A scorpion asks a frog to ferry it across a river. The frog tells the scorpion he fears being stung. The scorpion promises not to sting the frog saying if I did so we would both drown.

Considering this, the frog agrees, but midway across the river the scorpion stings the frog, dooming them both. When the frog asks why, the scorpion replies that it was in its nature to do so.

On February 20, 2019, the Federal Reserve released the minutes from their January policy (FOMC) meeting.

As leaked last week by Fed Governor Loretta Mester, and discussed HERE, it turns out that in January the committee did indeed discuss a process to end the systematic reduction of the Fed’s balance sheet, better known as Quantitative Tightening (QT).

Within the minutes was the following sentence: “Such an announcement would provide more certainty about the process for completing the normalizationof the size of the Federal Reserve balance sheet.”

The message implies that when the process of reducing the balance sheet ends the Fed’s balance sheet will be normalized. Is that really the case?

This article was made exclusive to RIA Pro subscribers on February 25th. We share it with you to demonstrate one of the many benefits of subscribing to RIA Pro. If you would like to take us for a test spin, use the coupon code PRO30 for a 30-day free trial. To learn more please click here.

The New Normal

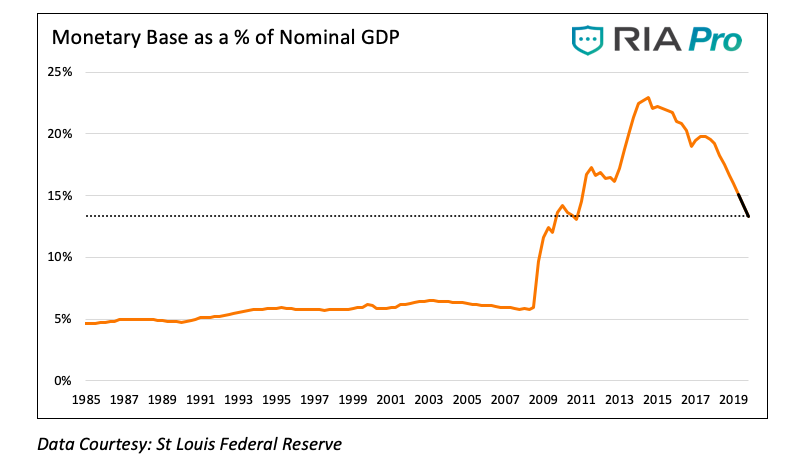

Before discussing the implications regarding the present size of the Fed’s balance sheet, we help you decide if the balance sheet will truly be normal come later 2019. The graph below plots the Federal Reserve’s Adjusted Monetary Base, a well-correlated proxy for the Fed’s balance sheet, as a percentage of GDP. The black part of the line projects the current pace of reduction ($50 billion/month) through December.

As shown, even if the Fed reduces their holdings through the remainder of the year, the balance sheet will still be nearly three times larger as compared to the economy than in the 25 years before the financial crisis. Would you characterize the current level of the balance sheet as normal?

Implications

If you answered no to the question, then you should carefully consider the implications associated with a permanently inflated Fed balance sheet. In this article, we discuss three such issues; inflation, safety/soundness, and future policy firepower.

Potential Inflation

When the Fed conducted Quantitative Easing (QE) with the primary purpose of injecting fresh liquidity into the capital markets, the size of their balance sheet rose as they purchased Treasury and mortgage-backed securities from their network of banks and brokers. To pay for the securities the Fed digitally credited the accounts of those firms for the dollar amount owed. A large portion of the money used to buy the securities ultimately ended up in the excess reserve accounts of the largest banks. Before explaining why this matters we step back for a brief banking lesson.

Under the fractional reserve banking system, banks can lend a multiple of their reserves (deposits and capital). The multiple, governed by the Fed, is known as the reserve ratio. Banks maximize profits by leveraging reserves as much as the reserve ratio allows. Before 2008 the amount of excess reserves was minimal, meaning banks maximized the amount of loans they created based on reserves.

