I have spent most of the time in 2020 analyzing, writing, and speaking about the US markets and commodities.

Therefore, I thought it time to explore the International ETF Country Funds.

I have vetted them for you.

In the latest presentation I did for StockchartsTV.com, I begin showing you MarketGauge’s ETF Monitor.

From there, I break it down into regions.

I start with Europe, from there go into Asia, then the Americas, and end with Africa.

With each chart I review the phase, the volume patterns, the price performance, and the momentum.

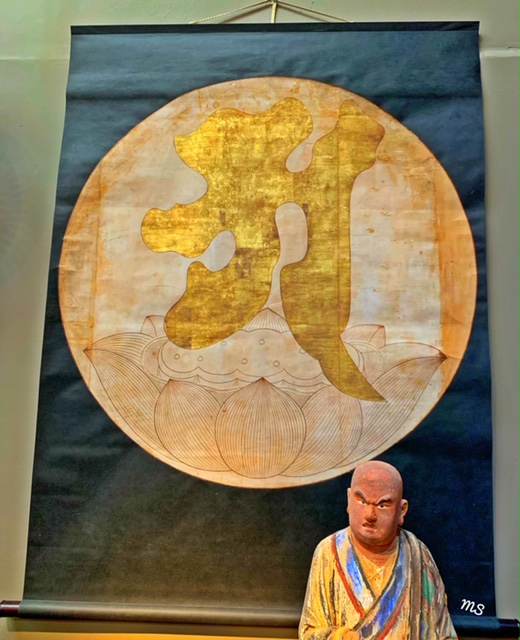

The image is from the Arnold H. Lieberman Collection

Then, I divide the picks into 3 categories-pass, short or buy.

Like a souvenir from each country, you get the specifics for where to enter, how much risk to take, position sizing and when to take profits.

Additionally, I give you tips for trading some of the lower volume ETFs.

Plus, I walk you through some of our profit taking strategies.

So, who needs to get on a plane?If you want to virtually travel the world with me and make money at the same time, simply click the link and enjoy! https://www.youtube.com/watch?v=ud0FGtB3y4Q&feature=youtu.be

Stockcharts.com just released a separate playlist to see all my presentations in one easy click. Please go here. https://stockcharts.com/tv/episodes/market-minute.html

S&P 500 (SPY) 299.56 resistance with 290 support

Russell 2000 (IWM) 129.50 support with resistance 136.85

Dow Jones Industrials (DIA) 241 support with resistance at 247.67

Nasdaq (QQQ) 225.75 support

KRE (Regional Banks) support 34.00 36 to clear

SMH (Semiconductors) Gap to fill to 144.96. 135.60 support

IYT (Transportation) 155.60 resistance 145 support

IBB (Biotechnology) 134 needs to clear

XRT (Retail) 38.00 support 40.50 resistance

Volatility Index (VXX) 36.10 is point to clear

Junk Bonds (JNK) 100 pivotal

LQD (iShs iBoxx High yield Bonds) 132 April highs

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.