I suspect we have more sideways action here.

Buying pressure will likely strengthen with a positive retest of 54.56, while selling pressure will strengthen with a failed retest of 53.75.

Price resistance sits near 54.89 to 55.27, with 55.6 and 56.05 above that. Price support holds between 53.77 and 53.48, with 53.15 and 52.8 below that.

Upside trades – Two options

- Positive retest of continuation level -54.3

- Positive retest of support level– 53.78

- Opening target ranges – 53.95, 54.11, 54.25, 54.4, 54.54, 53.68, 53.88, 54.05, 54.19, 54.54, 54.85, 55.04, 55.12, 55.48, 55.68, 55.88, 56.04

Downside trades- Two options

- Failed retest of resistance level -54.48

- Failed retest of support level– 53.48

- Opening target ranges – 54.26, 54.09, 53.88, 53.64, 53.48, 53.27, 53.11, 52.89, 52.64, 52.37, 52.2, 52.06, 51.91, 51.72, 51.52, 51.22, 51.04, 50.82, 50.47, 50.3, and 50.16

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.