This post was written with Craig Basinger of Richardson GMP.

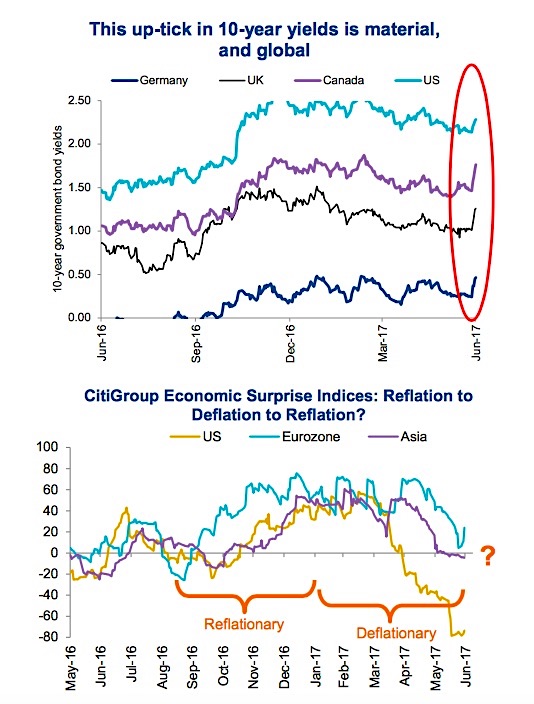

Over the past week we have seen global bond yields rally. This move higher has included an almost doubling of the German 10-year bond, from 0.25% to 0.46%, UK’s from 1% to 1.25%, Canada’s from 1.47% to 1.77% and to a lesser extent U.S. Treasuries from 2.14% to 2.28% (1st chart below).

Now we may be early as one week does not make a trend. Bond yields rallied from last summer through early 2017, but we have seen this trend of higher yields reverse over the past few months as softer economic data and lower commodity prices caused many to question whether the reflationary environment from 2016 was over. We don’t think so, and the reasons are as follows.

Economic Data

There is no denying the world was seeing stronger economic data in the 2nd half of 2016 compared to the 1st half of 2017. You don’t even have to look very far, the U.S. economy expanded by 3.5% and 2.1% in the last two quarters of 2016, and so far has posted a rather anemic 1.4% for the 1st quarter of 2017 which was 1.2% recently but saw a positive revision. This may be set to improve for a couple reasons. First quarter U.S. GDP data has tended to be rather misleading over the past few years, notably showing weakness that does not continue for the year. And currently 2nd quarter GDP which will be released in about a month is forecast to be 3.0%, a notable improvement. Of course the forecasts could be off, but for now we will give the consensus the benefit of the doubt. Plus, GDP forecast accuracy isn’t spot on but is rarely woefully off.

This soft patch in the data can also be seen in the Citigroup Economic surprise indices. We included the big economic zones, namely the U.S., Eurozone and Asia in the 2nd chart above. Rising trends in these indices certainly coincided with rising bond yields in the 2nd half of 2016. Softness in the surprise indices during the 1st half of 2017 also coincided with flat to falling bond yields. Now with Eurozone starting to rise, plus Asia and the U.S. stabilized, we may start seeing a more reflationary environment again. Perhaps that’s why we saw global bond yields rally last week.

ALSO READ: Crude Oil Review & 2H 2017 Outlook

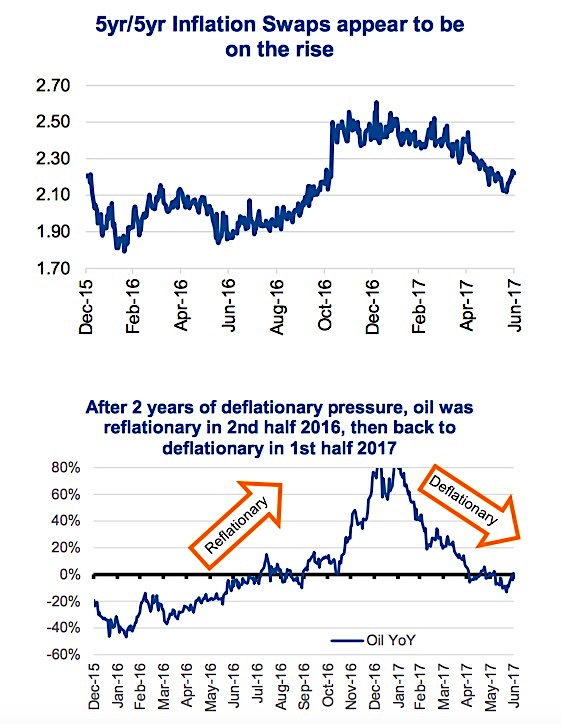

The big headline inflationary data still does not support the return of a more reflationary environment… yet. U.S. Consumer Prices (ex food and energy) has softened from 2.3% in January to 1.7% in May. A similar trend has been evident in the PCE Core, which garners more attention from the Federal Reserve. It is worth noting the market will always move ahead of these measures which are backward looking and delayed. For more timely indications, the 5-year inflation swaps appear to be reversing their downward trend and ticking higher (chart below). Still early, but we may be seeing a direction change.

