Stock Market Futures Trading Considerations For June 5, 2017

The S&P 500 (INDEXSP:.INX) is nearing strong price resistance after its surge to new highs. A divergence continues but sellers should wait for lower highs to form.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers. With graduations completed and some solid rest and recuperation, I am back on a regular schedule.

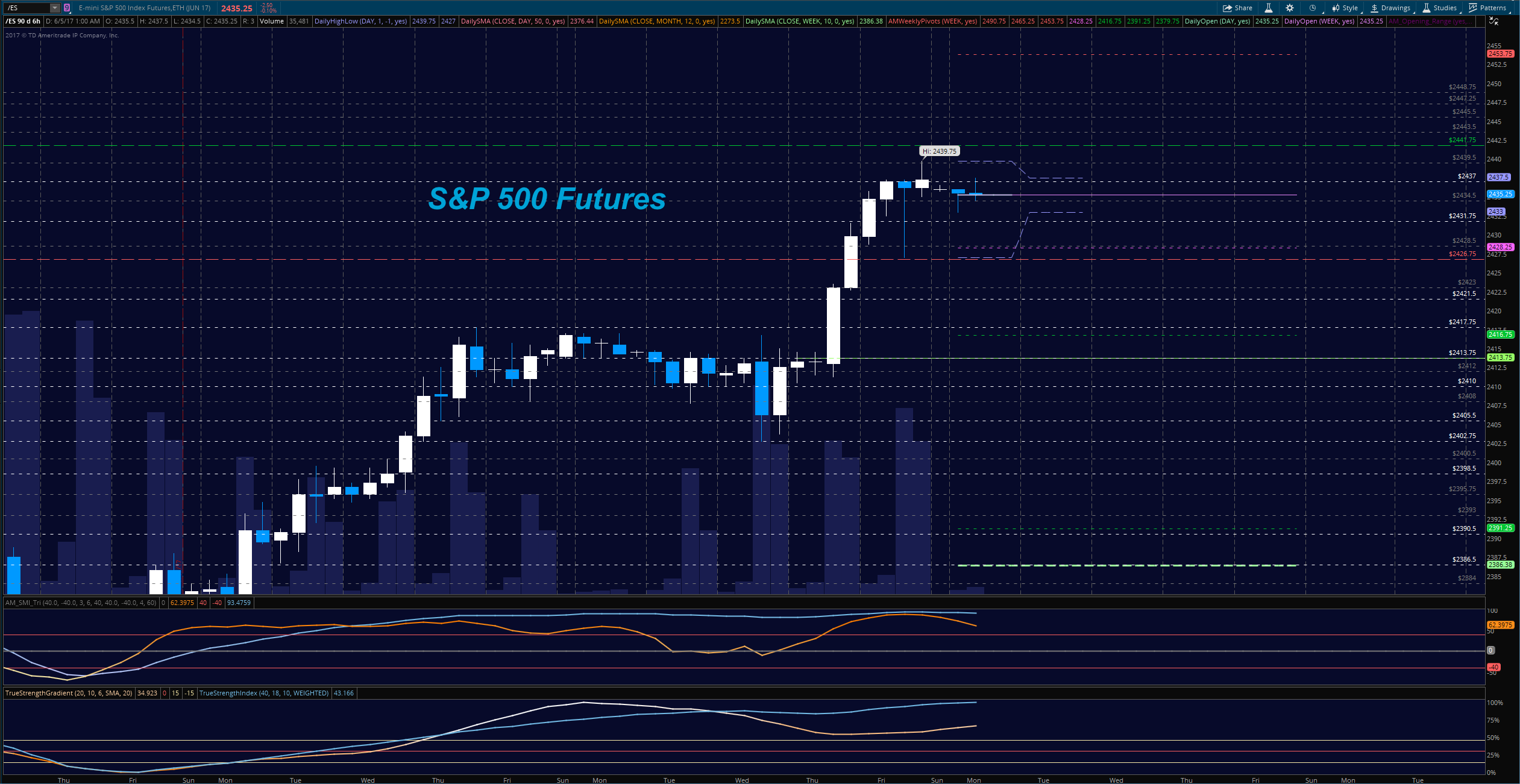

S&P 500 Futures (ES)

Support continues to hold well for traders as we drift higher with Friday giving us new highs as divergence continues into the news heavy week. These divergences tend to give us fading action that holds deeper support, so be cautious in your approach to short action today. Momentum sits with buyers in the big picture, and pullbacks continuing to be superb buying opportunities. The key event formation will be lower highs and a breach below of key support to signal any bearish action, and so far, that is not present. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2437.5 (though that is resistance for now)

- Selling pressure intraday will likely strengthen with a failed retest of 2426.75

- Resistance sits near 2437.5 to 2439.75, with 2441.5 and 2447.75 above that.

