By Andrew Kassen Just what is going on in the Metals complex?

By Andrew Kassen Just what is going on in the Metals complex?

On Friday dispassionate market observers, tinfoil golden calf worshippers (it truly is about the metal rather than the cow) and those with advisers who very wisely plowed 50% of their retirement assets IRA into a “Gold IRA” alike were atwitter over gold’s base jump from well above $1500. It was arguably the largest story of the day (overshadowing this; and this; and maybe even this).

And then, this morning happened (click image to zoom; explanatory arrow provided for clarity):

As you can see, the world’s one enduring store of value – at least since invertebrates began trafficking in it after the Cambrian Explosion – has been knocked down a peg or two.

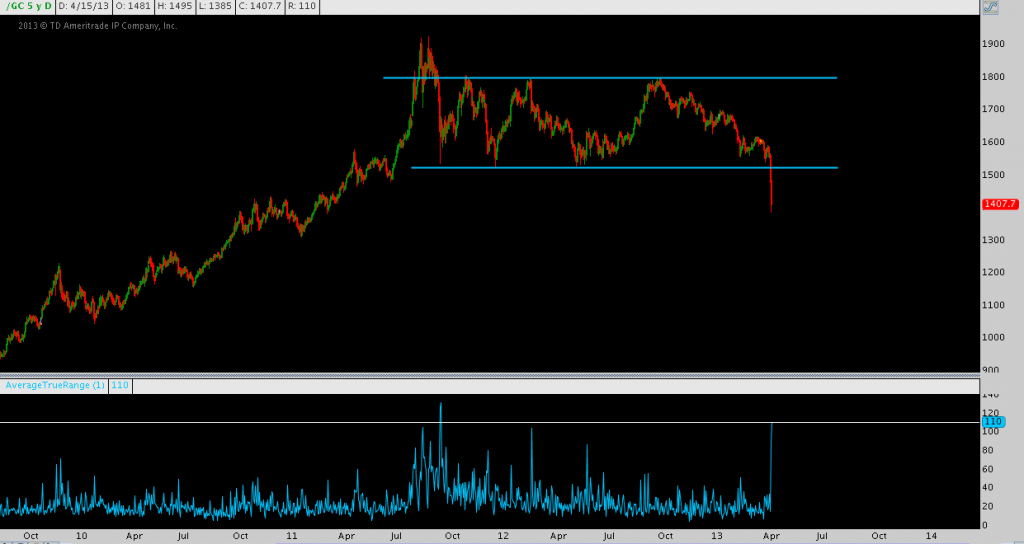

According to Gold’s Average True Range plotted here in the lower pane, days like this just don’t happen that often (click image to zoom):

No doubt about it: The 1.5 year range the blue lines demarcate above has been resolutely smashed in the last 36 hours of open trade.

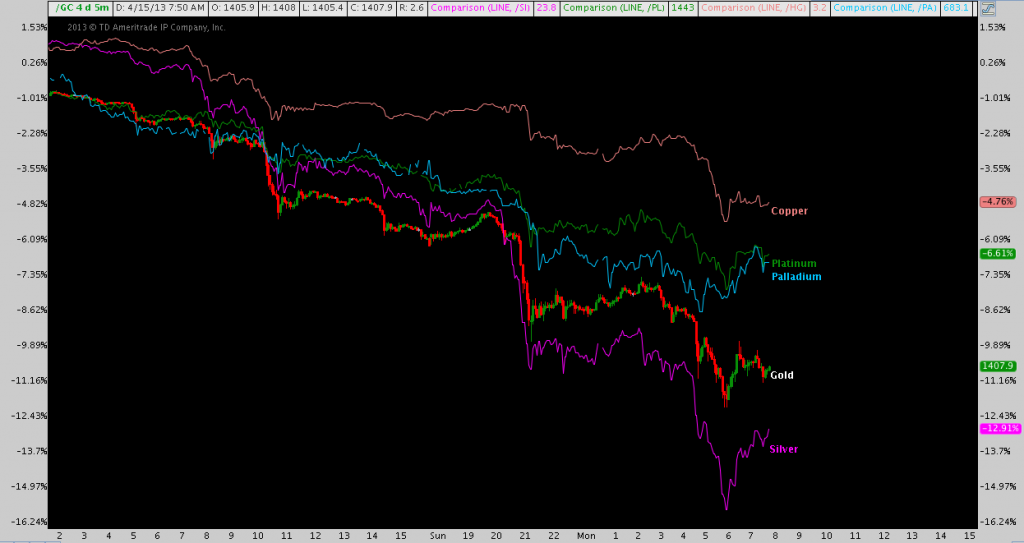

Though the remainder of the Metals gets far less coverage in wider financial media, the song remains much the same across-the-board with Silver (contract symbol: SI) taking it on the chin harder than its peers:

Talk about carnage in the Metals complex. The gleeful schadenfreude of hard metal antagonists on the one hand and clothes ripping, donning of sackcloth and ashes and general weeping and gnashing-of-teeth from goldbugs (er, “gold enthusiasts”) on the other hasn’t been more dissonant in living memory.

Whatever your interest in Gold (or silver, or copper) – whether you actively invest, monitor metals for their intermarket significance in your portfolio planning or hold GLD for non-correlated commodity exposure – my humble recommendation is to complete cut out that noise. Though his post starts off on the scrappy side (bound to happen when you are constantly engaged by hyper-zealot, quasi-religious barbarous relic ideologues), one place to look for clarity here is a Peter Brandt’s overview of the Metals last night. It’s as relevant as ever after this morning’s drop, very straightforward, technically austere and excellent, consistent with Peter’s style.

As Peter puts it, “A trade is a trade is a trade is a trade”. Whatever your opinion – or however beneficially or detrimentally you’re exposed – from here the commitment to price as the final arbiter and dispassionate focus on managing risk reflect in that quote are worth remembering as heightened volatility in the Metals continues to unfold.

Twitter: @andrewunknown and @seeitmarket

No position in any of the mentioned securities at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.