Stock Market Considerations For July 7, 2017

The jobs report has given stocks a lift this morning. The S&P 500 (NYSEARCA:SPY) is holding above very important near-term support… see my key trading levels for the S&P 500, Nasdaq, and crude oil are below.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service and shared exclusively with See It Market readers.

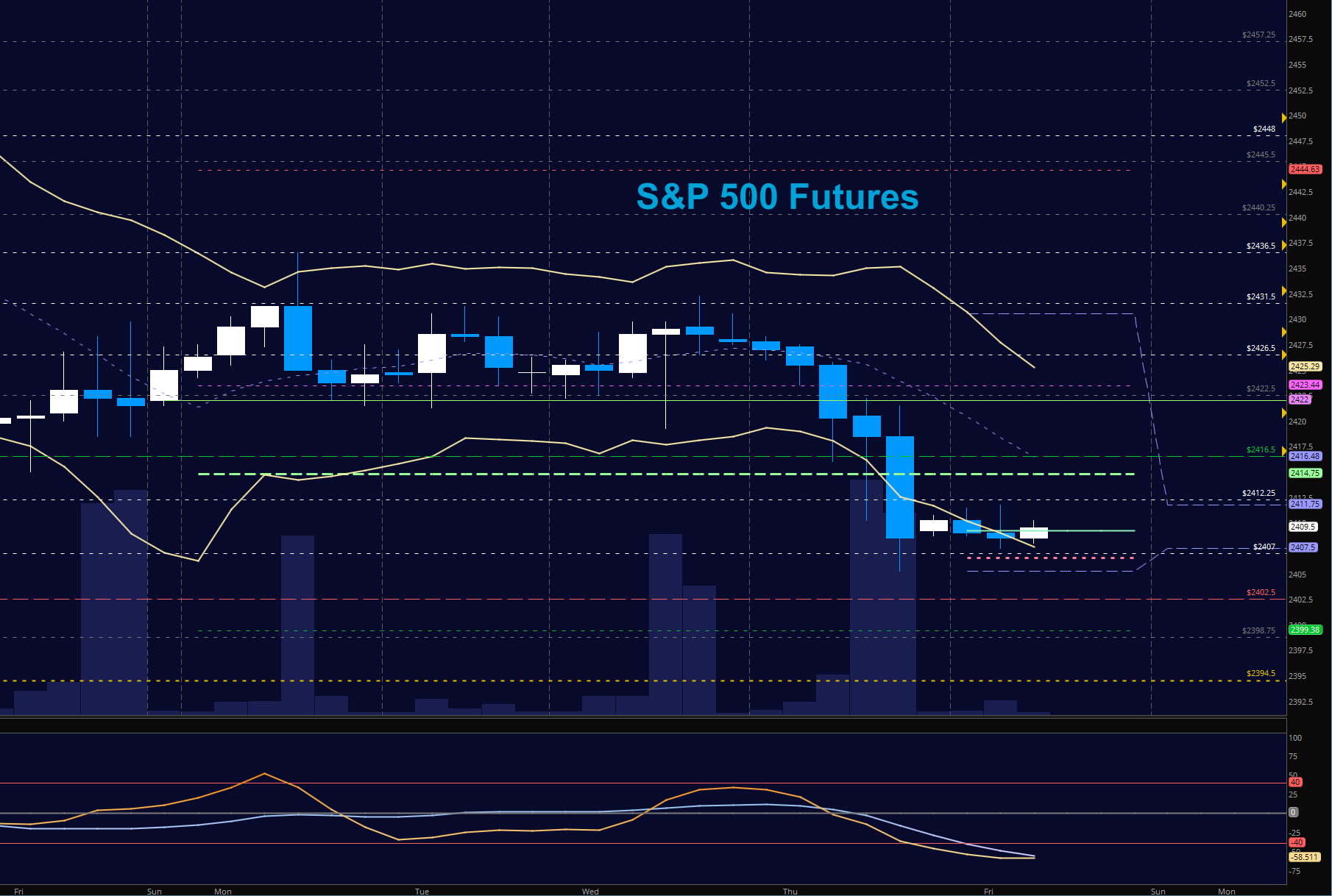

S&P 500 Futures (ES)

A pesky dip below a key level for big traders – below 2412 – has buyers now trying to hold 2407. Below that, we are likely to visit 2394. Deeper support watches near 2402 are ahead as we wait for the Non-Farm Payroll report this morning. Resistance now sits near 2424 on the S&P 500 (INDEXSP:.INX). Momentum is neutral across time frames and generally still flat, so we’ll need to watch these edges for changes in motion. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2424 (careful again here with resistance)

- Selling pressure intraday will likely strengthen with a failed retest of 2407

- Resistance sits near 2427.5 to 2436.5, with 2441.5 and 2445.5 above that.

