Given our longer-term investment time horizon, we are not the type to point out a single economic report, however, we believe that this report is important as it can verify our views on inflation and can finally open the door for the FED to pause its rate hiking cycle officially.

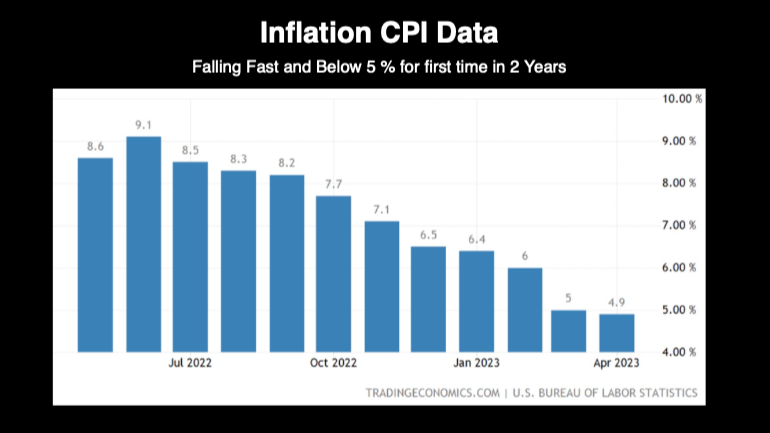

Wednesday’s release of the CPI report brought further positive developments.

Notably, the headline CPI figure dropped below 5% for the first time in two years, which is encouraging news.

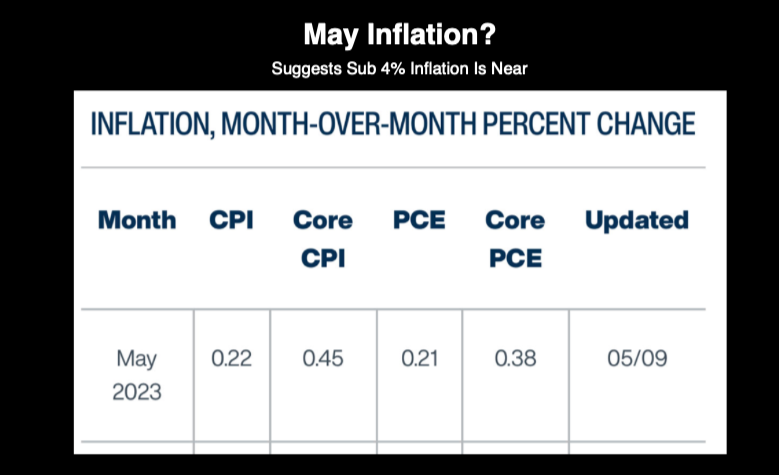

We closely monitor inflation trends throughout the month. Based on the data, the inflation rate for May is currently estimated to be around 0.22% to 0.45% on a month-over-month basis. This assessment considers various factors, including the shelter component, which will be discussed in more detail shortly. Considering the recent headline CPI reading of 4.9%, these tracking figures suggest that CPI may potentially reach the 3% range in May or in the following month.

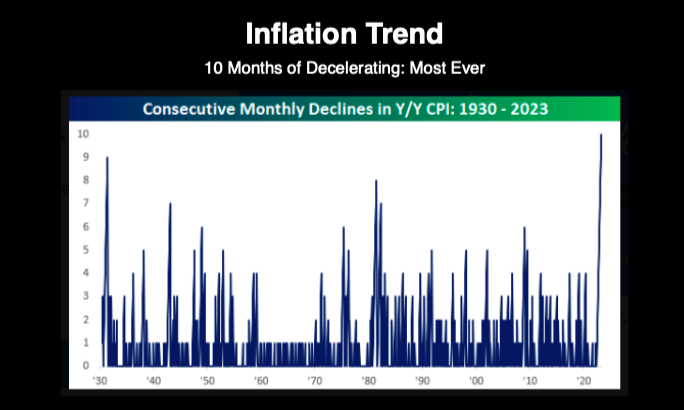

The last time the deceleration was this persistent was early 80’s, which marked the end of the inflation cycle of the 70’s.

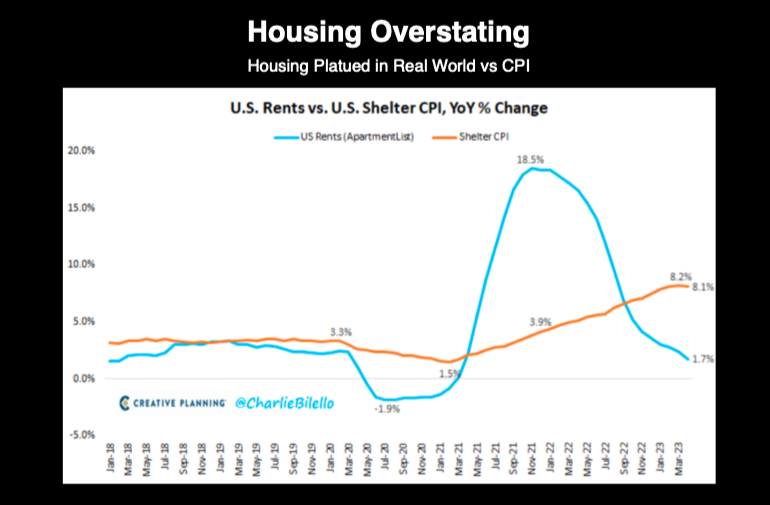

Despite sounding repetitive (our comments for months now), it is important to note that the official Consumer Price Index (CPI) report exaggerates current pricing levels. According to the CPI, shelter costs have increased by 8%, but real-time sources provide a different perspective, indicating declines of up to -10% or increases of only +2%. If we remove shelter, the adjusted CPI data aligns more closely with the Federal Reserve’s target of 2% (2.6%).

This is not a recommendation to purchase or sell any securities mentioned. This is for educational purposes only.

Twitter: @_SeanDavid

The author or his firm may have positions in the mentioned companies and underlying securities at the time of publication. This is not a recommendation to buy or sell securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.