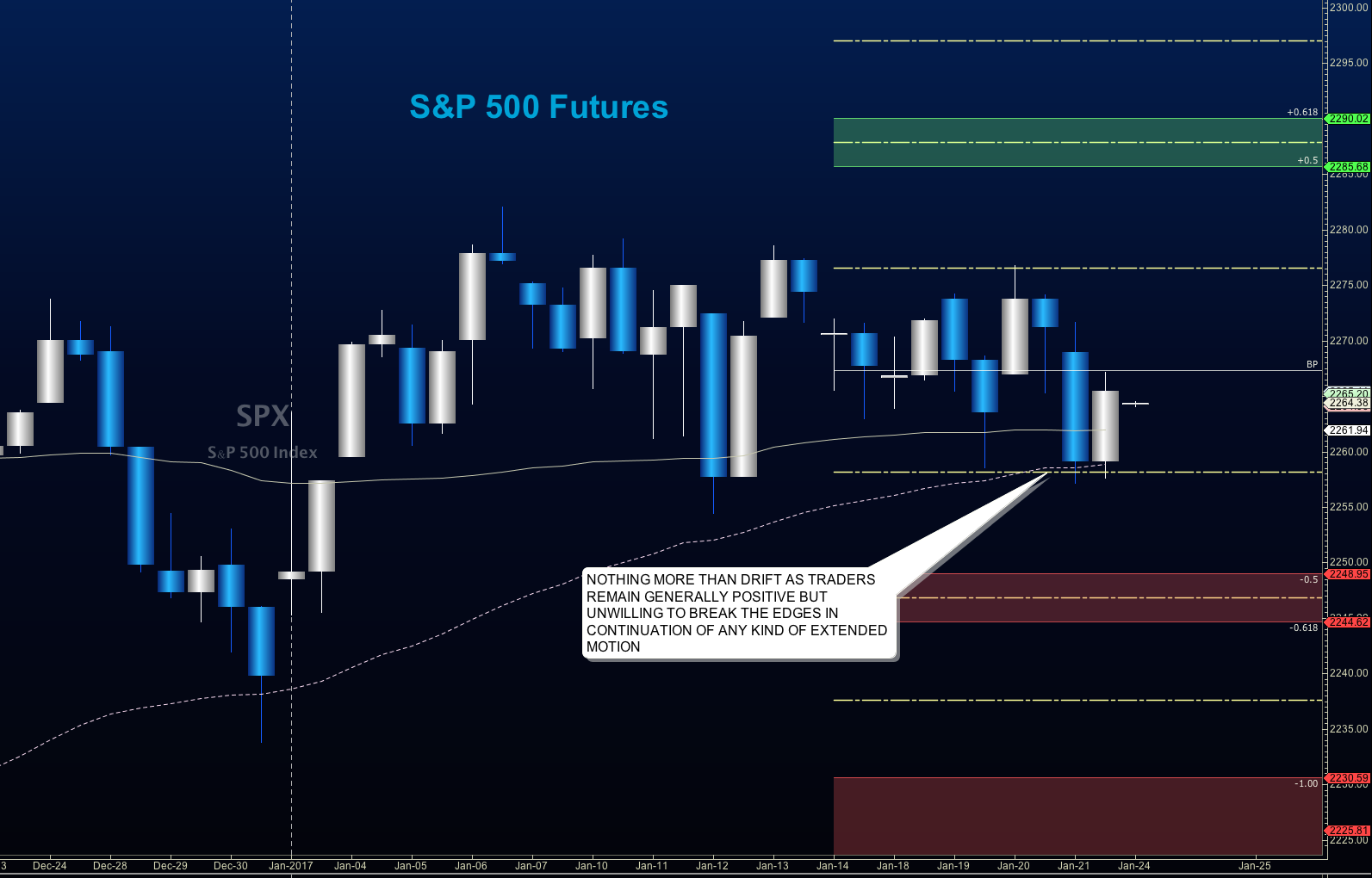

Stock Market Futures Considerations For January 24, 2017

Not much more to say here other than our ranges continue to hold the tight forms. At some point, the levy will break in either direction, but prices have not given way in either upside or downside. We are in a wait and see trading state.

Buying pressure will likely strengthen above a positive retest of 2269.75, while selling pressure will strengthen with a failed retest of 2252.

Price resistance sits near 2269.75 to 2272.75, with 2274.5 and 2279.5 above that. Price support holds between 2256- 2253,25, with 2249.75 and 2246.50 below that.

See today’s economic calendar with a rundown of releases.

TODAY’S RANGE OF MOTION

E-mini S&P 500 Futures Trading Chart For January 24

Upside trades – Two options for entry

- Positive retestof continuation level -2266.75 (watch for 2269-2272.25 for possible resistance)

- Positive retestof support level– 2260.25 (allow prices to confirm- heavy congestion)

- Opening targets ranges -2263.75, 2266.75, 2269.75, 2272.75, 2275.5, 2277, 2280.25, 2282.50, and 2285.25

Downside trades – Two options for entry

- Failed retestof resistance level -2266

- Failed retestof support level– 2258.5

- Opening target ranges –2263.75, 2260.25, 2257.25, 2254, 2251.75, 2249.75, 2246.50, 2242.75, and 2239.75

Nasdaq Futures

The NQ_F resumed its upward chase and is holding a breakout pattern but momentum remains damp. Resistance is present at current levels near 5070.

Buying pressure will likely strengthen with a positive retest of 5070.5, while selling pressure will strengthen with a failed retest of 5047.75. Price resistance sits near 5070.205 to 5074.75, with 5077.5 and 5083.75 above that. Price support holds between 5047.75 and 5042.75, with 5037.75 and 5032.25 below that.

Upside trades – Two options

- Positive retestof continuation level -5064.25 (needs confirmation on tight time frame after the open)

- Positive retestof support level– 5059.5

- Opening target ranges – 5063.25, 5066, 5069, 5073.25, 5077.5, 5081.75, 5084.25

Downside trades- Two options

- Failed retestof resistance level -5068.25 ( needs confirmation – very countertrend)

- Failed retestof support level– 5059

- Opening target ranges – 50.64.25, 5059.5, 5055.5, 5050.75, 5047.75, 5043.25, 5040.25, 5036.5, 5031.5, 5025, 5021.50, 5018.25, 5014.75, 5011.25, 5005.75, and 4997.75

Crude Oil –WTI

West Texas Intermediate remains range bound and has built a series of lower highs and higher lows – chart action is mixed and still waiting on a catalyst

Buying pressure will likely strengthen with a positive retest of 53.49, while selling pressure will strengthen with a failed retest of 51.78. Price resistance sits near 53.3 to 53.49, with 53.8 and 54.18 above that. Price support holds between 52.2 and 51.78, with 51.6 and 51.4 below that.

Upside trades – Two options

- Positive retestof continuation level -53.33

- Positive retestof support level– 52.64

- Opening target ranges –52.84, 53.27, 53.46, 53.86, 54.16, 54.28, 54.51, 54.76, 55.06, and 55.24

Downside trades- Two options

- Failed retestof resistance level -53.05

- Failed retestof support level– 52.8

- Opening target ranges –52.85, 52.63, 52.47, 52.26, 52.08, 51.78, 51.52, 51.24, 51.04, 50.82, 50.47, 50.3, and 50.16

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.