Currently, banks are sitting on about $1.5 trillionof excess reserves that are unconstrained. To put that in context, the average from 1985 to 2007 was only $1.3 billion. This large sum of untapped reserves means that banks can lend, and create money far easier than at any time in the past. If they were to do this the growth in the amount of credit in the system could surge well beyond the rate of economic growth and generate inflation. This potential did not exist prior to 2008.

Safety and Soundness

Banks and brokers in 2008 were leveraged as much as 40:1. Lehman Brothers, for example, was levered 44:1 at the time they filed for bankruptcy. Many banks failed and a good majority required unprecedented action by the Fed and U.S. government to bail them out. Clearly the combination of declining asset values and too much leverage broke the financial system.

The Fed currently has $39 billion of capital supporting $3.9 Trillion of assets. They are leveraged 100:1, meaning a 1% percent loss on their assets would wipe out their capital. This amount of leverage is approximately three times that which was normal prior to the crisis.

Fortunately, the Fed does not re-value their assets so the daily volatility of the fixed income markets cannot bankrupt them. Regardless, one would think the Fed would apply similar safety and soundness measures that they require of their member banks.

Ultimately, this inordinate amount of leverage raises questions about Federal Reserve integrity and the value of the dollar which is issued and supported by the Fed. Fiat currency regimes perch delicately on trust. Should we trust the entity that controls the money supply when they employ such unsound banking practices?

More importantly, if I am a foreigner using U.S. dollars, the world’s reserve currency, should I be concerned and possibly question my trust in the Fed? What is the risk that a problem emerges and to recapitalize the Fed simply prints dollars causing a significant devaluation of U.S. dollars? At what point does the risk-free status of U.S. Treasuries become challenged due to unsound Fed practices?

Next Recession

The Fed’s balance sheet is about four times larger today than it was at the start of the last recession. With the Fed Funds rate only at 2.25%, the Fed has little room to stimulate the economy and support the financial markets using traditional measures. During the next recession the onus will assuredly be put on QE. The questions raised above and many others are of much greater concern if the Fed were to boost their balance sheet to $6, $8 or even $10 trillion.

Such growth would further increase the already high level of leverage and potentially introduce fresh concerns about the real value of the U.S. dollar. This raises the specter of a negatively self-reinforcing feedback loop.

Summary

Over the last year, the market has struggled as the Fed steadily reduced the size of their balance sheet. The S&P 500 is unchanged over the past 13 months. The liquidity pumped into the markets during QE 1, 2, and 3 is being removed, and asset prices which rose on that liquidity are now falling as it is removed. The Fed is clearly taking notice. In December Jerome Powell said the QT process was on “autopilot” with no changes in site. A week later, with the market swooning, he discussed the need to “manage” QT. “Autopilot” became “manage” which has now turned to “end” in the course of two months.

If the Fed’s mandate is to support asset prices, this behavior makes sense.

To the contrary, the congressionally chartered mandate is clear; they are supposed to promote stable prices and full employment. Our concern is that capital markets, which are heavily dependent on the Fed and seemingly insensitive to price and valuation, are promoting instability and gross misallocation of capital.

One cannot fault markets, they are responding as one should expect on the basis of Fed posture and the prior reaction function. Markets are properly agnostic under such circumstances. It is the Fed that has created an environment that leads markets to react in the ways that it does.

Like the fable of the scorpion and frog, the Fed is trusting markets to not destabilize as long as the Fed gives it a ride. While the relationship may seem cooperative today, it is not in the nature of markets to comply with foolish policy-making. Just like it is natural for scorpions to sting, it is natural for markets to find and expose weakness.

Regardless of the Fed’s characterization of a normal balance sheet, the normalization process is far from normal. What the Fed is doing is redefining “normal” to support inflated and over-valued asset prices and accommodate an unruly market. This will only aggravate any deeper problems lurking.

“At the end of the day, are we ever going to have price discovery in the natural way or is the Fed going to step in every single time the markets try to normalize?” –Danielle DiMartino Booth

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.