Dividend-focused investing is at the core of most investors’ portfolios, and for good reason.

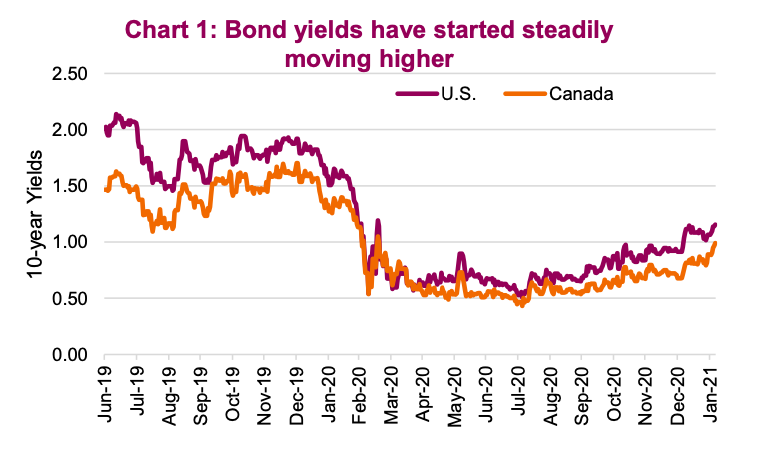

As bond yields drifted lower for much of the past 40 years, the quest for other sources of cash flow fed a steady stream of investors and capital into dividend-paying stocks.

And it has been a relatively pleasant ride, as this portion of the market has historically enjoyed good returns and less volatility than the overall broad stock index (a strong combo). Throw on some preferential tax treatment and we continue to believe dividend-paying equities should remain at the core of most portfolios.

However, dividend investing is becoming more challenging than decades past. Most, us included, believe bond yields may have bottomed and are poised to rise in the near term as the global economy emerges from this pandemic. This shorter-term cyclical rise may be followed by rising inflationary pressures in the medium to longer term (Crying wolf on inflation, again?).

We are not expecting a huge rise in bond yields but see them climbing, nonetheless. And for dividend investors, this matters as some companies are more or less sensitive to changing yields in the bond market.

Not all dividends are the same

The U.S. and Canada, and many other international equity markets, have a wide variety of dividend-paying companies across many industries. This will prove critical in the quarters ahead if bond yields continue to rise, as dividend payers in some industries have historically been hurt by rising yields while dividend payers in other industries have benefited.

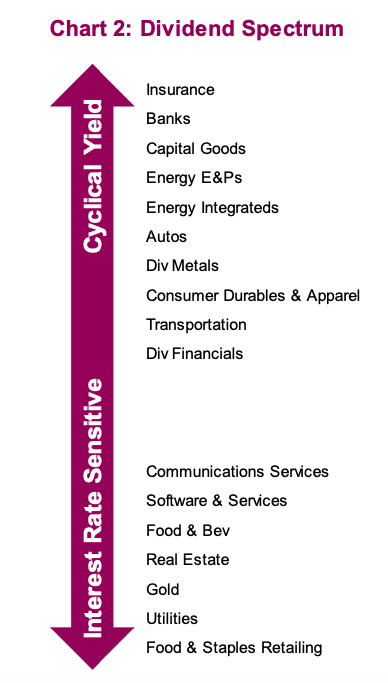

To help measure this relative sensitivity, we have created a spectrum ranging from Interest Rate Sensitive at one extreme to Cyclical Yield at the other.

Generally speaking, Interest Rate Sensitive companies are more akin to bond proxies while Cyclical Yield names tend to be more economically sensitive.

Our scoring or ranking system uses a combination of an industry’s correlation to bond yields, sensitivity to bond yields (think like Beta but instead of relative to the market it’s relative to yields) and an out-of-sample score for periods over the past decade of rising yields. Chart 2 depicts the scoring of a number of key sectors/industries within the TSX. The top grouping, Cyclical Yield, are those that we would expect to hold up better in a rising yield environment. The bottom grouping, Interest Rate Sensitive, are those that we would expect to perform best in a falling yield environment.

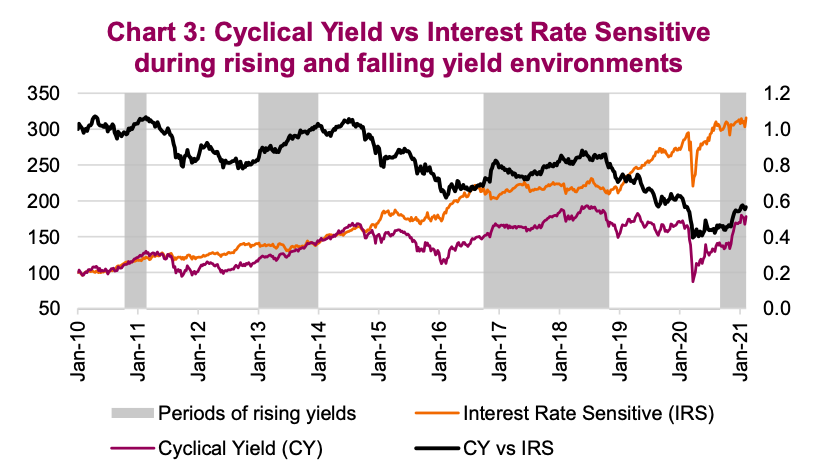

Chart 3 compares the performance of the Cyclical Yield versus Interest Rate Sensitive industries over the past decade. Cyclical Yield is outperforming when the black relative line is rising and underperforming when falling. The grey shaded areas are periods of rising bond yields.

Investment Implications

If bond yields have started an extended trend higher (this does remain a big ‘If”), dividend strategies will have a tougher go than years past; specifically, those that are more heavily weighted towards interest rate-sensitive sectors or industries. We believe for dividend managers, tilting increasingly towards cyclical yield names and industries will help reduce this interest rate risk. However, it does come at a cost. If the economy falters, the cyclical yield names are certainly not the best place to be.

Much with all investing, it depends on what happens next. Currently we believe the probability is for higher rising yields and would recommend investors increase their exposure to cyclical yield over interest-rate sensitivities within their dividend portfolios.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.