- Support holds between 2408 and 2402.25, with 2398.5 and 2394.5 below that.

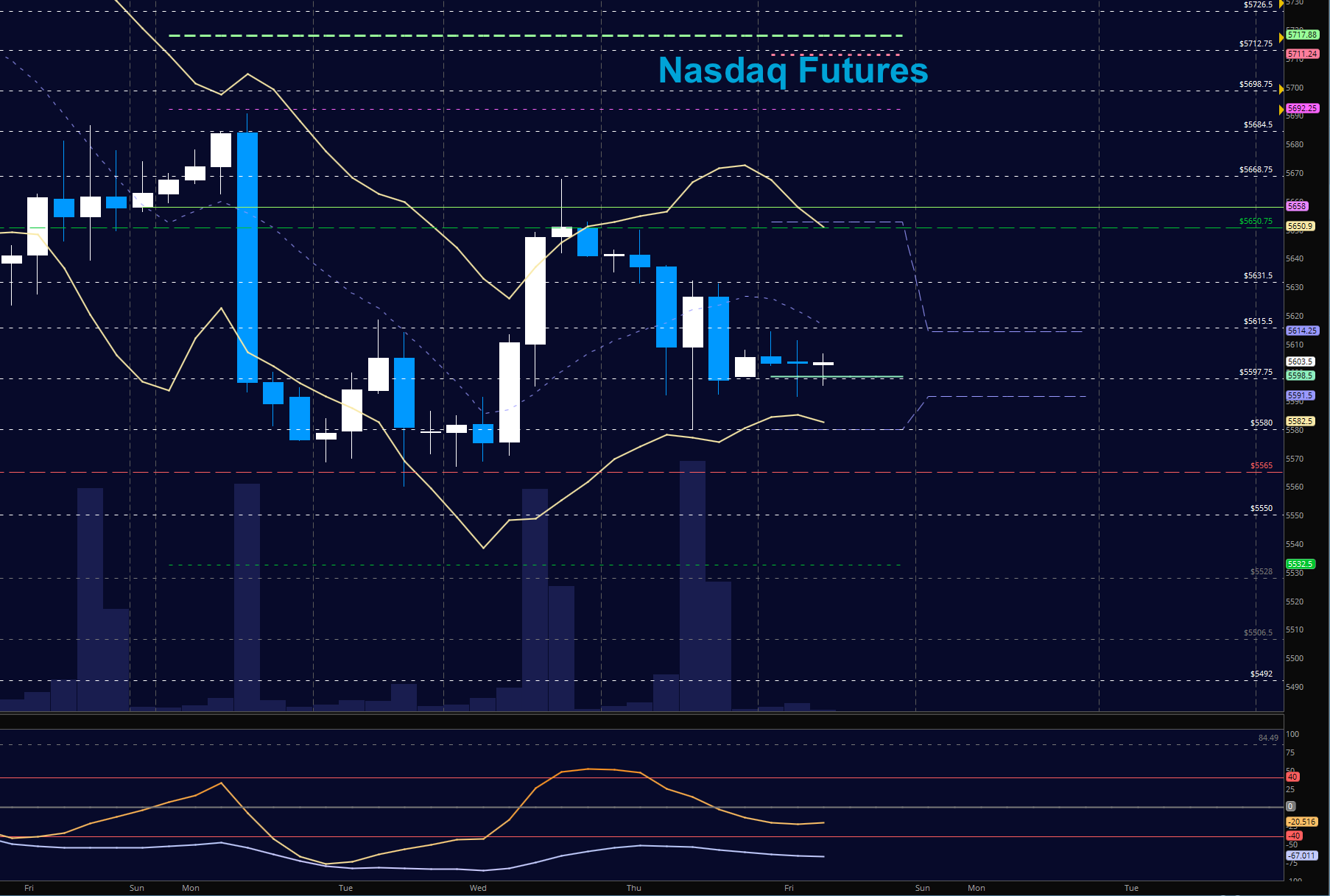

NASDAQ Futures (NQ)

Though the negative backdrop continues, this chart has held its lows from yesterday. A tight pattern of congestion and a drift of sideways momentum is present. Support levels are lower and near 5565, but I still have eyes on the mark near 5454 – a breakaway event with a gap just above. Resistance appears to be near 5650.75 today. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 5616.5

- Selling pressure intraday will likely strengthen with a failed retest of 5590.5

- Resistance sits near 5622.75 to 5631.5, with 5650.25 and 5684.5 above that.