This reflation to deflationary and potentially back to reflationary pressures also appears evident in commodity prices. While most measures of prices or inflation exclude energy given its volatility, it still impacts prices across many industries. Shippers include energy surcharges or pass it on in higher prices of goods that just can’t be adjusted. There was reflationary pressures from oil, measuring the year- over-year change in the 2nd half of 2016. But then the course reversed in the 1st half of 2017. Noticing a trend? Now we have energy prices sitting roughly where they were a year ago at this time. Let’s call this neutral, but importantly, the deflationary pressure has abated. And given oil prices remained range bound in the 2nd half of 2016 in the $40 to $50/barrel range, we would need to see a thirty handle on oil for this to become a deflationary pressure again. Possible but not our baseline outlook.

A Crowded Trade

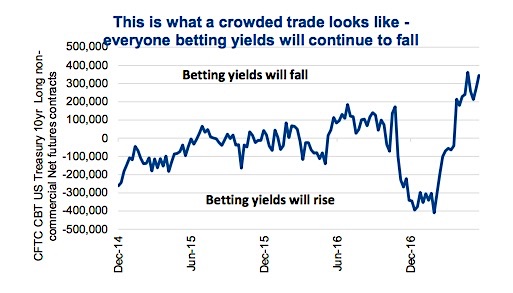

We are seeing some signs of a turn back to a reflationary environment, albeit these are early signs. One that also supports this view is speculative non-commercial net futures contracts. Essentially, this is speculators betting on the direction of the bond market. After the run up in yields (lowering bond prices), they piled on the shorts. As bond yields then remained flat to lower (raising bond prices), they covered the shorts and went long. Today, there is almost a record number of net long non- commercial contracts, in other words they are betting yields will continue to go down. Often when the world is betting in one direction, it goes the other way. Especially when the number of bets reaches extremes.

Implications

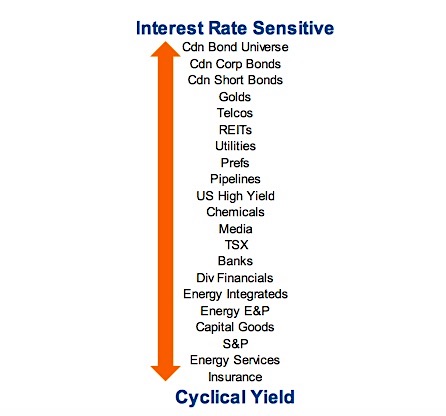

If you are in the same camp as us, that the market has been a bit too fast in discounting the reflationary trade, there is work to be done. In 2013, we experienced what was called the ‘taper tantrum’ as bond yields moved higher on the expectation that the Fed was going to begin tapering their asset purchases. This didn’t bring the market down but there were winners and losers. Sectors that are more interest rate sensitive got hit fairly hard. This group includes Utilities, Telcos, Consumer Staples and Real Estate sectors. Meanwhile others benefited including Financials and Industrials. The chart/table below is various industries and asset classes ranked by their sensitivity to changes in bond yields. Those on the top half of the list are most at risk should yields move higher. This is our Cyclical Yield theme that runs through many of the dividend focused portfolios we manage.

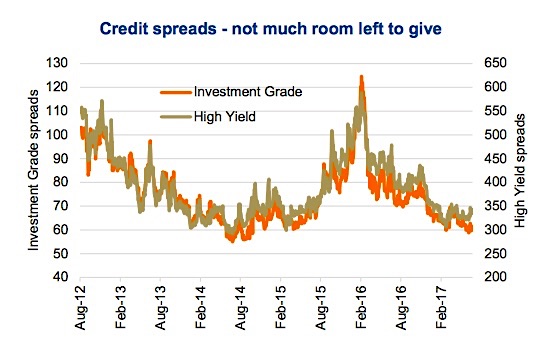

Now as highlighted earlier, we did see bond yields move higher in Q4 of 2016, yet the impact was muted for many interest rate sensitives as these companies are also very credit sensitive. And it appears the negative impact of rising yields was offset by declining credit spreads (that is good for credit sensitives). But now the problem is if we see another uptick on bond yields, credit spreads likely won’t be able to offset the negative impact on interest rate sensitives as spreads are near trough levels. Essentially this makes the market more interest rate sensitive today than in 2016.

Strategies to mitigate this risk include reducing bonds or at least reducing duration. Term premiums are historically low so you are not giving up too much from a yield perspective. You can also reduce exposure to the more interest rate sensitive sectors and reallocate to more cyclical yield sectors. Financials including regional banks, money centers and lifecos all stand to benefit from rising yields. We are already starting to see early signs of a loss in momentum in Telcos, Utilities, Consumer Staples and Real Estate sectors.

Charts sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.