Commodities prices remain elevated and that continues to feed into the inflation talk (along with supply side issues, stimulus, and the economic recovery). Yes, several variables at play and all pressuring inflation.

Today, we go back to a commodity that I’ve highlighted before (in May and in June), natural gas and the United States Natural Gas Fund ETF (UNG).

Natural Gas, like oil and gasoline, plays an important role as an energy cost for consumers and businesses… so it’s good to keep an eye on. It’s also tradable as an ETF and futures commodity so understanding the trend is important in multiple ways.

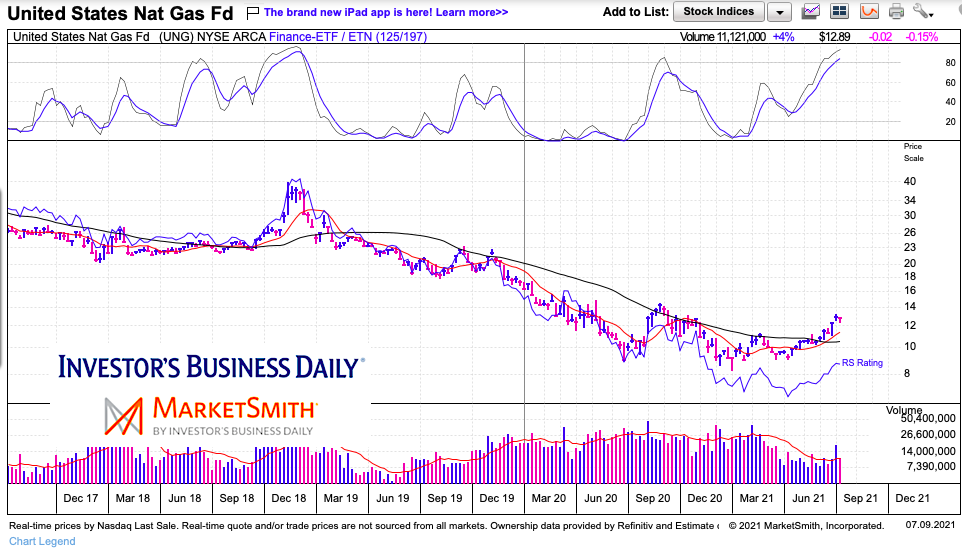

Below are “weekly” and “daily charts of UNG (the ETF). Both highlight a very bullish cup-like base that recently saw price break above the 10/40 week MAs and 50/200 day MAs. Futures are also constructive; different pattern but strong upside potential.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

$UNG United States Natural Gas Fund ETF “weekly” Chart

This is a longer-term chart that highlights just how far Natural Gas has to run. The base takes us up to $14-$16 where a pause is likely. But $18-$20 and highly could be in the offing longer-term.

$UNG United States Natural Gas Fund ETF “daily” Chart

Here we see the more recent rally and flag-like consolidation. The 20 and 50 day MAs are rising (bullish) and the 200 day MA is flat (neutral). As long as price remains elevated, the 200 day MA will soon begin to rise. This is constructive action for natural gas bulls.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.