- Support holds between 5591.5 and 5574.75, with 5550.5 and 5477.75 below that.

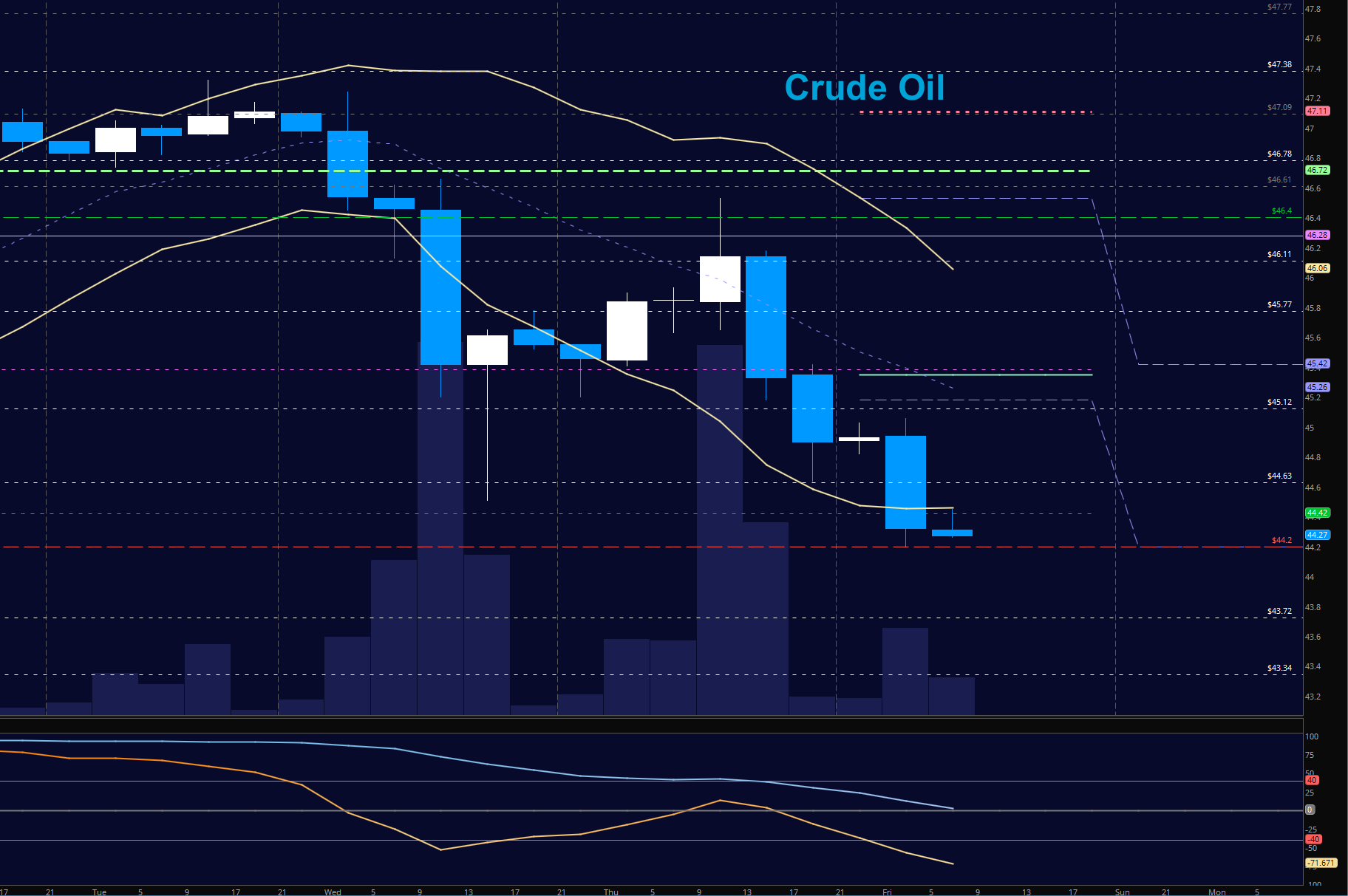

WTI Crude Oil

After a hopeful bounce from traders into the 46.11 area and above, oil resumed its downward motion. Momentum is mixed, but the formation still shows that bounces will find sellers. I continue 44.2 very important here so I do expect to see a battle ensue. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 46.34

- Selling pressure intraday will strengthen with a failed retest of 44.10

- Resistance sits near 46.24 to 46.86, with 47.14 and 47.4 above that.

- Support holds between 44.2 to 43.72, with 43.34 and 42.78 below that.

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day. Visit TheTradingBook for more information.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.