Trump’s Plan

Donald Trump does not have a magic wand that allows him to instantly enact his wishes. Consider the following:

- Legislative– Trump must deal with Democrats in Congress throughout government that abhor the thought of him as President. There are quite a few Republicans who harbor similar views.

- Tax cuts– While positive for the economy, will they result in more productive investments? If not, they do little more than provide a short-term economic spark and increase the budget deficit and already gargantuan national debt.

- Infrastructure spending– Infrastructure projects can be productive, like the Hoover Dam, or unproductive like a bridge to nowhere. Unproductive projects, as is fairly typical, provide little more than a temporary burst of growth and higher debt levels. Many economists believe the fiscal multiplier to be negative. In other words, the amount spent on fiscal projects actually reduces economic growth. Typically, we fail to consider the money that could have been invested in more productive growth that instead is used to fund unproductive projects. Expenditures on new infrastructure are very different from revitalization projects on existing structures, akin to remodeling a home.

- Interest rates– If Trump is successful in generating economic growth and inflation, interest rates will rise. The government, corporations and individuals of this country are already burdened with a heavy debt load in large part masked by historically low interest rates.

- Dollar– The U.S. Dollar may continue to appreciate versus the respective currencies of many of our trade partners as growth and higher interest rates are factored into currency prices. If this occurs, U.S. exports and corporate earnings will be pressured. Additionally, a stronger U.S. Dollar creates, deflationary pressures and destabilizes countries heavily reliant on dollar funding, such as China and other emerging market economies. These countries are a very big part of the U.S. economic supply chain.

- Trade deals– Renegotiating trade deals may be beneficial in the long run, but in the short term such actions can produce hostility from other nations and may result in a reduction in global trade.

Our point is not to say Trump’s proposals will or will not work. Without more details, which will emerge over the next few years, we are only able to speculate on their effectiveness. We summarized a few of Trump’s proposals above to help you better understand that there are many factors to consider before bluntly claiming them positive as the market has done.

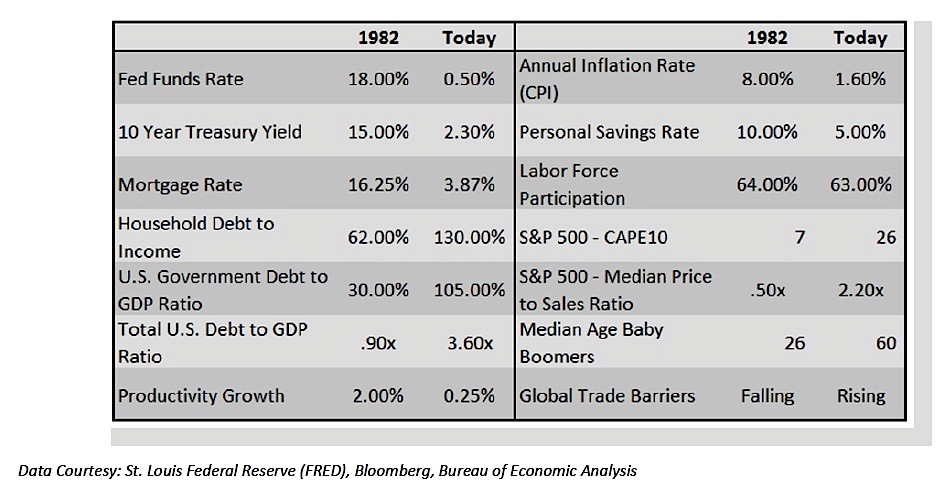

Many investors are suddenly comparing Trump’s economic policy proposals to those of Ronald Reagan. For those that deem that bullish, we remind you that the economic environment and potential growth of 1982 was vastly different than it is today. Consider the following table:

Summary

As investors, we must understand the popular narrative and respect it as it is a formidable short- term force driving the market. That said, we also must understand whether there is logic and truth behind the narrative. In the late 1990’s, investors bought into the new economy narrative. By 2002, the market reminded them that the narrative was borne of greed not reality. Similarly, in the early to mid-2000’s real estate investors were lead to believe that real-estate prices never decline.

The bottom line is that one should respect the narrative and its ability to propel the market higher. However, think for yourself and truly understand the pros and cons of Trumps proposals as well as the daunting odds of enacting them. Your investing success is dependent on determining whether the narrative is the truth or simply a rationalization to provide comfort and control when desperately needed.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.