- Support holds between 2431.5 and 2426.5, with 2422.5 and 2417.75 below that.

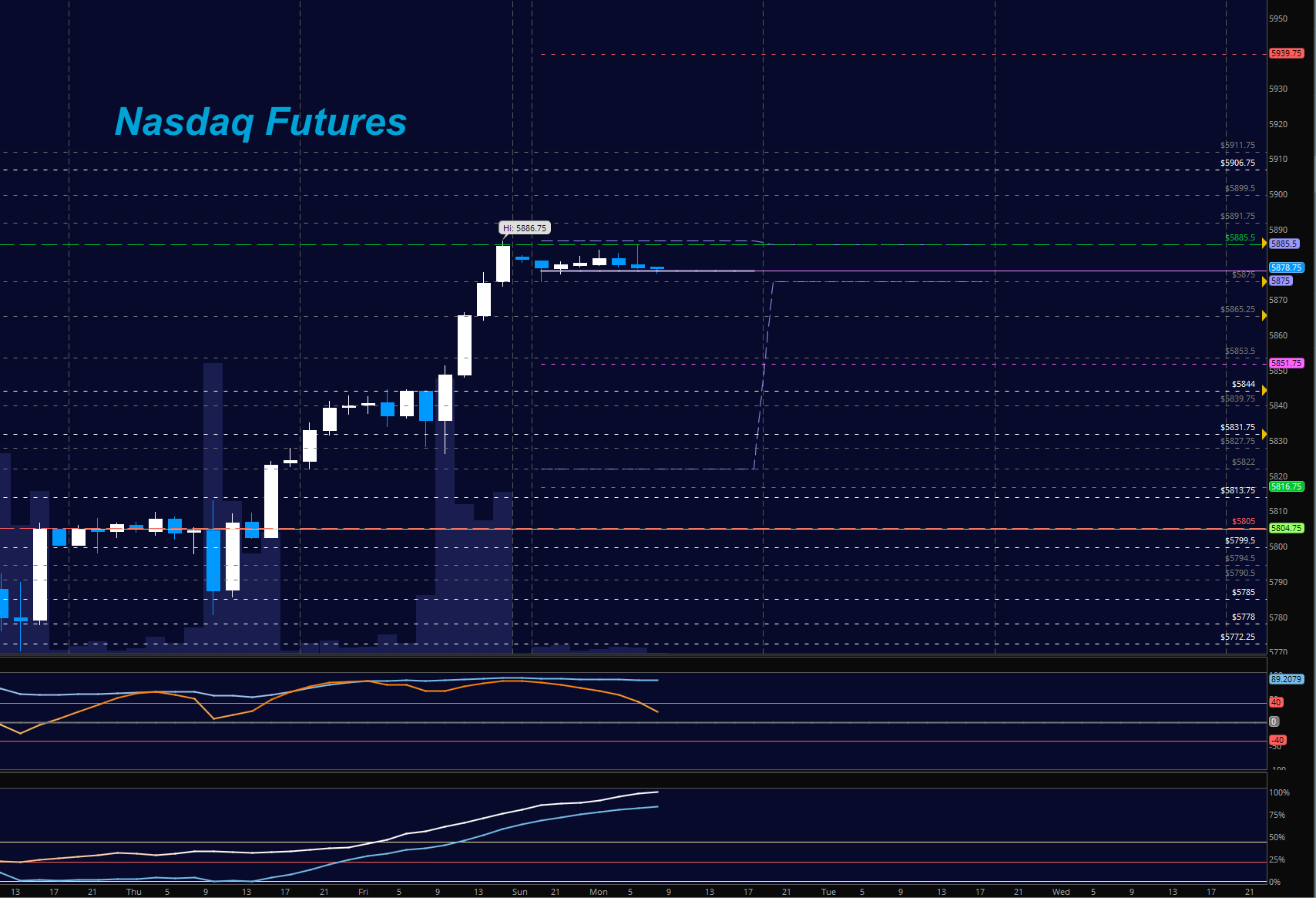

NASDAQ Futures

New highs again Friday, as we create new congestion events. Bounces have held well into higher supports and formations are still bullish as the technology sector holds steady – though AAPL has an unusual downgrade this morning (which will likely be a buying opportunity as we made new highs on Friday). The levels to watch for support today seem to be 5875 to 5844 – a wide region to be sure but we moved quickly on Friday. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 5885

- Selling pressure intraday will likely strengthen with a failed retest of 5844

- Resistance sits near 5885.5 to 5891.25, with 5906.75 and 5926.75 above that.

