A key index of biotechnology stocks may be approaching significant levels of resistance.

Throughout the course of the post-February rally, one topic that has been bandied about (including by us) is the question of a new bull market up-leg vs. a bear market rally. At the root of the question is the magnitude of potential upside to the current bounce. If this is a new up-leg, then new highs (and possibly well beyond) in the major stock market indices are certainly possible.

On the other hand, if it is merely a bear market rally, then the rally potential is limited. Under that scenario, perhaps the largest cap-weighted indices may be able to score new highs, but likely not by any significant amount. Furthermore, the broader stock market indices would most likely fall short of previous highs, indicative of a mere mean-reversion bounce (albeit an impressive one).

As our view has been that the broad stock market has been in a topping pattern over the past 12+ months, we were squarely in the bear market rally camp when the bounce began in February. Thus, while we were not surprised to see the bounce, we had limited expectations for it. One has to keep an open mind at all times, however. As such, as the rally unfolded, we judged its quality to be superb. This judgement has caused us to at least reconsider the nature of a potential bear market bounce – if not, the possibility of a fresh up-leg to the bull market.

Part of the difficulty in making this judgement is the dichotomy among the various sectors of the market. There are some that are clearly enjoying an extension of their bull markets (e.g., consumer staples, utilities). On the other hand, there are those sectors that are, by all appearances, witnessing mere mean-reversion bear market bounces. One group falling into that latter category is biotechnology.

After leading the market higher for three years, biotechnology stocks have been experiencing the ugly side of a bubble, post-pop, over the past 12 months. Thus, while the sector has been enjoying a solid bounce off of its February lows, as a % of its 2015-2016 decline, its gains pale in comparison to almost any other sector. What that also means is that much of the potential resistance stretching up to the sector’s July 2015 top has yet to be tested.

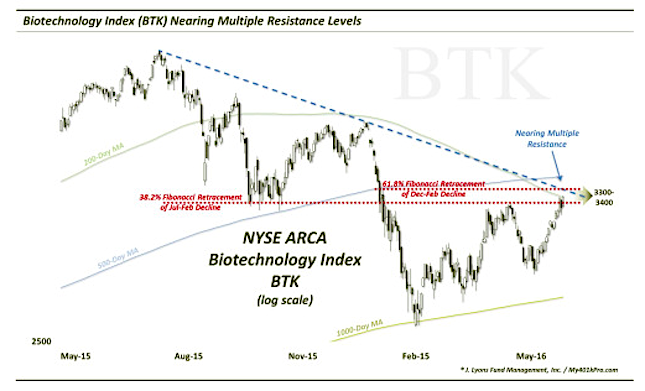

One major area of potential resistance appears to be fast approaching on the most popular biotechnology index, the “BTK”.

As the chart shows, there are several significant levels aligned between roughly the 3300 and 3400 area, including the following:

- The post-July 2015 Down trendline

- The 61.8% Fibonacci Retracement of the December-February decline

- The 38.2% Fibonacci Retracement of the July-February decline

- The 200-day simple moving average

- The 500-day simple moving average

As you see, there are plenty of challenges nearby that the BTK will need to overcome if it wants to extend its rally much further. Having closed at 3336 today, there is not much more room higher before the index hits that upper 3400 resistance zone. If the BTK fails to overcome this area, it would be further evidence arguing in favor of the biotech sector experiencing a mere bear market rally.

Of course, with challenges comes opportunity. And as with our Russell 2000 post last week, in the event that the BTK is able to surmount this area of resistance, it will open up considerable further upside (roughly 10% more perhaps, by our analysis, to near the 3750 level).

First thing first, however. The popular index of biotechnology stocks (BTK) has to break through these multiple resistance layers to open up that upside. Considering the challenge there, as well as our view of the biotech bounce being a mean-reversion, bear market rally, we’d look for the rally to fizzle out in the vicinity of the aforementioned levels – until it proves otherwise.

Thanks for reading.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

Twitter: @JLyonsFundMgmt

Read more from Dana’s Tumblr Blog

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.