In 2014, GoPro (NASDAQ:GPRO) IPO’d and its stock price shot up to over $90 per share. It’s now trading around $10. That’s a huge decline in the company’s valuation.

There was a lot of hype behind GoPro and its sporty cameras, but that excitement faded fast.

So what’s the cause behind GoPro’s precipitous valuation decline?

It’s really quite simple. It’s hardware is struggling to stay relevant. Everyone can make a tiny camera or a drone… it’s the technology and hardware that comes with it that keeps the end product on the cutting edge.

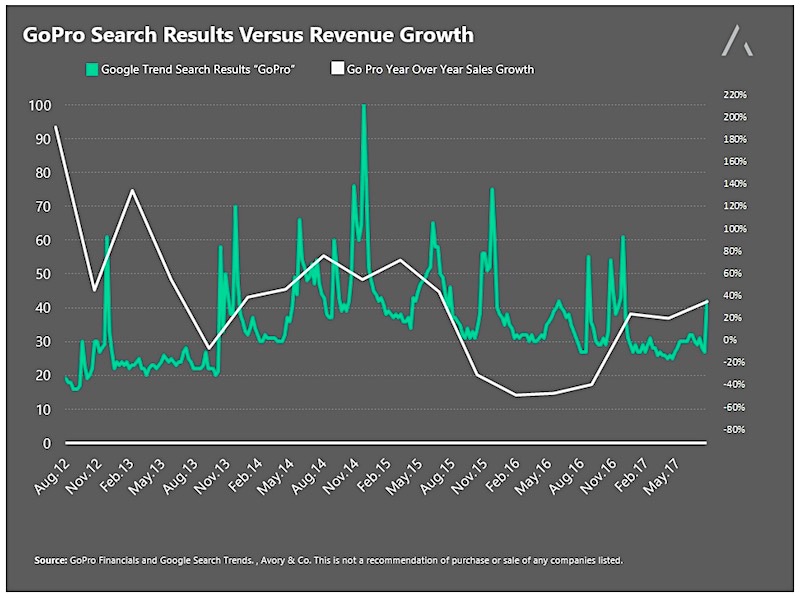

In the chart below, I’ve plotted two insightful indicators that may explain GoPro’s valuation decline. The green line is Google Search trends for “GoPro”, and the white is their year over year revenue growth.

Twitter: @_SeanDavid

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.