- Support holds between 5875.25 and 5853.5, with 5844 and 5822.25 below that.

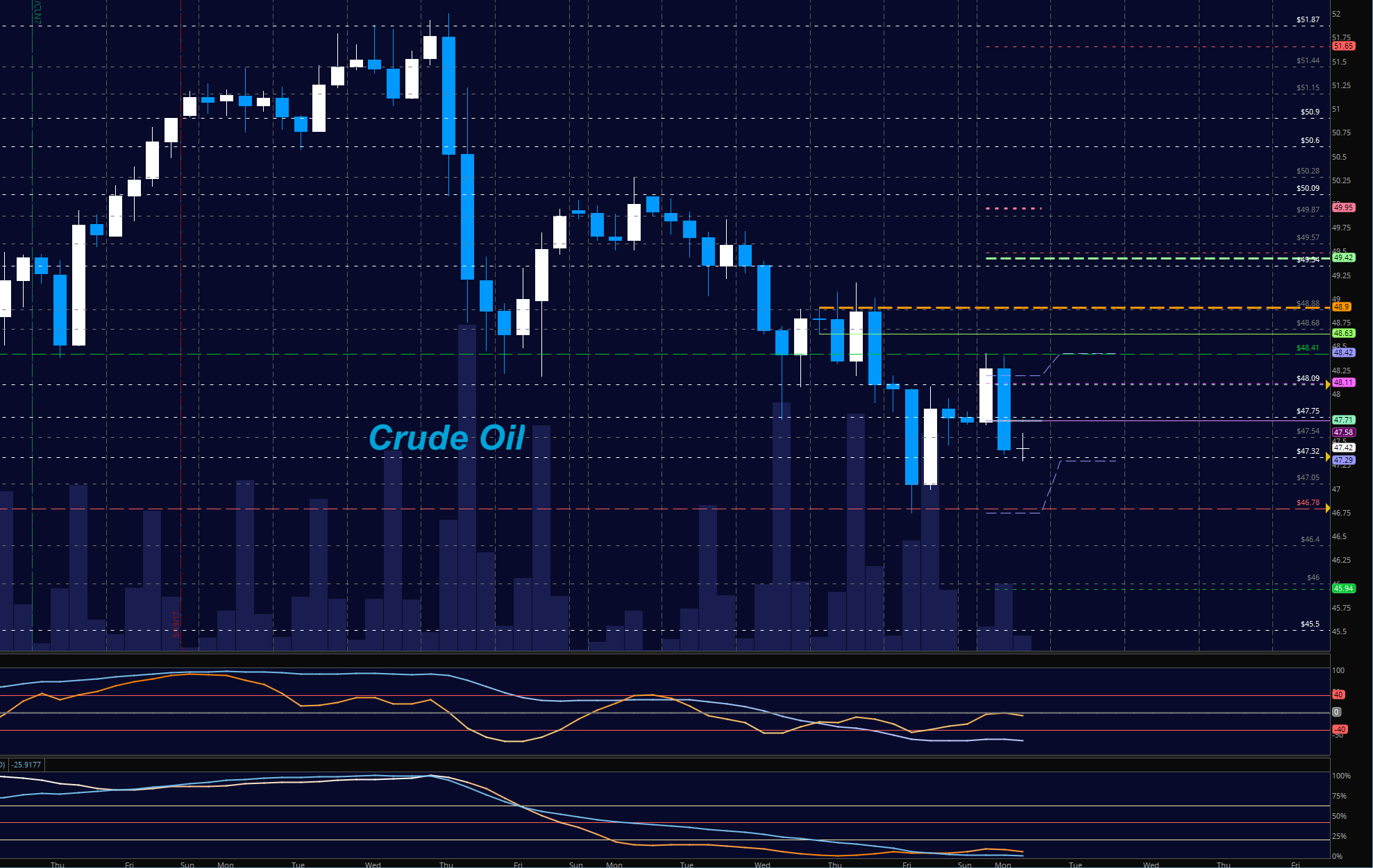

Crude Oil – WTI

The WTI chart continues to present lower highs and lower lows as chatter about levels of supply run the gamut. The level at 48.89 is likely to shift the balance if buyers can breach and hold this region, but that looks unlikely at this time. Momentum is decidedly negative but showing some divergence. The level near 47.34 will be critical today as it seems to be a battleground between buyers and sellers right now. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 48.12

- Selling pressure intraday will strengthen with a failed retest of 47.24

- Resistance sits near 48.12 to 48.6, with 48.89 and 49.42 above that.

- Support holds between 47.3 and 47.05, with 46.78 and 46.4 below that.

Our live trading room is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.