MARKET COMMENTARY

As traders await employment numbers, the big move upward in the stock market has stalled. Prices are holding above their lows, but we have failed to break above the highs of last month.

Employment numbers may do little to move markets as we will slosh to and fro as the election events settle down and the change of the guard moves forward (in all likelihood, it seems).

Because price cycles are so much quicker these days, I am unsure of the length of time we will see these surges and fades move back and forth. BE PATIENT AND WAIT FOR PRICE to give you the edge. Intraday formations are the ones governing the charts with a wide range intact into this election reporting cycle and news will drive our motion.

Note you will find a link to our webinar for the “live trading room” further below.

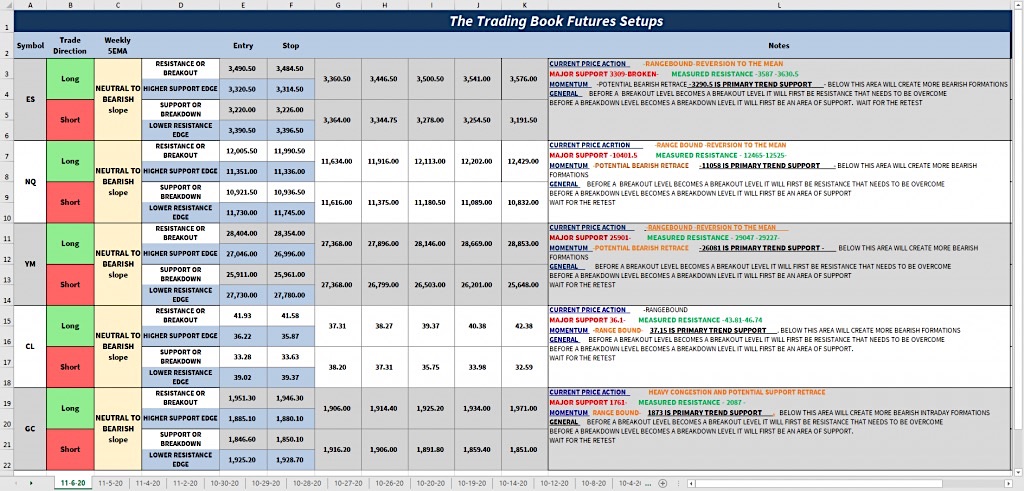

The S&P 500 Index futures (ES_F) tested the 3500 region yesterday but has failed to breach 3541. Deep fades into known support remain as zones to buy. Buyers are still in charge. Pay attention to the VWAP. Once we drift below that line and fail to recapture it, sellers will be bold in their attack to drive prices deeper.

The Nasdaq 100 Index futures (NQ_F) has tested the edge of the wedge we built in the live trading session and is now retreating. I fully expect this pattern to hold so I will watch for confirmation of price and move forward in the direction of the primary trace. Be careful in the moves and try not to buy breakouts before they confirm (or breakdowns for that matter) but look for the tight motion in the retrace to support before moving ahead. PAY ATTENTION TO YOUR STOPS.

Crude Oil futures (CL_F) and Gold futures (GC_F) fell into deep support and are now approaching the recovery zones. For crude oil, that level to recover is 37. And for gold, it is 1936. As we sit, oil is fading off our suspected dead cat bounce, and gold is breaking through 1925 (watch for the retest of this) again, as the dollar has a dramatic fall.

Watch the VWAP to help you with the strength of pressure. The loss of the VWAP will force some selling action, and the breach above the VWAP that holds will bring buyers to attempt stronger positioning.

THIS WEEK’S LIVE TRADING ROOM LINK

TRADING LEVELS -updated

If you find yourself being chopped up, widen your time frame or take time away from your screens. This is a time when less is more.

Here’s a link to the METASTOCK trading setups for S&P 500 futures and Nasdaq 100 futures using Target Rich Trades.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.