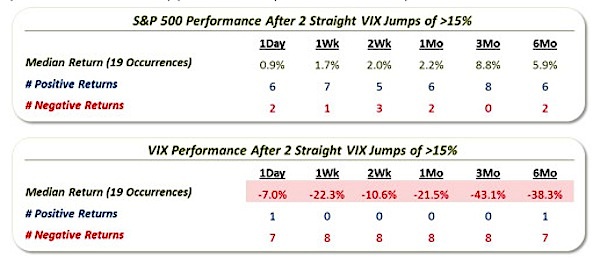

4) This was the 9th time that the VIX rose >15% on consecutive days; during the prior 8 occasions, the S&P 500 dropped >1% on both days while, this time, neither of the past 2 days were down >1%.

While the VIX was up 23% and 16% respectively over the past 2 days, neither of the days saw the S&P 500 lose as much as 1%. During each of the prior 8 2-day streaks of 15% jumps in the VIX, the S&P 500 fell more than 1% on each of the days. Again, the S&P 500 managed to bounce back consistently, and rather strongly this time, over the short to intermediate-term. Also, the VIX almost unanimously fell back in the short to intermediate-term. Again, these results follow more calamitous circumstances in the market (i.e., an average loss in the S&P 500 of -7.5%) than we’ve seen in the past few days. Therefore, the extent to which the precedents can be applied to our present case is up for debate.

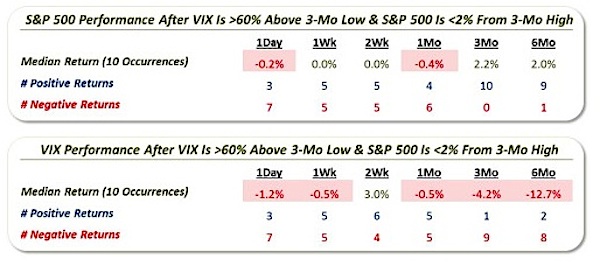

5) After Monday, 689 Days since 1986 have seen the VIX close more than 60% above its 3-month low; this is just the 11th such day with the S&P 500 <2% from its 3-month high.

While the VIX rally pushed the volatility index 60% above its 3-month low, the S&P 500 was still just 1.9% away from its 3-month high (Monday close). Of the 689 days that have seen the VIX that far above its 3-month low, this is just the 11th day with the S&P 500 sitting less than 2% away from its 3-month high. The other days all occurred in early 1996 and December 2014. From what can be gleaned from 2 precedents (if anything), stocks dropped in the short-term before bouncing back in the intermediate-term following the prior events. Meanwhile, the VIX continued to chop about in the short-term before falling back in the intermediate-term.

Also from Dana: Biotechnology Index BTK Nears Critical Price Level

The extent to which historical precedents can provide guidance as to expected future behavior in financial markets is a much-debated topic. The random market theorists would say it is bunk. We believe that not only can historical references be of assistance but there are cyclical tendencies that have much more to do with market behavior than contemporary news and economic events, etc. Sometimes, however, we run into circumstances that do not allow for analysis of historical precedents – because there are none. That is what we are facing in this situation with the out-sized rise in the VIX.

While we have tried to find similar historical situations, this VIX rally is truly unprecedented. Therefore, we would caution against trying to closely apply any of the statistical findings in this post to present circumstances. Rather, we will continue to rely on our standard, proprietary models, as always, in analyzing present conditions and simply marvel at a market that continues to come up with surprises.

Thanks for reading.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

Twitter: @JLyonsFundMgmt

Read more from Dana’s Tumblr Blog

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.